Boomer life according to the economist

Discussion

otolith said:

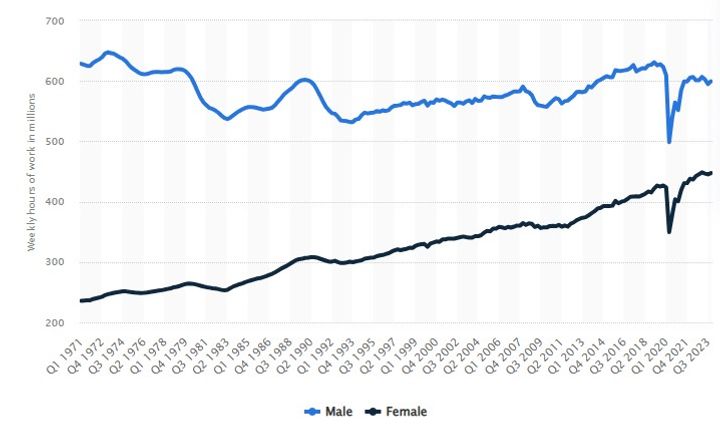

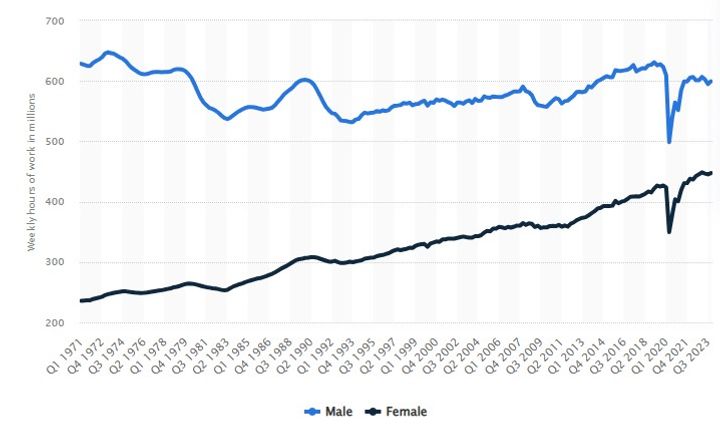

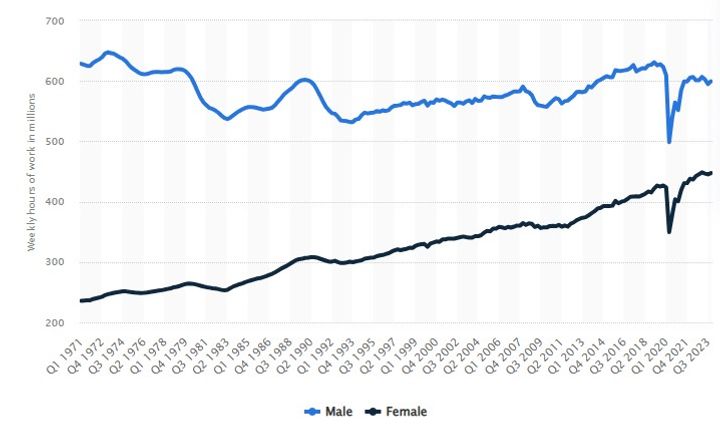

RE the disconnect in growth between median wages and house prices - I wonder to what extent the increase in hours worked by women has enabled the bidding up of house prices. There's a chicken and egg thing going on there, but clearly the affordability is driven by combined household income rather than median wage. For a given wage, if you are both working you will be able to make a better offer for a property than a couple with a stay at home mum.

I think that's a very valid point, but what's getting missed in this rush for the 'right house' is that ANY couple wanting kids is going to see the second partner's wage almost wiped out for the first 3 years (because of either not working or paying for nursery fees). That's the first 3 years of each child, and then there's an ongoing reduction because most "Mums" (they are still largely the Mum) stay part time until the kids are somewhat older. So that equation only works for child-free couples or for couples with (slightly) older kids. And sadly those struggling the most to buy are 20-something and 30-something couples who are right in child-bearing age....so if a couple want 2 kids, that could easily wipe-out 6 full years of second-income and essentially halve it for another 4-8, depending on gap-between-kids.

98elise said:

I'm not implying that at all. Your suggesting it's BTL buyers responsible not owner occupiers. It's simply buyers. Neither actually alters the demand or supply equation.

But of course it does. BTL buyers buy multiple properties, therefore they become a factor in the "bidding" against far more properties than owner-occupiers who'll typically only bid on one (preferred) property at a time.Hustle_ said:

We’re told that supply and demand is a driving force behind rents, but that BTL investor demand is not a factor at all in property sale prices?

I know. It's amazing how self-interest blinkers people to the reality of their behaviour.

My neighbour has just accepted an offer on his house that is 10% below what it was valued at in 2006. If inflation is factored in that is in the region of a 45% loss. Therefore, in my area, contrary to much of the rest of the UK, the longer you wait to buy a house the more affordable it becomes.

He is also in the unfortunate position of owning 5 BTL properties that have monthly mortgage payments in excess of the rent that he receives. Very charitable of him ;-)

He is also in the unfortunate position of owning 5 BTL properties that have monthly mortgage payments in excess of the rent that he receives. Very charitable of him ;-)

Edited by BAMoFo on Monday 22 April 14:10

havoc said:

otolith said:

RE the disconnect in growth between median wages and house prices - I wonder to what extent the increase in hours worked by women has enabled the bidding up of house prices. There's a chicken and egg thing going on there, but clearly the affordability is driven by combined household income rather than median wage. For a given wage, if you are both working you will be able to make a better offer for a property than a couple with a stay at home mum.

I think that's a very valid point, but what's getting missed in this rush for the 'right house' is that ANY couple wanting kids is going to see the second partner's wage almost wiped out for the first 3 years (because of either not working or paying for nursery fees). That's the first 3 years of each child, and then there's an ongoing reduction because most "Mums" (they are still largely the Mum) stay part time until the kids are somewhat older. So that equation only works for child-free couples or for couples with (slightly) older kids. And sadly those struggling the most to buy are 20-something and 30-something couples who are right in child-bearing age....so if a couple want 2 kids, that could easily wipe-out 6 full years of second-income and essentially halve it for another 4-8, depending on gap-between-kids.

havoc said:

otolith said:

RE the disconnect in growth between median wages and house prices - I wonder to what extent the increase in hours worked by women has enabled the bidding up of house prices. There's a chicken and egg thing going on there, but clearly the affordability is driven by combined household income rather than median wage. For a given wage, if you are both working you will be able to make a better offer for a property than a couple with a stay at home mum.

I think that's a very valid point, but what's getting missed in this rush for the 'right house' is that ANY couple wanting kids is going to see the second partner's wage almost wiped out for the first 3 years (because of either not working or paying for nursery fees). That's the first 3 years of each child, and then there's an ongoing reduction because most "Mums" (they are still largely the Mum) stay part time until the kids are somewhat older. So that equation only works for child-free couples or for couples with (slightly) older kids. And sadly those struggling the most to buy are 20-something and 30-something couples who are right in child-bearing age....so if a couple want 2 kids, that could easily wipe-out 6 full years of second-income and essentially halve it for another 4-8, depending on gap-between-kids.

98elise said:

I'm not implying that at all. Your suggesting it's BTL buyers responsible not owner occupiers. It's simply buyers. Neither actually alters the demand or supply equation.

But of course it does. BTL buyers buy multiple properties, therefore they become a factor in the "bidding" against far more properties than owner-occupiers who'll typically only bid on one (preferred) property at a time.Hustle_ said:

We’re told that supply and demand is a driving force behind rents, but that BTL investor demand is not a factor at all in property sale prices?

I know. It's amazing how self-interest blinkers people to the reality of their behaviour.

BTL doesn't remove house from the equation. It has the same affect as owner occupiers buying. It puts one household in one house no matter how you achieve it.

Is it just the profit idea you disagree with, or renting/letting in general?

Portia5 said:

Would you like a little wager on this one (I know you're a bit of a sportsman from the crypto thread):

https://www.rightmove.co.uk/properties/146913725#/...

Now 50-60 years ago first time buyers would have been all over this one like tramps on chips. Indeed the area was full of young first time buyers and was until the 90's.

I'm not going to take the bet as I know nothing about the Glasgow housing market, but your post does not negate the points I made. https://www.rightmove.co.uk/properties/146913725#/...

Now 50-60 years ago first time buyers would have been all over this one like tramps on chips. Indeed the area was full of young first time buyers and was until the 90's.

FTB are finding it harder to get on the proper ladder as house prices and deposit requirements are outstripping wage increases. The fact you have found one clearly undesirable property (hence the asking price), does not mean anything. No doubt the market has changed in 50-60 years, my Grandparents were just buying their first house back then, and they're all dead now!

Hustle_ said:

We’re told that supply and demand is a driving force behind rents, but that BTL investor demand is not a factor at all in property sale prices?

Bear in mind that in some areas/locations the only interested bidders are investors (flippers and landlords and the occasional money launderer )There are also periods when the sales market falls back on investors because without their interest there would be no interest at all. Last one I remember was around 2010 (?)when suddenly all the estate agents morphed into letting agents because there weren't any sales anymore

98elise said:

BTL buyers are outnumbered by owner occupier buyers so they will have a bigger influence on prices.

BTL buyers will rarely over pay. They have no emotional attachment to a particular property and are not interested in bidding wars. Add to that getting a BTL mortgage is based on what it will rent for, so higher prices limit what you can buy.

It was a few years ago, but it seemed BTLers swooped on anything that would provide a yield from (at the time) £800/mth rent. Impossible to know if that raised prices, but it certainly put a floor under them. BTL buyers will rarely over pay. They have no emotional attachment to a particular property and are not interested in bidding wars. Add to that getting a BTL mortgage is based on what it will rent for, so higher prices limit what you can buy.

98elise said:

The issue is number of houses (supply) and the number of households (demand).

BTL doesn't remove house from the equation. It has the same affect as owner occupiers buying. It puts one household in one house no matter how you achieve it.

Is it just the profit idea you disagree with, or renting/letting in general?

It doesn't remove the house from the equation, but a BTL buyer is another buyer bidding for the house. It clearly puts upward pressure on prices. BTL doesn't remove house from the equation. It has the same affect as owner occupiers buying. It puts one household in one house no matter how you achieve it.

Is it just the profit idea you disagree with, or renting/letting in general?

You're saying that it's fine because you buy it, rent it out, and someone lives in it, but they are paying more in rent than they would for the mortgage, and so BTL buyer bidding up prices mean more people have to rent, which means more money to landlords so they have more money to invest in more BTL and more people are forced to rent for longer.

The argument simply doesn't stand up. You have supply and you have demand. Landlords are adding to the demand side of the equation, irrespective of what they do with the house afterwards.

Condi said:

I'm not going to take the bet as I know nothing about the Glasgow housing market, but your post does not negate the points I made.

FTB are finding it harder to get on the proper ladder as house prices and deposit requirements are outstripping wage increases. The fact you have found one clearly undesirable property (hence the asking price), does not mean anything. No doubt the market has changed in 50-60 years, my Grandparents were just buying their first house back then, and they're all dead now!

You don't really have to know about the market to bet that ZERO ftbs will bid on a very cheap property. FTB are finding it harder to get on the proper ladder as house prices and deposit requirements are outstripping wage increases. The fact you have found one clearly undesirable property (hence the asking price), does not mean anything. No doubt the market has changed in 50-60 years, my Grandparents were just buying their first house back then, and they're all dead now!

The thing that's changed is that ftbs aren't interested in buying rung 1 properties and doing them up and selling them and moving on to rung 2 to rinse and repeat like many of us boomers did. It can certainly BE done, it's just that they don't want to do it.

Is this the fault of investors?

eta: "UNDESIRABLE"????? It's so undesirable that it's gone to closing date after 3 days on the market to stop the phone ringing with investors trying to grab it!

Edited by Portia5 on Monday 22 April 13:07

BAMoFo said:

My neighbour has just accepted an offer on his house that is 10% below what it was valued at in 2006. If inflation is factored in that is in the region of a 45% loss. He is also in the unfortunate position of owning 5 BTL properties that have monthly mortgage payments in excess of the rent that he receives.

Risk reward, he took the risk of buying multiple properties and would have reaped the benefits of having them paid off. Portia5 said:

You don't really have to know about the market to bet that ZERO ftbs will bid on a very cheap property.

The thing that's changed is that ftbs aren't interested in buying rung 1 properties and doing them up and selling them and moving on to rung 2 to rinse and repeat like many of us boomers did. It can certainly BE done, it's just that they don't want to do it.

Is this the fault of investors?

Boomers were buying their first houses by themselves at 25. Young people today are buying as part of a couple at 35. The 2 demographics are obviously looking for different things in their property. The thing that's changed is that ftbs aren't interested in buying rung 1 properties and doing them up and selling them and moving on to rung 2 to rinse and repeat like many of us boomers did. It can certainly BE done, it's just that they don't want to do it.

Is this the fault of investors?

The whole idea of the housing ladder is a broken concept, at least as it used to be known, with EA fees, solicitors fees, stamp duty etc, moving is an expensive business. This partly explains why a couple in their late 20's wants the 3 bed semi rather than the 2 bed doer-upper.

And while you've found an example of a £25k property in Glasgow which might not attract buyers, if you take a more normal housing situation such as 2 bed £125k flats in any medium sized city then you have direct competition between FTB and BTL investors. Think places like Nottingham, Sheffield, Plymouth etc.

It really isn't an argument worth having, every single metric shows it is harder for young people to buy their first place now than at any time since the end of the Second World War. The only argument that people buying in the 70s and 80s can make is about inflation which meant their mortgage payments were high, but what they forget is that their pay increases were also high and so the value of the debt diminished much more quickly than it does when interest rates and inflation are low. While the first few years may have been hard, it became much easier from then on.

Condi said:

Portia5 said:

You don't really have to know about the market to bet that ZERO ftbs will bid on a very cheap property.

The thing that's changed is that ftbs aren't interested in buying rung 1 properties and doing them up and selling them and moving on to rung 2 to rinse and repeat like many of us boomers did. It can certainly BE done, it's just that they don't want to do it.

Is this the fault of investors?

Boomers were buying their first houses by themselves at 25. Young people today are buying as part of a couple at 35. The 2 demographics are obviously looking for different things in their property. The thing that's changed is that ftbs aren't interested in buying rung 1 properties and doing them up and selling them and moving on to rung 2 to rinse and repeat like many of us boomers did. It can certainly BE done, it's just that they don't want to do it.

Is this the fault of investors?

You might as well be barking at locals 'enjoying' the weather in the north of Scotland compared to those in the south of England, or should I say, barking more than previously.

turbobloke said:

Neither cohort was responsible for the context which enabled / prevented purchases of that nature. Times change, contexts change, shift happens.

Au contraire, Turbowaffle, au contraire. The political establishment over the last 20-30 have enacted policies to create the situation we are currently in, while benefitting very nicely from the effects of those policies. They have greatly enriched one part of the population at the expense of another, which is already proving to be terrible for society and will only keep getting worse until things change and something is done to start reducing the inequality.

To say "s

t happens" is just burying your head in the sand rather than actually thinking about what you're writing. Equivalent to a 3 year old putting his fingers in his ears and saying "la la la la". The analogy is very apt.

t happens" is just burying your head in the sand rather than actually thinking about what you're writing. Equivalent to a 3 year old putting his fingers in his ears and saying "la la la la". The analogy is very apt. asfault said:

BAMoFo said:

My neighbour has just accepted an offer on his house that is 10% below what it was valued at in 2006. If inflation is factored in that is in the region of a 45% loss. He is also in the unfortunate position of owning 5 BTL properties that have monthly mortgage payments in excess of the rent that he receives.

Risk reward, he took the risk of buying multiple properties and would have reaped the benefits of having them paid off. Thats 4-5% is before any costs, voids, defaults etc. Any remaining profit is taxed, and you can't offset mortgage interest as a cost any more.

If I was investing today I would be putting it an ISA and playing the stockmarket. I have equal amounts in property and the stock market and I'm doing way better with my stocks (and its all tax free and highly liquid). My Lloyds shares yield 6% and have just given me over a 20% gain in a month

I do keep looking at the auctions though. A 1 bed starter home in my area of Kent recently sold for 135k. Bargain!

98elise said:

asfault said:

BAMoFo said:

My neighbour has just accepted an offer on his house that is 10% below what it was valued at in 2006. If inflation is factored in that is in the region of a 45% loss. He is also in the unfortunate position of owning 5 BTL properties that have monthly mortgage payments in excess of the rent that he receives.

Risk reward, he took the risk of buying multiple properties and would have reaped the benefits of having them paid off. Thats 4-5% is before any costs, voids, defaults etc. Any remaining profit is taxed, and you can't offset mortgage interest as a cost any more.

If I was investing today I would be putting it an ISA and playing the stockmarket. I have equal amounts in property and the stock market and I'm doing way better with my stocks (and its all tax free and highly liquid). My Lloyds shares yield 6% and have just given me over a 20% gain in a month

I do keep looking at the auctions though. A 1 bed starter home in my area of Kent recently sold for 135k. Bargain!

Hustle_ said:

I didn't realise that BTL businesses nationally are only buying properties where nobody wants to live! This actually makes me feel a lot more positive about it all.

No they're buying properties in places where people DO want to live, (namely the people who they rent them to), but there are many areas where only very few or zero people want to buy to occupy as owners.Edited by Portia5 on Monday 22 April 13:52

98elise said:

With average gross yields of 4-5% most houses would never be paid off by the rent received. The vast majority of BTL mortgages are IO.

In about 8 weeks time that £25k dump I posted will be fully renovated and rented out for no less than 700pcm and will have cost 55k max to get there.How is that even close to 4-5% 'yield'?

And anyone who buys a btl using IO borrowing who intends to keep it for any length of time is MENTAL!! Or hypnotised by a shyster FA.

IO is for flipping a 3-12 month project. Repayment every time for keepers. Sheeeesh! Do you think ANY build -to -rent is done using IO borrowing? They'd laugh at the suggestion.

IO's something you can get an agreement to revert to short term in certain very defined circumstances in commercial lending. The financial industry really really needs its balls kicked for hypnotising a huge crowd of dafties into IO loans for btls. Causes endless trouble, not least for tenants when the IO borrower burns out - which usually doesn't take much of an interest rise to happen.

If the maths don't stack on cap&int repayment, don't bother. If you do IO you'll be working for the bank till the penny drops.

Gassing Station | Finance | Top of Page | What's New | My Stuff