Boomer life according to the economist

Discussion

Portia5 said:

You don't really have to know about the market to bet that ZERO ftbs will bid on a very cheap property.

The thing that's changed is that ftbs aren't interested in buying rung 1 properties and doing them up and selling them and moving on to rung 2 to rinse and repeat like many of us boomers did. It can certainly BE done, it's just that they don't want to do it.

That has a lot to do with policy and the economic climate though doesn't it. Due to the cost of living, FTBs are strugging to raise a deposit without help. If they raise a deposit they are finding that they are invariably stretched to reach an entry point and won't have surplus capital for major improvements. Consumer utility work is regulated to a greater degree and require tradies. Tradies are riding high, partially because of modern perceptions of property as an investment. SDLT rates, which are a function of property prices as well as policy, are prohibitive to moving house and encourage property development rather than moving on. The cost of materials and fittings nowadays is also a deterrent from 'having a go'- there also seem to have been raising expectations from all quarters concerning the quality and presentation of property whereas before home fittings and furniture was less integrated and there was an expectation that a finished property might exhibit some 'DIY' character. The thing that's changed is that ftbs aren't interested in buying rung 1 properties and doing them up and selling them and moving on to rung 2 to rinse and repeat like many of us boomers did. It can certainly BE done, it's just that they don't want to do it.

Anything which cannot be mortgaged or which needs urgent or extensive work will be bought by a cash buyer in some form.

As I've said before, this will in future hopefully be viewed as a pinch point.

98elise said:

BTL doesn't remove house from the equation. It has the same affect as owner occupiers buying. It puts one household in one house no matter how you achieve it.

This is not as true as it might sound. While the number of properties is the same in both cases, the number of independent units of house needing people (not sure what the proper term is) that can be housed by them is not the same. It's actually quite different.

I can't remember where I read it / watched it, but there is a difference because BTL properties often include 3/4/5 people house sharing whereas owner occupied homes do not - sure there's the odd FTB'er that rents a room out, but nothing like the level in the BTL market.

i.e. in the case of the BTL, each house takes 5 people out of the housing market. Whereas a house bought by a FTB takes 1 or maybe 2 people out of the market. In that way, you need way more properties if everyone owns them given the way they are used today.

So it's not really about the number of houses that you care about when considering the supply and demand - it's the number of people looking for somewhere to live - and that reduces a lot with more BTL's in the world.....

fat80b said:

i.e. in the case of the BTL, each house takes 5 people out of the housing market. Whereas a house bought by a FTB takes 1 or maybe 2 people out of the market. In that way, you need way more properties if everyone owns them given the way they are used today.

So it's not really about the number of houses that you care about when considering the supply and demand - it's the number of people looking for somewhere to live - and that reduces a lot with more BTL's in the world.....

So if house/rental prices are driven up even further, necessitating HMOs with an average of say 2 people per room rather than 1, this makes landlords even more virtuous? What a load of balls So it's not really about the number of houses that you care about when considering the supply and demand - it's the number of people looking for somewhere to live - and that reduces a lot with more BTL's in the world.....

Portia5 said:

NRS said:

It’s very amusing to see the landlords on here so upset for the poor tenants. It’s nothing to do with them being taxed more and making less money, it’s all about the poor tenants!

Are the BTR developers part of your anti-landlord rhetoric or are they exceptions to your "landlord bad" drivel?

The supply of houses is the same, but when you have more buyers turning up it puts a pressure on the house prices. 3 houses for sale, but 2 buyers turn up. The price will fall as sellers compete to get the 2 buyers. Add in 2 BTL people, then you'll suddenly have 4 buyers for the 3 houses, and prices will be bid higher until one of the 4 cannot afford it. BTL people being in the market means more competition for house prices pushing them up. Add in once they have a house or multiple houses they will rent the same property back to the market, but at a higher price due to the competition, AND to make enough profit to make it worthwhile to run a BTL. That also puts pressure on the market, and means new buyers take longer to get onto the housing market as it takes longer to save up a deposit.

There is some parts of the market where BTL faces little competition, mainly your area of expertise, which is the very low value houses that many buyers won't touch these days as you don't want to live in the area long, plus you lose a lot of money in moving costs meaning there is less point in buying there. Not to mention losing the financial support on a FTB, so you don't want to lose that on a 20k house in Glasgow you'll move out of a few years later.

havoc said:

Condi said:

Quite simply this is why BTL properties are popular despite the "low returns" landlords keep talking about.

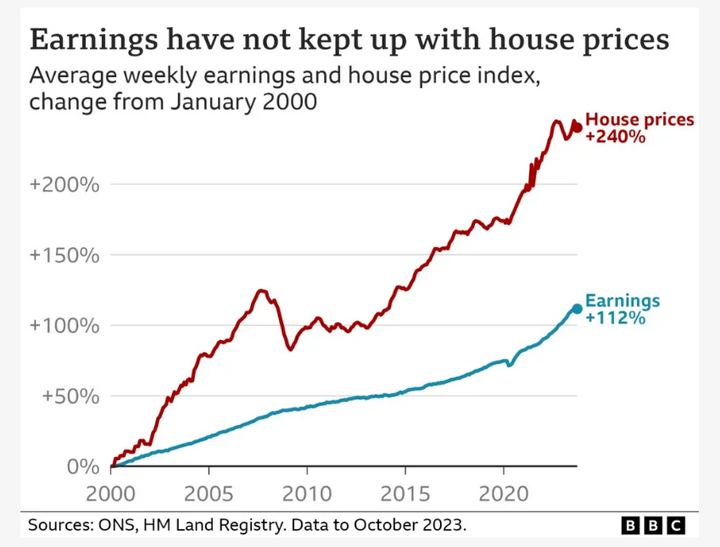

Socially it's a terrible thing, it concentrates wealth into fewer hands and increases inequality, while also increasing the generational divide between those people who have assets and those who don't. It means that younger people are spending more of their income on essential living costs, and so while wages are rising, if rents are rising faster then people are getting worse off. Something does need to be done about house price inflation, houses are becoming much more of an investment class than a place for people to live, which is wrong.

Every single statistic shows that it is much harder for a young person to buy a house today than at almost any point since the Second World War, and it is doing enormous social damage.

First-time buyers face toughest test for 70 years

https://www.bbc.co.uk/news/articles/c87zgx42m5go

But, but, but...won't someone think of the landlords!!! Socially it's a terrible thing, it concentrates wealth into fewer hands and increases inequality, while also increasing the generational divide between those people who have assets and those who don't. It means that younger people are spending more of their income on essential living costs, and so while wages are rising, if rents are rising faster then people are getting worse off. Something does need to be done about house price inflation, houses are becoming much more of an investment class than a place for people to live, which is wrong.

Every single statistic shows that it is much harder for a young person to buy a house today than at almost any point since the Second World War, and it is doing enormous social damage.

First-time buyers face toughest test for 70 years

https://www.bbc.co.uk/news/articles/c87zgx42m5go

turbobloke said:

Neither cohort was responsible for the context which enabled / prevented purchases of that nature. Times change, contexts change, shift happens.

I know you take the pragmatic view of these are the times we live in, you just have to get on with it, but shouldn't we consider if this is a good or bad thing, what the reasons are/were and whether we should/can look to change the pathway?If this had been done previously then perhaps the situation wouldn't have become so much more difficult than before?

Condi's points on affordability I don't think are being challenged, so why have we gone to larger multiples what policies or lack of them caused this, do we want to arrest the earnings/price ratio or do we expect and accept it'll be going higher and higher and mortgages longer and longer terms, the first time buyer ages increases more, less wage earning people can ever buy, more homes owned by 'investors'.

I think socially it would be far better for things to get easier, move back to lower multiples especially in the current student loan/effectively extra taxation times, but I think systemically financially its tough because of how it's been for so long and with the leverage is so high, so that issue takes precedence?

There is so much nonsense in that NRS post that the only appropriate response is......

https://www.google.co.uk/search?sca_esv=fa55d09ee7...

https://www.google.co.uk/search?sca_esv=fa55d09ee7...

Scootersp said:

turbobloke said:

Neither cohort was responsible for the context which enabled / prevented purchases of that nature. Times change, contexts change, shift happens.

I know you take the pragmatic view of these are the times we live in, you just have to get on with it, but shouldn't we consider if this is a good or bad thing, what the reasons are/were and whether we should/can look to change the pathway?If this had been done previously then perhaps the situation wouldn't have become so much more difficult than before?

Condi's points on affordability I don't think are being challenged, so why have we gone to larger multiples what policies or lack of them caused this, do we want to arrest the earnings/price ratio or do we expect and accept it'll be going higher and higher and mortgages longer and longer terms, the first time buyer ages increases more, less wage earning people can ever buy, more homes owned by 'investors'.

I think socially it would be far better for things to get easier, move back to lower multiples especially in the current student loan/effectively extra taxation times, but I think systemically financially its tough because of how it's been for so long and with the leverage is so high, so that issue takes precedence?

And, like a lot of PH, they've probably done very nicely out of the way things have been so instead of taking a wider or more holistic view of what is best for society it's a case of "I'm alright Jack, you millennials eat too much avocado on toast, when we were young we were down the mines 25 hours a day and slept on a cardboard sheet".

Any discussion on housing and house prices goes the same way, despite the massive weight of evidence that the current situation is, if not unsustainable, at least not helpful and is building up social inequality, which is known to be the cause of lots of other social problems. Non are so blind as who do not want to see.

Portia5 said:

98elise said:

With average gross yields of 4-5% most houses would never be paid off by the rent received. The vast majority of BTL mortgages are IO.

In about 8 weeks time that £25k dump I posted will be fully renovated and rented out for no less than 700pcm and will have cost 55k max to get there.How is that even close to 4-5% 'yield'?

And anyone who buys a btl using IO borrowing who intends to keep it for any length of time is MENTAL!! Or hypnotised by a shyster FA.

IO is for flipping a 3-12 month project. Repayment every time for keepers. Sheeeesh! Do you think ANY build -to -rent is done using IO borrowing? They'd laugh at the suggestion.

IO's something you can get an agreement to revert to short term in certain very defined circumstances in commercial lending. The financial industry really really needs its balls kicked for hypnotising a huge crowd of dafties into IO loans for btls. Causes endless trouble, not least for tenants when the IO borrower burns out - which usually doesn't take much of an interest rise to happen.

If the maths don't stack on cap&int repayment, don't bother. If you do IO you'll be working for the bank till the penny drops.

Overtime my IO's have done pretty well. Inflation alone makes them worth it on a long term investment.

You also don't like the stockmarket but I'm doing nicely there as well as well

Edited by 98elise on Monday 22 April 15:05

Olivera said:

fat80b said:

i.e. in the case of the BTL, each house takes 5 people out of the housing market. Whereas a house bought by a FTB takes 1 or maybe 2 people out of the market. In that way, you need way more properties if everyone owns them given the way they are used today.

So it's not really about the number of houses that you care about when considering the supply and demand - it's the number of people looking for somewhere to live - and that reduces a lot with more BTL's in the world.....

So if house/rental prices are driven up even further, necessitating HMOs with an average of say 2 people per room rather than 1, this makes landlords even more virtuous? What a load of balls So it's not really about the number of houses that you care about when considering the supply and demand - it's the number of people looking for somewhere to live - and that reduces a lot with more BTL's in the world.....

Being a landlord is a business, providing a service.

Portia5 said:

There is so much nonsense in that NRS post that the only appropriate response is......

https://www.google.co.uk/search?sca_esv=fa55d09ee7...

https://www.google.co.uk/search?sca_esv=fa55d09ee7...

Come on Groak! You're saying LL's are good because they keep prices down by supplying more rental properties - this is increased supply. But they don't drive up prices by creating increased demands when trying to buy houses? How does that make sense - does the supply and demand impacts on prices only impact rents but not the purchase prices? That is:

https://www.google.co.uk/search?sca_esv=fa55d09ee7...

fat80b said:

98elise said:

BTL doesn't remove house from the equation. It has the same affect as owner occupiers buying. It puts one household in one house no matter how you achieve it.

This is not as true as it might sound. While the number of properties is the same in both cases, the number of independent units of house needing people (not sure what the proper term is) that can be housed by them is not the same. It's actually quite different.

I can't remember where I read it / watched it, but there is a difference because BTL properties often include 3/4/5 people house sharing whereas owner occupied homes do not - sure there's the odd FTB'er that rents a room out, but nothing like the level in the BTL market.

i.e. in the case of the BTL, each house takes 5 people out of the housing market. Whereas a house bought by a FTB takes 1 or maybe 2 people out of the market. In that way, you need way more properties if everyone owns them given the way they are used today.

So it's not really about the number of houses that you care about when considering the supply and demand - it's the number of people looking for somewhere to live - and that reduces a lot with more BTL's in the world.....

The first house I rented was in 1984 and it was with 3 mates. There was no chance we would want to buy together, or one buy and rent rooms to the others.

98elise said:

Being a landlord is a business, providing a service.

It's a highly regulated and legislated business because government rightly sees housing as first and foremost a social concern. Hence levers have been pulled to curtail BTLs, and will likely be pulled further when a Labour government takes office.98elise said:

You're the only one claiming virtue, and also dismissing it.

Being a landlord is a business, providing a service.

I think he's being sarcastic. Being a landlord is a business, providing a service.

Anyway, what did Boomers ever do for us?

They've lived a life far beyond their means, funded by debt. The pensions payments and healthcare costs they expect to get from the state far exceed the amount they contributed during their working lives, which is having to be funded by the current working population (who, btw, will not receive anything quite so generous when they retire). Boomers have benefitted nicely from immigration and freedom of movement, a drawbridge now pulled up for the younger generation. They also benefitted from free university - now costing £9,000 per year plus housing costs, with the average graduate coming out with a debt they are never expected to pay off, and a debt which has eye-watering interest rates. They've failed to protect the environment, and instead of investing in our sewage systems have preferred to let water companies leverage debt to fund dividend payments. They've monumentally failed to build enough houses, which worked nicely for them, not so for the younger generations.

Honestly, the Boomer generation will go down as a generation which lived well beyond their means, racked up a lot of debt, and failed to use the unprecedented period of peace and prosperity to tackle some of the issues affecting society today. Instead they prioritised themselves, and their own prosperity, while ignoring issues such as housing, health and social care, and the environment. It is no coincidence that millennials will be the first generation poorer than their parents - all their money is going to pay off the debts which Boomers created (and when I say debt, inc pension, health and social care costs, which are debts because they were never budgeted for during their working lives).

BAMoFo said:

asfault said:

Risk reward, he took the risk of buying multiple properties and would have reaped the benefits of having them paid off.

They are all interest only mortgages so will never be paid off.Condi said:

Instead they prioritised themselves, and their own prosperity, while ignoring issues such as housing, health and social care, and the environment.

Let's face it we all do this in the main, some more at the extremes but we do tend to look after number one. Hence why I'm not blaming the BLT crowd I just think they should have been naturally contained more, as it's far easier to make something difficult/marginally profitable to do so people don't chose to do it, than it is to let them and then try and 'take' it away. What I think has changed is leadership that should, as a group, do what you are suggesting, put the brake on us all where required, think through the actions of legislation and where it benefits current and future generations, but I tend to think there is less altruism, less societal group think and more pantomime, the illusion of power, complacency borne out of the ability (it seems) to spend/borrow quite extensively and enjoy all the 'growth' prosperity that has given.

Olivera said:

98elise said:

Being a landlord is a business, providing a service.

It's a highly regulated and legislated business because government rightly sees housing as first and foremost a social concern. Hence levers have been pulled to curtail BTLs, and will likely be pulled further when a Labour government takes office.The rental market is an established and fundamental part of the housing market. There is huge institutional demand for BTR that is now parked due to the current government policies. The institutional demand to build BTR is driven by tenant demand, as not everyone wishes to buy.

Condi said:

I think he's being sarcastic.

Anyway, what did Boomers ever do for us?

They've lived a life far beyond their means, funded by debt. The pensions payments and healthcare costs they expect to get from the state far exceed the amount they contributed during their working lives, which is having to be funded by the current working population (who, btw, will not receive anything quite so generous when they retire). Boomers have benefitted nicely from immigration and freedom of movement, a drawbridge now pulled up for the younger generation. They also benefitted from free university - now costing £9,000 per year plus housing costs, with the average graduate coming out with a debt they are never expected to pay off, and a debt which has eye-watering interest rates. They've failed to protect the environment, and instead of investing in our sewage systems have preferred to let water companies leverage debt to fund dividend payments. They've monumentally failed to build enough houses, which worked nicely for them, not so for the younger generations.

Honestly, the Boomer generation will go down as a generation which lived well beyond their means, racked up a lot of debt, and failed to use the unprecedented period of peace and prosperity to tackle some of the issues affecting society today. Instead they prioritised themselves, and their own prosperity, while ignoring issues such as housing, health and social care, and the environment. It is no coincidence that millennials will be the first generation poorer than their parents - all their money is going to pay off the debts which Boomers created (and when I say debt, inc pension, health and social care costs, which are debts because they were never budgeted for during their working lives).

For a bit of perspective, would you be prepared to say what you actually do as an individual- other than blow out hot air - to assist these issues you complain the 'boomers' have neglected?Anyway, what did Boomers ever do for us?

They've lived a life far beyond their means, funded by debt. The pensions payments and healthcare costs they expect to get from the state far exceed the amount they contributed during their working lives, which is having to be funded by the current working population (who, btw, will not receive anything quite so generous when they retire). Boomers have benefitted nicely from immigration and freedom of movement, a drawbridge now pulled up for the younger generation. They also benefitted from free university - now costing £9,000 per year plus housing costs, with the average graduate coming out with a debt they are never expected to pay off, and a debt which has eye-watering interest rates. They've failed to protect the environment, and instead of investing in our sewage systems have preferred to let water companies leverage debt to fund dividend payments. They've monumentally failed to build enough houses, which worked nicely for them, not so for the younger generations.

Honestly, the Boomer generation will go down as a generation which lived well beyond their means, racked up a lot of debt, and failed to use the unprecedented period of peace and prosperity to tackle some of the issues affecting society today. Instead they prioritised themselves, and their own prosperity, while ignoring issues such as housing, health and social care, and the environment. It is no coincidence that millennials will be the first generation poorer than their parents - all their money is going to pay off the debts which Boomers created (and when I say debt, inc pension, health and social care costs, which are debts because they were never budgeted for during their working lives).

Condi said:

98elise said:

You're the only one claiming virtue, and also dismissing it.

Being a landlord is a business, providing a service.

I think he's being sarcastic. Being a landlord is a business, providing a service.

Anyway, what did Boomers ever do for us?

They've lived a life far beyond their means, funded by debt. The pensions payments and healthcare costs they expect to get from the state far exceed the amount they contributed during their working lives, which is having to be funded by the current working population (who, btw, will not receive anything quite so generous when they retire). Boomers have benefitted nicely from immigration and freedom of movement, a drawbridge now pulled up for the younger generation. They also benefitted from free university - now costing £9,000 per year plus housing costs, with the average graduate coming out with a debt they are never expected to pay off, and a debt which has eye-watering interest rates. They've failed to protect the environment, and instead of investing in our sewage systems have preferred to let water companies leverage debt to fund dividend payments. They've monumentally failed to build enough houses, which worked nicely for them, not so for the younger generations.

Honestly, the Boomer generation will go down as a generation which lived well beyond their means, racked up a lot of debt, and failed to use the unprecedented period of peace and prosperity to tackle some of the issues affecting society today. Instead they prioritised themselves, and their own prosperity, while ignoring issues such as housing, health and social care, and the environment. It is no coincidence that millennials will be the first generation poorer than their parents - all their money is going to pay off the debts which Boomers created (and when I say debt, inc pension, health and social care costs, which are debts because they were never budgeted for during their working lives).

Zj2002 said:

Olivera said:

98elise said:

Being a landlord is a business, providing a service.

It's a highly regulated and legislated business because government rightly sees housing as first and foremost a social concern. Hence levers have been pulled to curtail BTLs, and will likely be pulled further when a Labour government takes office.The rental market is an established and fundamental part of the housing market. There is huge institutional demand for BTR that is now parked due to the current government policies. The institutional demand to build BTR is driven by tenant demand, as not everyone wishes to buy.

It was the same with offsetting mortgage interest. It caused a lot of Landlords to exit the BTL market, and now rents are spiralling upwards.

It's actually becoming really difficult to rent a place now. There are more people chasing each property than ever, and landlords can be choosy.

25 renters chasing each rental...

https://www.bbc.co.uk/news/business-67006468

PH thread on the rental market being broken...

https://www.pistonheads.com/gassing/topic.asp?h=0&...

Edited by 98elise on Monday 22 April 17:02

Gassing Station | Finance | Top of Page | What's New | My Stuff