Trade in Values vs Sale Value

Discussion

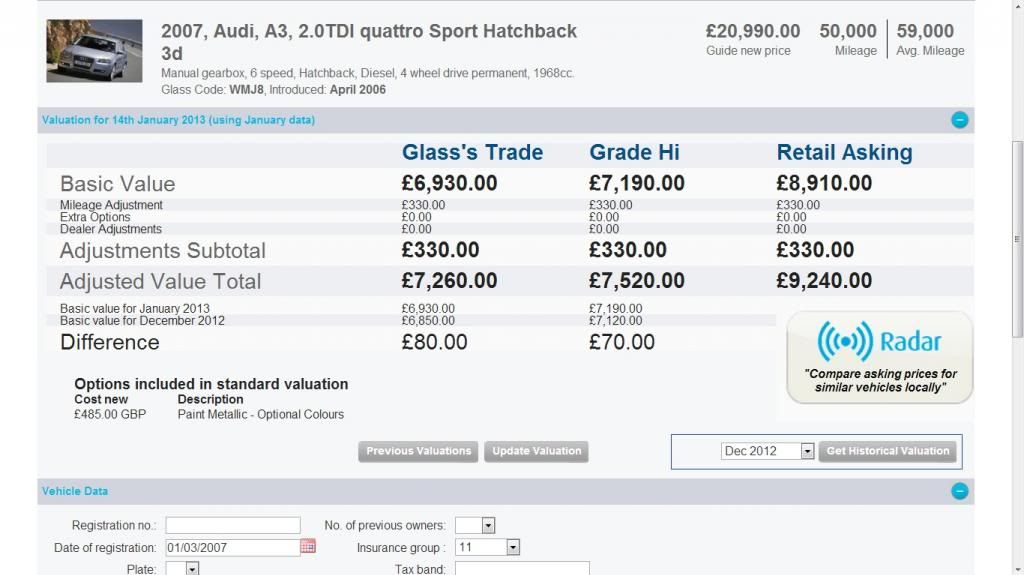

I can't see the OP getting remotely close to £10k+ as a px unless the car being purchased is horrendously overpriced.

A quick look at ebay or Autotrader shows several 07 A3's with leather and 40-60k ballpark for about £9k from various dealers. Even privately, it would have to something exceptional to command £9,995.

There are thousands of A3's for sale - they are a very common car - if you're worried about depreciaiton again for goodness sake don't buy another!

A quick look at ebay or Autotrader shows several 07 A3's with leather and 40-60k ballpark for about £9k from various dealers. Even privately, it would have to something exceptional to command £9,995.

There are thousands of A3's for sale - they are a very common car - if you're worried about depreciaiton again for goodness sake don't buy another!

anonymous said:

[redacted]

hard to say: on the other hand he traded the Skoda in for an A3 and still had the Skoda last May:http://www.pistonheads.com/gassing/topic.asp?h=0&a...

northwest monkey said:

I can't think of much that doesn't.

Got a 6-year old laptop I keep for an emergency spare. Cost new about £1500, value now is effectively nil and it barely works. A car on a 56 plate is still considered "recent" and will probably work very well.

My MiL does the books for a small chain of jewellers. They will buy in say a ring at £100, clean it then pop it in the window at £295. No warranty offered, no real prep work but a huge mark-up.

You should see what they do with Rolex/Brietling etc.....

That said, I was offered a significantly greater amount of money for my watch than I paid for it. Like Rolex or not, you can't deny that they hold their value.Got a 6-year old laptop I keep for an emergency spare. Cost new about £1500, value now is effectively nil and it barely works. A car on a 56 plate is still considered "recent" and will probably work very well.

My MiL does the books for a small chain of jewellers. They will buy in say a ring at £100, clean it then pop it in the window at £295. No warranty offered, no real prep work but a huge mark-up.

You should see what they do with Rolex/Brietling etc.....

Buying a new car on finance is a very expensive thing to do, but lot of people must do it else the new prices wouldn't hold up and second hand prices wouldn't be so low. Maybe if people showed some due diligence and calculated the real monthly cost over the likely time they will have the car before getting bored they wouldn't do it.

I moved to the US twelve years ago. My kids have had a mandatory 'personal finance' class in high school where they have to create a sim world where they have to struggle to allocate what they earn, learn about cost of renting apartments, leasing vs buying cars, residuals, insurance costs, interest etc. They come out laughing at the idea you borrow money to buy something that depreciates so quickly. HOWEVER leasing is very popular and most new cars are leased - predictable monthly cost, hand car back at end, usually maintenance is included etc. Yes it has built in financing and depreciation, but you are shielded from it, and view the transaction as a reasonable cost to own a car for a finite time.

I moved to the US twelve years ago. My kids have had a mandatory 'personal finance' class in high school where they have to create a sim world where they have to struggle to allocate what they earn, learn about cost of renting apartments, leasing vs buying cars, residuals, insurance costs, interest etc. They come out laughing at the idea you borrow money to buy something that depreciates so quickly. HOWEVER leasing is very popular and most new cars are leased - predictable monthly cost, hand car back at end, usually maintenance is included etc. Yes it has built in financing and depreciation, but you are shielded from it, and view the transaction as a reasonable cost to own a car for a finite time.

what I think Ill have to do is give up on getting rid of the car now, accept that I am not going to get 10k

(those saying im in cloud cuckoo land, I can see that glass say its worth 8/9k, I just fail to understand how -as someone said- the finance company underwrote a car that would never come close to paying them back if re-posessed)

and wait until maybe august september time when I will have paid another 2K off the car (Assuming it wont depreciate 2000 more in 9 months) and attempt to just hand it back then, forget Audi, and go somewhere else.

(those saying im in cloud cuckoo land, I can see that glass say its worth 8/9k, I just fail to understand how -as someone said- the finance company underwrote a car that would never come close to paying them back if re-posessed)

and wait until maybe august september time when I will have paid another 2K off the car (Assuming it wont depreciate 2000 more in 9 months) and attempt to just hand it back then, forget Audi, and go somewhere else.

BettySwollocks2 said:

(those saying im in cloud cuckoo land, I can see that glass say its worth 8/9k, I just fail to understand how -as someone said- the finance company underwrote a car that would never come close to paying them back if re-posessed)

The finance company doesn't usually look to avoid neg-eq mid-term. Buy pretty much anything, give it a few months, then get a settlement figure and unless you put in a decent deposit then you'll have negative equity. Let me guess, you put in the absolute bare minimum finance deposit?I love the fact that it's the finance company's fault that you're upside down by the way, top notch buck passing

BettySwollocks2 said:

and wait until maybe august september time when I will have paid another 2K off the car (Assuming it wont depreciate 2000 more in 9 months) and attempt to just hand it back then, forget Audi, and go somewhere else.

FWIW I think it's going to be another year after that before the finances balance but you seem to be heading down a sensible route.BettySwollocks2 said:

According to parkers depreciation calculator its depreciating at 110.36 per month so in another 9 months I should have removed 1500 worth of negative equity, which should be enough to help me out of it.

I would suggest its depreciating at your monthly payment amount(which I assume to be £222 per month - £2k divided by 9 months) - as finance tends to simply fund the depreciation, rather than actually purchasing anything. The "purchase" is either in the form of a hefty deposit upfront or balloon at the end.northwest monkey said:

Snowboy said:

I can't think of anything else that loses value so quickly.

I can't think of much that doesn't.Got a 6-year old laptop I keep for an emergency spare. Cost new about £1500, value now is effectively nil and it barely works. A car on a 56 plate is still considered "recent" and will probably work very well.

My MiL does the books for a small chain of jewellers. They will buy in say a ring at £100, clean it then pop it in the window at £295. No warranty offered, no real prep work but a huge mark-up.

You should see what they do with Rolex/Brietling etc.....

But most people who buy laptops (or sofa or shoes) consider it dead money.

It's not like there are shops around where you can trade in old for new.

Jewelery and watches accepted, but most people still don't trade these in every few years.

I guess the crux of it is that cars devalue a lot over time.

And most of the general public aren't aware of the standard markup bewteen wholsale and retail.

BettySwollocks2 said:

(those saying im in cloud cuckoo land, I can see that glass say its worth 8/9k, I just fail to understand how -as someone said- the finance company underwrote a car that would never come close to paying them back if re-posessed)

If you were to add up all the payments you've made so far and the deposit you paid so far, and the auction value of the car, it might not be a million miles away from what you financed in the first place, hence theres not much risk for them at this point, particularly given you have no intentions of defaulting.Gassing Station | General Gassing | Top of Page | What's New | My Stuff