Are the wheels about to fall of car finance?

Discussion

.... and here we go.

USED - i repeat USED - BMW 520d M Sport, £47,995.

http://usedcars.bmw.co.uk/5-Series/2.0TD-520d-M-Sp...

Tweak the finance example to be four years and BMW Select (PCP) finance, and you get -

On the Road Cash Price - £47995

£40,795.75 (Total Amount of Credit)

£16,137.36 (Optional Final Payment)

10.9 %Rate of Interest (fixed)

£60,136.73 (Total Amount Payable)

So your £47,995 BMW 520d M Sport is "worth" £16,137.36 after 4 years. So thats £31,857.64 of depreciation.

On top of that, theres a whacking 10.9% APR so your interest totals £12,141.73

Your payments would be £899 a month.

If you bought that car, paid the payments and cleared the residual at the end that USED BMW 520d M Sport would cost you £60,136.73

USED - i repeat USED - BMW 520d M Sport, £47,995.

http://usedcars.bmw.co.uk/5-Series/2.0TD-520d-M-Sp...

Tweak the finance example to be four years and BMW Select (PCP) finance, and you get -

On the Road Cash Price - £47995

£40,795.75 (Total Amount of Credit)

£16,137.36 (Optional Final Payment)

10.9 %Rate of Interest (fixed)

£60,136.73 (Total Amount Payable)

So your £47,995 BMW 520d M Sport is "worth" £16,137.36 after 4 years. So thats £31,857.64 of depreciation.

On top of that, theres a whacking 10.9% APR so your interest totals £12,141.73

Your payments would be £899 a month.

If you bought that car, paid the payments and cleared the residual at the end that USED BMW 520d M Sport would cost you £60,136.73

Edited by daemon on Friday 23 June 18:39

daemon said:

HedgeyGedgey said:

Justin Case said:

I was looking at some figures for a new car price !14500, PCP over four years. Playing with the figures and rounding off slightly off they come to approximately: deposit £1700, interest payments £!400, depreciation £9000. I don't think that finance is the problem

Jesus f

king Christ, that has to be the worst PCP deal ever!!!!!!

king Christ, that has to be the worst PCP deal ever!!!!!!I can find you a worse one than that, on a used car though....

HedgeyGedgey said:

daemon said:

HedgeyGedgey said:

Justin Case said:

I was looking at some figures for a new car price !14500, PCP over four years. Playing with the figures and rounding off slightly off they come to approximately: deposit £1700, interest payments £!400, depreciation £9000. I don't think that finance is the problem

Jesus f

king Christ, that has to be the worst PCP deal ever!!!!!!

king Christ, that has to be the worst PCP deal ever!!!!!!I can find you a worse one than that, on a used car though....

VGTICE said:

Some are too simple to realise that the problem here is not with those who are prudent and have basic understanding of maths and finance which enables them to select the best option. The problem is the majority who think that low monthlies equal good deal ignoring other important aspects like the price, length of term, interest rate, first rental/deposit. And they are encouraged to do so by car salesmen and finance providers. I remember the days when "regular" people used to take the piss out of those who were buying sofas/TV's/phones/white goods on credit using weekly installments because it's "cheaper" to pay 7 quid per month (over 84/96/108 months) than to pay the full amount upfront. Now those who were taking the piss do the same but with cars.

I think that PCP deals on used cars at 11% apr or bordering on a scam, you end up paying nearly as much in interest as the residual value on many deals, I said so in my earlier post.However, that doesn't change the fact that I keep my cars for a set amount of time, and whichever way is cheapest to be in that car for that period is the sensible way to do it.

liner33 said:

You would say majority , I would say minority.

I remember before 2007/08 people like you were saying that subprime was minority and there's no chance in the world anything bad could happen. The fact that people are only interested in monthlies and don't care about purchase price, interest rates, term length can of course could be totally by accident. Or perhaps they are duped into it by shyster tactics, like the ones presented in this little training video.https://youtu.be/1B2Qm2_zMow

Now I came across this little story from 2015 showing how fantastic and transparent the industry is (I'm sure it's minority).

http://www.thecarexpert.co.uk/dont-get-discount-ca...

SK 23 June 2015 at 3:06 pm

Hi I wanted to leave another post as I asked for some help from you a while ago and it was invaluable – thank you! I can't find my original post now but I wanted to leave an update in the hope that it might help someone else.

A couple of months ago I had got the money saved that I wanted to spend on a second-hand, quite rare model of Polo, after doing loads of research about what I wanted.

After keeping a close eye on Autotrader, I visited my three reasonably local VW dealerships. At the first one they didn't appear to want to sell any vehicle to anyone who walked through the door. The second got me to go there, only to try to convince me to buy a brand new car, all of which could have been done on the phone or email as they didn't look at my part-exchange and they didn't have the model of the car they wanted me to buy blind!

The third dealer was the only garage close by that had the car I wanted (the few others were all around 200 miles away!). The car was overpriced but the 'deposit contribution' brought it in line with what it should have cost, and the salesman refused to reduce the price for anything other than buying it on finance. He did the usual 'you're better off buying on finance' spiel – even though there is no possible way that can be the right choice for every customer, when they don't know anything about each person's individual situation! He told me that FSA regulations meant that he wasn't allowed to give me the APR and other figures that buying the car on finance would cost – just the monthly payment. He said that the APR would be "about 5 to 6%". Eventually worn down by having been there for hours and being so hungry I couldn't think straight, I agreed to the finance and after signing a few forms was told that meant I would have to make an extra trip to the dealer to sign the finance paperwork, which meant an extra two-hour round trip and a precious extra half-day of work. I went back to sign the paperwork, which a different person handled. He asked if I had had finance before and when I said no, he said "Well, you know that the finance you're getting is for a car, not a house extension or something like that?". He seemed to think that covered everything as he then ticked all the boxes on a sheet of paper and handed me the pen to sign the finance agreement. I told him that I was going to read through the paperwork, to which he looked very surprised and said I could if I wanted to. The APR was 12%, which would have meant I was paying about £4K extra for a car that I had the money in the bank to buy outright. By now I was totally convinced that I didn't want to get tied into the agreement, so I took extra care making sure that there was a valid 14 day cooling off period, which there was. Previously agreed gap insurance and the car tax were both included in the finance – I had already asked them to remove the gap insurance and the salesman said that I would get back more in the cashback they owed me – both of which meant I would be borrowing money I didn't need and paying interest on it.

I went back to collect the car, leaving my part exchange. You said that I shouldn't leave the garage without the balance of my part exchange but they said that they didn't have the money, it came from the finance company. So at this point the dealer had my old car, and the finance company owed me the cashback – in no way a customer-friendly situation. By now I was so traumatised by the entire experience that I just wanted to get my new car and go.

The night before I'd gone to sign the paperwork I was on the verge of a panic attack all evening and couldn't sleep. I cannot understand how buying a car could turn out to be so stressful – I have bought loads of second-hand cars before and never felt like this. I am absolutely over the moon with my Polo but the rest of the experience was awful. I've never bought from a main dealer before and I really hope I never have to again. Unfortunately I'm always so set on exactly what I want, which usually is quite a rare model of the car, that it puts me in a potentially negative position of only having a few options to choose from. As far as I'm concerned I should have left all three VW dealerships as a fan, even though I didn't buy a car from the first two. I should have been impressed to the point of recommending those dealerships to friends and family but they just don't seem to be bothered about their brand in that way! Absolutely crazy!

Anyway I will leave this essay now, there is a lot more I could say but I have tried to keep to the main points. Thanks again for your brilliant articles, your advice got me through this experience and meant I got what I wanted. If I hadn't known about the 14 day cooling off period I hate to think that I would have got stuck in the awful deal they lied to lure me into.

gizlaroc said:

VGTICE said:

Some are too simple to realise that the problem here is not with those who are prudent and have basic understanding of maths and finance which enables them to select the best option. The problem is the majority who think that low monthlies equal good deal ignoring other important aspects like the price, length of term, interest rate, first rental/deposit. And they are encouraged to do so by car salesmen and finance providers. I remember the days when "regular" people used to take the piss out of those who were buying sofas/TV's/phones/white goods on credit using weekly installments because it's "cheaper" to pay 7 quid per month (over 84/96/108 months) than to pay the full amount upfront. Now those who were taking the piss do the same but with cars.

I think that PCP deals on used cars at 11% apr or bordering on a scam, you end up paying nearly as much in interest as the residual value on many deals, I said so in my earlier post.However, that doesn't change the fact that I keep my cars for a set amount of time, and whichever way is cheapest to be in that car for that period is the sensible way to do it.

Used car PCPs in particular are very poor.

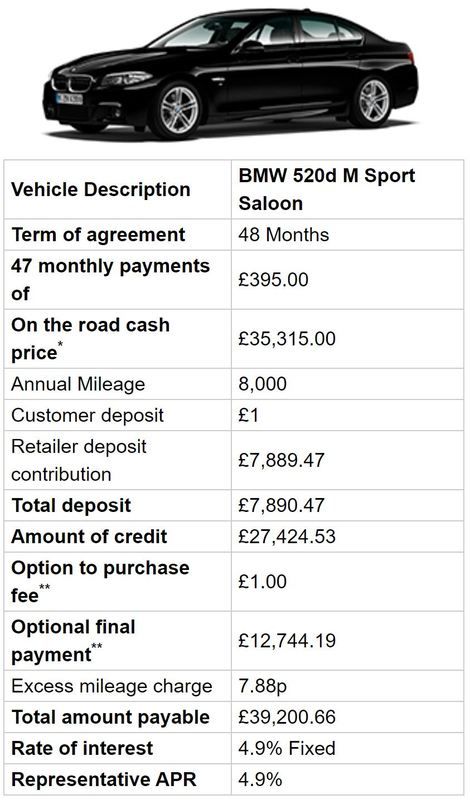

Who would ever accept the deal above on a used 520d @ £7000+ deposit, £900 a month when you can get a brand new one for £1 deposit and £395 a month?

https://www.cooperbmw.co.uk/offers/new-car-offers/...

Theres probably better personal lease deals out there too - i found that with only a cursory 30 second look around.

Again, its about taking the time to look at all the options and see what works best and / or cheapest for the individual

daemon said:

Again, its about taking the time to look at all the options and see what works best and / or cheapest for the individual

Of course it is, but again people who take time to do proper due diligence are minority. If they weren't nobody would buy used cars and with dead used cars market GFV on new cars (which makes the deals so incredible) would tank destroying the new car market deals. It's not rocket science.daemon said:

.... and here we go.

USED - i repeat USED - BMW 520d M Sport, £47,995.

http://usedcars.bmw.co.uk/5-Series/2.0TD-520d-M-Sp...

Tweak the finance example to be four years and BMW Select (PCP) finance, and you get -

On the Road Cash Price - £47995

£40,795.75 (Total Amount of Credit)

£16,137.36 (Optional Final Payment)

10.9 %Rate of Interest (fixed)

£60,136.73 (Total Amount Payable)

So your £47,995 BMW 520d M Sport is "worth" £16,137.36 after 4 years. So thats £31,857.64 of depreciation.

fUSED - i repeat USED - BMW 520d M Sport, £47,995.

http://usedcars.bmw.co.uk/5-Series/2.0TD-520d-M-Sp...

Tweak the finance example to be four years and BMW Select (PCP) finance, and you get -

On the Road Cash Price - £47995

£40,795.75 (Total Amount of Credit)

£16,137.36 (Optional Final Payment)

10.9 %Rate of Interest (fixed)

£60,136.73 (Total Amount Payable)

So your £47,995 BMW 520d M Sport is "worth" £16,137.36 after 4 years. So thats £31,857.64 of depreciation.

king hell, that's a lot of money for a 2 litre diesel.

king hell, that's a lot of money for a 2 litre diesel.£48k for a 2 litre diesel.

f

king f

king f king hell.

king hell.Not 10, not even 20, 30 or even 40, but £48k for a f

king 2 litre diesel???

king 2 litre diesel???What's wrong with these people? Let me guess, buy one brand new and they're EVEN MORE!!!

Ok, going to have a lie down now. Possibly in my £500 1.9 litre diesel.

VGTICE said:

daemon said:

Again, its about taking the time to look at all the options and see what works best and / or cheapest for the individual

Of course it is, but again people who take time to do proper due diligence are minority. If they weren't nobody would buy used cars and with dead used cars market GFV on new cars (which makes the deals so incredible) would tank destroying the new car market deals. It's not rocket science.That applies to cash buyers too.

VGTICE said:

daemon said:

VGTICE said:

I remember before 2007/08 people like you were saying that subprime was a minority

Subprime was a minority.

You implied the subprime type was the most prevalent mortgage type.

Your graph shows it was the most prevalent mortgage type among defaults

Big difference

Edited by daemon on Friday 23 June 21:44

Globs said:

daemon said:

.... and here we go.

USED - i repeat USED - BMW 520d M Sport, £47,995.

http://usedcars.bmw.co.uk/5-Series/2.0TD-520d-M-Sp...

Tweak the finance example to be four years and BMW Select (PCP) finance, and you get -

On the Road Cash Price - £47995

£40,795.75 (Total Amount of Credit)

£16,137.36 (Optional Final Payment)

10.9 %Rate of Interest (fixed)

£60,136.73 (Total Amount Payable)

So your £47,995 BMW 520d M Sport is "worth" £16,137.36 after 4 years. So thats £31,857.64 of depreciation.

fUSED - i repeat USED - BMW 520d M Sport, £47,995.

http://usedcars.bmw.co.uk/5-Series/2.0TD-520d-M-Sp...

Tweak the finance example to be four years and BMW Select (PCP) finance, and you get -

On the Road Cash Price - £47995

£40,795.75 (Total Amount of Credit)

£16,137.36 (Optional Final Payment)

10.9 %Rate of Interest (fixed)

£60,136.73 (Total Amount Payable)

So your £47,995 BMW 520d M Sport is "worth" £16,137.36 after 4 years. So thats £31,857.64 of depreciation.

king hell, that's a lot of money for a 2 litre diesel.

king hell, that's a lot of money for a 2 litre diesel.£48k for a 2 litre diesel.

f

king f

king f king hell.

king hell.Not 10, not even 20, 30 or even 40, but £48k for a f

king 2 litre diesel???

king 2 litre diesel???What's wrong with these people? Let me guess, buy one brand new and they're EVEN MORE!!!

Ok, going to have a lie down now. Possibly in my £500 1.9 litre diesel.

Most PCH (lease) deals are a rip. I looked at some Alfa 4C deals earlier this week. Of the ~400 on offer, only 2 were good value. In other words, 99% were a bit cr*p. Not a mainstream model, of course, but you see broadly similar ratios when looking at massmarket models from BMW etc.

Yipper said:

Most PCH (lease) deals are a rip. I looked at some Alfa 4C deals earlier this week. Of the ~400 on offer, only 2 were good value. In other words, 99% were a bit cr*p. Not a mainstream model, of course, but you see broadly similar ratios when looking at massmarket models from BMW etc.

PCH deals work best where the leasing company can get massive discounts by buying off the manufacturer in a large volume and the car has reasonable or better than average depreciation.Deals on stuff like Golf Rs, etc tend to work very well.

I would never have thought that lease deals on Alfas were ever going to be great (based on the above)

Edited by daemon on Friday 23 June 22:07

daemon said:

You implied the subprime type was the most prevalent mortgage type.

No I didn't. If you read what I wrote without trying to flip it to fit your agenda you'll find out that what I actually mean is that people like you tried to downplay the issue with subprime being big enough to cause any harm. Shills always try to clutch at straws to defend the indefensible. I'm not sure what your interest in this incoming f k up is since you're so defensive about it.

k up is since you're so defensive about it.VGTICE said:

daemon said:

You implied the subprime type was the most prevalent mortgage type.

No I didn't. If you read what I wrote without trying to flip it to fit your agenda you'll find out that what I actually mean is that people like you tried to downplay the issue with subprime being big enough to cause any harm. Shills always try to clutch at straws to defend the indefensible. I'm not sure what your interest in this incoming f k up is since you're so defensive about it.

k up is since you're so defensive about it.Heres what you wrote -

VGTICE said:

I remember before 2007/08 people like you were saying that subprime was minority

It WAS a minority lending type.Edited by daemon on Friday 23 June 22:52

Gassing Station | General Gassing | Top of Page | What's New | My Stuff