Barclays customers can now 'switch off' spending

Discussion

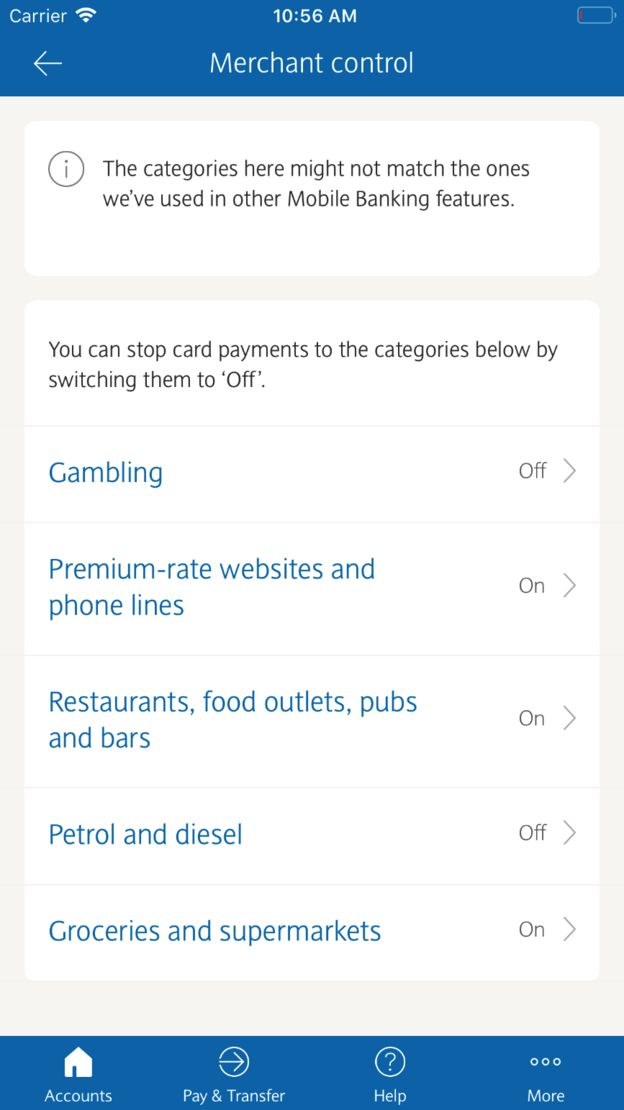

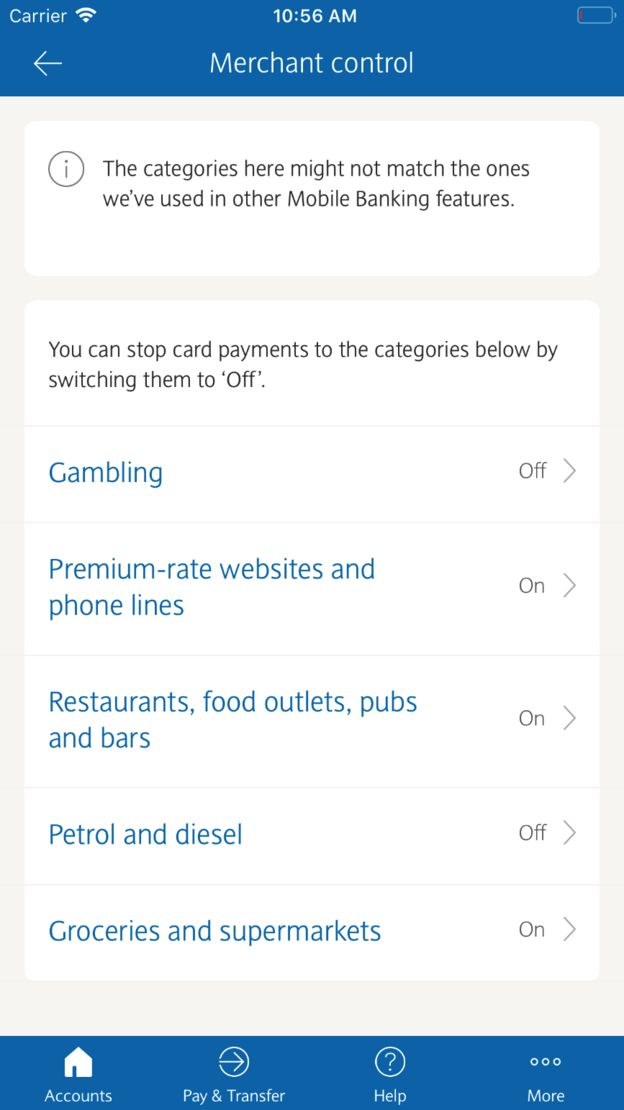

Barclays allows its customers to "switch off" certain types of spending on their debit cards.

Customers can do this through the app:

Purchases are blocked by distinct categories rather than specific retailers. The idea is to help help vulnerable customers, particularly problem gamblers, or those in serious debt.

https://www.bbc.co.uk/news/business-46512030

The thing is, will any of this actually help the exact audience it is intended for?

I also note the exclusion of this facility on their credit cards, according the article that will happen at some point in the future, but I remain skeptical. Surely it's in their [banks] best interests to have you spending/using the credit card as much as possible.

Have any Barclays customers here tried the feature yet?

Customers can do this through the app:

Purchases are blocked by distinct categories rather than specific retailers. The idea is to help help vulnerable customers, particularly problem gamblers, or those in serious debt.

https://www.bbc.co.uk/news/business-46512030

The thing is, will any of this actually help the exact audience it is intended for?

I also note the exclusion of this facility on their credit cards, according the article that will happen at some point in the future, but I remain skeptical. Surely it's in their [banks] best interests to have you spending/using the credit card as much as possible.

Have any Barclays customers here tried the feature yet?

JaredVannett said:

The thing is, will any of this actually help the exact audience it is intended for?

From the very article you cite:BBC said:

Monzo, which introduced a similar tool in June, has reported a 70% decline in spending on gambling as a result.

Your tone comes across as being somewhat anti this tool, and I can't quite see why. They're just giving people the option to control their spending in a more rigorous manner, which doesn't strike me as a bad idea.jamest1988 said:

Interesting concept, Id be curious about what stops you just switching the spending back on in a moment of weakness, a 24hr waiting period maybe or something more concrete.

I hope the other banks take this on board and implement something similar soon.

Exactly, by all means it's a good a noble idea... just wondering if in the real world it will make a difference.I hope the other banks take this on board and implement something similar soon.

Spidersleg said:

I don't understand the point of this feature. Obviously the gambling bit, but why would you want to stop yourself buying fuel or groceries?

So you have more money to spend on gambling?Maybe people have accounts which they only use for a specific purpose? I guess this would help prevent fraud if your card was clone/lost as it restricts the number of outlets it can be used at?

Spidersleg said:

I don't understand the point of this feature. Obviously the gambling bit, but why would you want to stop yourself buying fuel or groceries?

Realistically, I suspect they are just there to bulk out the screen and make it look less obvious that they are actually targetting problem gambling and premium phone lines. If they just had those then they'd get people accusing them of running a moral crusade, and I suspect they could have opened themselves up to legal action from the gambling companies. By adding the additional options, which nobody will ever use, they avoid any such claims and also get to market it as 'controlling your spend'.jamest1988 said:

Interesting concept, Id be curious about what stops you just switching the spending back on in a moment of weakness, a 24hr waiting period maybe or something more concrete.

I hope the other banks take this on board and implement something similar soon.

Monzo's waiting period is 48 hours. I don't know off-hand whether it waits 48 hours and then switches off, or whether you have to go back again after 48 hours (which would be better).I hope the other banks take this on board and implement something similar soon.

edit: I just tested it - you need to open a chat with them and then it looks like it takes effect from 48 hours. I guess the requirement to chat is even more effective than having a button.

Edited by Gareth79 on Tuesday 11th December 13:43

eldar said:

foiled said:

With the Barclays app, the different categories can be switched on and off at will, no need to wait 48 hours

Kind of defeats the purpose?"A voluntary gambling block on payment cards is about adding 'friction'.

Of course it doesn't make it impossible to gamble, it makes it more difficult,.

And importantly the research shows the fact "I chose to block this" means people think twice before working around it"

https://twitter.com/MartinSLewis/status/1072413338...

I think it's a great idea and wish they'd take it further. Why not deny all transactions except from specific retailers, as I know a particular card will only ever be used at Amazon or tesco. That way if my card went missing it can't be used anywhere. Or set a limit, or max number of transactions per day, etc.

My concern is whether this is the thin end of the wedge. Will the bank start to regard themselves as responsible for ensuring “friction” on other spends... will the bank have a view on whether you are spending too much of your own money.... will you get a red flag in your app if, say, the average grocery spend is £250/momth and you spend £350.... of you do not deposit (with them) sufficient funds in your 0.3% interest ISA....

Barclays are already becoming intrusive with their in-app prompt to allow open banking- something I am also cynical about

Barclays are already becoming intrusive with their in-app prompt to allow open banking- something I am also cynical about

deckster said:

Spidersleg said:

I don't understand the point of this feature. Obviously the gambling bit, but why would you want to stop yourself buying fuel or groceries?

Realistically, I suspect they are just there to bulk out the screen and make it look less obvious that they are actually targetting problem gambling and premium phone lines. If they just had those then they'd get people accusing them of running a moral crusade, and I suspect they could have opened themselves up to legal action from the gambling companies. By adding the additional options, which nobody will ever use, they avoid any such claims and also get to market it as 'controlling your spend'.Let's say the car is running low on fuel and it's a few days before payday. There might be a choice between paying for more fuel or going by bike or walking for a few days. The app might prove useful for that person.

Not everyone who uses a car, HAS to use a car every day.

Gassing Station | Finance | Top of Page | What's New | My Stuff