How much disposable income are you comfortable investing?

Discussion

Initially I was going to phrase this as "How much of my disposable income should I invest into Vanguard LS100?"

But I've been around here long enough now to know that it'll only be met by the usual (rightly so) responses...

So, I'm 24, a higher rate tax payer who is already maximising company pension contributions (5% employee / 10% employer - I don't have the option to up my personal contributions), recently become a home owner, no finance/debts and ~6 months expenditure saved for the worst case scenario. So, as far as I'm concerned, I have nothing left to save for other than later in life and a manual M2

I saved for my house deposit via a S&S LISA so I'm familiar with investments and the risk they carry... So, I've just opened a S&S ISA with Vanguard directly with the intention to invest £250 per month in their LS100 offering. Great. But, after bills, travel expenses and some frivolity I have £1.2k to play with, so £250 feels is feeble, or is it?

For some reason, I think due to being a new home owner and the increased bills/responsibility has made me slightly risk averse, or at least makes me want to be able to see/access my money readily... But on the flip side, I know that I can easily sell my funds and withdraw from the S&S ISA wrapper whenever I want to, of course it may be subject to market volatility but still... It's definitely a psychological thing. Not to mention all of my money is sat in a Santander 123 account paying a measly 1.5%, soon to be 1% when I know from experience funds can provide multiples of that.

Basically, how much of your disposable income are you comfortable investing?

But I've been around here long enough now to know that it'll only be met by the usual (rightly so) responses...

So, I'm 24, a higher rate tax payer who is already maximising company pension contributions (5% employee / 10% employer - I don't have the option to up my personal contributions), recently become a home owner, no finance/debts and ~6 months expenditure saved for the worst case scenario. So, as far as I'm concerned, I have nothing left to save for other than later in life and a manual M2

I saved for my house deposit via a S&S LISA so I'm familiar with investments and the risk they carry... So, I've just opened a S&S ISA with Vanguard directly with the intention to invest £250 per month in their LS100 offering. Great. But, after bills, travel expenses and some frivolity I have £1.2k to play with, so £250 feels is feeble, or is it?

For some reason, I think due to being a new home owner and the increased bills/responsibility has made me slightly risk averse, or at least makes me want to be able to see/access my money readily... But on the flip side, I know that I can easily sell my funds and withdraw from the S&S ISA wrapper whenever I want to, of course it may be subject to market volatility but still... It's definitely a psychological thing. Not to mention all of my money is sat in a Santander 123 account paying a measly 1.5%, soon to be 1% when I know from experience funds can provide multiples of that.

Basically, how much of your disposable income are you comfortable investing?

Edited by 95JO on Monday 20th January 15:52

Drezza said:

I'm also 24, low rate (20%) tax payer and I have a mortgage of £600p/m. I invest £300 pm into S&S ISA, 5% pension. my take home is probably about 1700 net. I drive a s tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

Nice, just to be clear, the £250 isn't all I'm saving - The remaining £1k or so just gets lumped in to the Santander 123, doing nothing! tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge.

tty old 2007 diesel Skoda and spend about £25 a week on food/ drink so hardly living the high life but still managing to save a decent wedge. djc206 said:

Fair enough. Yeah why not, start a SIPP and get the 40% relief. Of course that money wouldn’t be accessible for over 3 decades so that might not be an attractive prospect to someone as young as you.

Probably the best thing I could do in terms of return, but like you said, I don't want to wait 30+ years really!Mr Pointy said:

Are you saying you have maxed out your pension contributions? Have you any allowance left over you could put in a SIPP/PP? Any allowance left over from the past three years?

No, I’m paying in the maximum my employer allows me to, as mentioned above, I could utilise a SIPP and reclaim the Government bonus. But if I’m being honest, I don’t fancy locking away more money that I can’t access for 30+ years. However, I appreciate this is almost definitely the best thing to do (financially).Mr Pointy said:

Yes it might well be as you're only putting in £3000 out of the £20,000 annual allowance. As you say it's not locked away so I'd at least double or triple it. You've still got money to play with but if you've invested it you won't waste it.

That’s what I thought - I definitely won’t be able to max out my annual allowance any time soon but after some more thought on the commute home, I think £500 per month is definitely a step in the right direction.Mr Pointy said:

Keep an amount (£10k) in cash & shove the rest into your ISA. Even Vanguard LS40 (lowish risk level) was up by 13% over the last 12 months.

Time is the key; you need to have it invested so the magic of compound interest can take place. Save really hard now & you can retire early.

I’ve got £8k in cash, so I’ll allow that to build over a few months and start the process of lumping into the LS100. Time is the key; you need to have it invested so the magic of compound interest can take place. Save really hard now & you can retire early.

re: LS40 - Indeed, I was shocked by that when browsing earlier. My Dad is looking to do similar, however he’s closer to taking his pension so I’ll be pointing him in that direction!

I’ve already had a glimpse of what that S&S investments can return after seeing a 30% gain over 2 years of holding a couple of funds... Maybe that was beginners luck though

But yes, that’s the plan, I’d like to retire/semi-retire in my early 50’s - We’ll see!

Thanks for the reply,

b hstewie said:

hstewie said:

hstewie said:

hstewie said: I tend to try to "ladder" things a little.

So:

Makes sense, I’d like to diversify in the future. However, at the minute I don’t have much to diversify since putting down the deposit for my house. So:

- Cash

- Savings

- NS&I Bonds

- Cautious and "wealth preservation" funds where I'm happy storing a lot as it's not going to tank overnight

- 100% normal equities

- 100% racier equities

As mentioned above, £8k in cash, decent pensions (mix of Civil Service and Aviva managed fund) and roughly £17k in my car. However, now the big ticket item is done (house deposit), I want to put that ~£1.2kpm to the best possible use, without locking it away until I’m 55+

So, I think I’ll diversify once I have north of £50k in cash/investments. I’ve read elsewhere to not bother until north of £100k!

But thanks for the reply, definitely an approach I will adopt in due course.

mike9009 said:

All good advice above.

I would also look at overpaying the mortgage too. As you probably know, the compound interest payments get quite large over the mortgage term.......

It is cheap money at the moment but over the lifetime of the mortgage things might well change.

Mike

I’m surprised this didn’t come up sooner as I failed to mention that I’ve considered it.I would also look at overpaying the mortgage too. As you probably know, the compound interest payments get quite large over the mortgage term.......

It is cheap money at the moment but over the lifetime of the mortgage things might well change.

Mike

I’ve discussed with my OH and we’ve agreed to look in to it come remortgage time (4.5 years)... As you mention, interest rates are very low so we’re taking advantage of it currently.

red_slr said:

Trust me on this, at 24 if you are able to invest that kind of money (>£1k a month) then go for it.

Most people at 24 who have >£1k/mo disposable income are trying to work out how best (or not) to spend it, not save it.

The next 20 years are going to be gone in a blink.

So pick a decent ISA fund (seems like you already found VLS) and just fire and forget.

If something changes in your circs then you can always stop the payments, or decrease or of course increase.

As for SIPP, that's a decision only you can make. Personally for me a SIPP was not the right vehicle, but that's the route I went down. So I ended up mid 30s realising I had spent 15 years paying into a pension I probably couldn't access when I wanted too. It was 50 when I started my pension, then went to 55 and now it looks like it will be 58 or maybe even more.

It shows life changes, and the rules change. Back then I was naïve and thought that these things were set in stone but they are not. You need to be able to adapt and change course quickly and for me at least the SIPP was no good for that.

I still have a SIPP and pay into it each month, but at a much reduced rate, surplus going into my ISA.

Thanks for the reply red_slrMost people at 24 who have >£1k/mo disposable income are trying to work out how best (or not) to spend it, not save it.

The next 20 years are going to be gone in a blink.

So pick a decent ISA fund (seems like you already found VLS) and just fire and forget.

If something changes in your circs then you can always stop the payments, or decrease or of course increase.

As for SIPP, that's a decision only you can make. Personally for me a SIPP was not the right vehicle, but that's the route I went down. So I ended up mid 30s realising I had spent 15 years paying into a pension I probably couldn't access when I wanted too. It was 50 when I started my pension, then went to 55 and now it looks like it will be 58 or maybe even more.

It shows life changes, and the rules change. Back then I was naïve and thought that these things were set in stone but they are not. You need to be able to adapt and change course quickly and for me at least the SIPP was no good for that.

I still have a SIPP and pay into it each month, but at a much reduced rate, surplus going into my ISA.

I’m very conscious that I’m in a fortunate position at my age and I’m always actively trying to be conservative with my money, rather than financing an M2 or similar, despite my friends/family’s encouragement

You make a good point in regards to the pension age rising further, one that I hadn’t really given much thought. I was more concerned with not being able to access it for 30+ years, never mind any more!

I think a SIPP is something I’ll look in to if ever I’m in a position where I can max my ISA contributions.

b hstewie said:

hstewie said:

hstewie said:

hstewie said: I'd also add try and make sure you understand your own psychology

You've mentioned a few times about making money.

Make sure you understand how you'd react when your investments lose money.

You feel losses more than gains and the last decade hasn't been normal compared to historical stock markets.

That probably sounds doom and gloom when I think it's just something to keep in mind but with the caveat that I bloody wish I'd started investing when I was 24.

Of course, I appreciate that my investments may decrease in value over the coming years and I’d like to think I’m prepared for that. However, in my short exposure (~2 years), I have been fortunate enough not to experience a down turn...

You've mentioned a few times about making money.

Make sure you understand how you'd react when your investments lose money.

You feel losses more than gains and the last decade hasn't been normal compared to historical stock markets.

That probably sounds doom and gloom when I think it's just something to keep in mind but with the caveat that I bloody wish I'd started investing when I was 24.

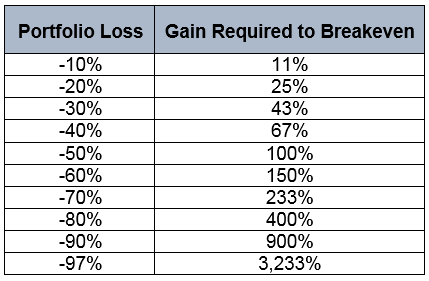

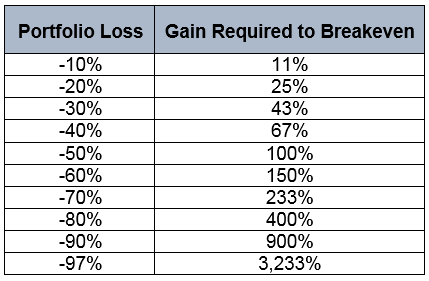

So that visual representation is hard viewing! Hopefully my circumstances don’t drastically change for the worse and I can ride out any down turns.

Out of curiosity, if you were saving for a car - Would you build those savings in a current/savings account or within your investment? (Assuming the new car purchase isn’t essential, meaning some exposure to risk is available - Have I answered my own question?)

Simpo Two said:

'Saving for a new car' is a financial oxymoron to me - if you really mean 'new' car. If you get to the point where you can afford it you may be too sensible to buy it!

By new car, I mean new to me - I always tend to by lightly used (1-3 years old) Edited by Simpo Two on Monday 20th January 20:55

But alas, this is PH after all!

Armitage.Shanks said:

djc206 said:

Don’t be too conservative with your money lest you become one of those dullards that has never done anything but accumulate wealth and then once they’ve got it all have no idea how to enjoy it because it’s the figures that give them the joy not the world of opportunities that having a few quid brings. I have colleagues like this sitting on millions but miserable as sin except when counting their money. That or end up losing half of it in a divorce, one former colleague had 3 of those under his belt, we didn’t see him smile very often!

There’s a middle ground where being fiscally responsible and still enjoying your relative youth can sit comfortably together. I struck a pretty good balance through my 20’s I think. Nice cars, nice holidays, a lot of experiences in the prime of my life but also a very good pension going and a house with a decent amount of equity in it. A mixture of head and heart.

I was just about to post something very similar. Life can be full of regrets wishing it had been done sooner.There’s a middle ground where being fiscally responsible and still enjoying your relative youth can sit comfortably together. I struck a pretty good balance through my 20’s I think. Nice cars, nice holidays, a lot of experiences in the prime of my life but also a very good pension going and a house with a decent amount of equity in it. A mixture of head and heart.

Also how secure is your job, planning a family etc.? I paid my mortgage off c10yrs early as I wanted to be free of debt using the surplus to retire early.

- Berlin, Amsterdam and an Italian road trip planned already for this year!

- Berlin, Amsterdam and an Italian road trip planned already for this year!It’s very secure (I think), I’ve always worked in the Civil Service, but last year I moved to a GovCo owned by the same Department. Not much has changed, except more autonomy and a big pay rise in exchange for the DB pension - I’ll likely go full circle and rejoin the CS when the right job comes up.

But no plans for a family, yet... We’ll reassess in 5 years time

ILikeCake said:

The same underlying indexes make up each LifeStrategy fund, just in different proportions. In effect you've created a LifeStrategy74 fund. For the sake of 6% difference in equities/bonds, surely just shove it all in LS80 for simplicity!?

OP - this picture gets thrown around a lot and seems to be popular. It's America focused but you get the gist.

Yeah, I've seen this before - It makes sense and follows the theme of most replies here, which is reassuring!OP - this picture gets thrown around a lot and seems to be popular. It's America focused but you get the gist.

Thanks all for the replies, definitely cemented my decision to avoid to SIPP route (for now at least) and to double my S&S ISA contributions.

I think I just needed to voice my thoughts and ensure I'm not missing something blindingly obvious.

supercommuter said:

95JO said:

Simpo Two said:

Excellent, carry on  I always headed for high-mileage prestige... fun to drive a 3-year old XJ6 that cost less than your client's new Vauxhall!

I always headed for high-mileage prestige... fun to drive a 3-year old XJ6 that cost less than your client's new Vauxhall!

Good taste! I’m primarily eyeing up a manual M2 however I can’t seem to shake the want for a manual 997 CS... I always headed for high-mileage prestige... fun to drive a 3-year old XJ6 that cost less than your client's new Vauxhall!

I always headed for high-mileage prestige... fun to drive a 3-year old XJ6 that cost less than your client's new Vauxhall!I am late twenties and like you was a higher rate tax payer very early in my 20's and saved, tucked loads away. I have only just started spending and wish i had purchased what i wanted earlier on. Dont look so cool in a convertible now with the remaining strands of my hair blowing out

But don’t worry, I won’t hesitate to do a buy once I can get in to one without any finance whilst maintaining the rainy day fund, I suspect it’ll be this time next year!

Plus I’m still not bored of my M235i, yet

orangesrule said:

Interesting thread. I'm in a similar position at 28. Current salary is 35k, but I quite often earn over 50k. I spread my earnings as follows:

£300 VLS60 isa

£150 Company share scheme

£280ish (9.5%) of salary in pension (employer contribution 8%)

£200 regular savings

I then try to save £500 in a standard savings account, and occasionally bleed some savings off to premium bonds - I do often wonder i should put more into my ISA! In fact I might start putting 500 into VLS and 300 into standard savings.

I own my house mortgage free, but in the coming 18months hoping to upsize, so trying to no lock away lots of cash.

Sounds like a need to step my game up! Nice work paying off your mortgage so quickly, impressive £300 VLS60 isa

£150 Company share scheme

£280ish (9.5%) of salary in pension (employer contribution 8%)

£200 regular savings

I then try to save £500 in a standard savings account, and occasionally bleed some savings off to premium bonds - I do often wonder i should put more into my ISA! In fact I might start putting 500 into VLS and 300 into standard savings.

I own my house mortgage free, but in the coming 18months hoping to upsize, so trying to no lock away lots of cash.

pb8g09 said:

I’m 28 and have been a high rate tax payer for the last 4 and a half years.

I can’t manage to put away more than £500 a month. Scratching my head why. Missus isn’t exactly a career focussed individual which combined with a big mortgage means I can only dream of having these dilemmas!

I suppose I'm luckily in that my OH is even more frugal/career focussed than me - She earns a decent wage ~£31k and we split bills on a percentage basis (63% / 37%)... She did say when she gets promoted she may drop to 4 days a week! She's only 21! I was looking forward to a mini pay rise as the percentages would've changed dramatically - Oh well, guess I'll have to go part-time myself I can’t manage to put away more than £500 a month. Scratching my head why. Missus isn’t exactly a career focussed individual which combined with a big mortgage means I can only dream of having these dilemmas!

Edited by 95JO on Wednesday 22 January 10:10

red_slr said:

Could have been gifted or inherited or maybe had a huge deposit. I would say its unusual for someone at 28 to be mortgage free via straight overpayments using "traditional" type LTVs. Bravo though either way.

True, I just didn't want to assume!A former colleague took out a 10 year mortgage, albeit on a £140k property but he was only earning £28k at the time and had no partner, so it's definitely do-able, especially if HRT.

pb8g09 said:

Yup ours is 67:33 so sounds like we are on relatively similar money. You’re obviously in a much more sensibly priced part of the country to me! Trying to convince the other half to move north....!

Such a PH approach, I like it. I had to talk her round to it at first, but once she realised she benefits from it the most she was sold

Yeah, we live on the border of Widnes/Warrington (NW) where new build 4 bedroom detached houses are sub £300k - Best of luck with the convincing!

Gassing Station | Finance | Top of Page | What's New | My Stuff