Chase Bank - Anyone here have an account?

Discussion

Going over to the US in a couple of weeks and heard about Chase. Thought I would download / open an account and was wondering if many on here have used / has an account ?

Meant to be free banking over in the US ? What does that actually mean ? No doubt I will still get hit with the horrible exchange rate when using my card to buy something ?

Simon

Meant to be free banking over in the US ? What does that actually mean ? No doubt I will still get hit with the horrible exchange rate when using my card to buy something ?

Simon

So with revolut if I put £1000 into the account, then convert it to USD , does this mean when Im using the card in the US it deducts it from that USD amount ?

I wouldn't suffer any charges etc ?

If I was to use my Barclay card then each transaction would be converted to GBP and fees applied I think.

I wouldn't suffer any charges etc ?

If I was to use my Barclay card then each transaction would be converted to GBP and fees applied I think.

You can either convert it to the USD account and spending will then draw down on the USD account

OR

leave it in GBP and it will auto convert on demand. There are no charges, expect for currency conversions at weekends (1%?) when the currency spread is a bit larger. The rates are still likely to be better or as good as anything else you can get.

OR

leave it in GBP and it will auto convert on demand. There are no charges, expect for currency conversions at weekends (1%?) when the currency spread is a bit larger. The rates are still likely to be better or as good as anything else you can get.

I have a Chase account and you get the Mastercard interbank rate when its used overseas. No charges or commission added on. Same as Starling and the other banks that offer no fee for non-GBP transactions.

You can see the rate here: https://www.mastercard.co.uk/en-gb/personal/get-su...

You can see the rate here: https://www.mastercard.co.uk/en-gb/personal/get-su...

I always use Halifax Clarity card. Its a credit card so you can sort out paying the bill when you get back, no fees and they give you the mastercard bulk rate. No interest to pay if you pay the bill in full.

You can use to withdraw currency at an atm abroad but you get charged interest from the point you withdraw. Its pence if you just need a few hundred dollars and handy as avoids having to take lots of cash with you.

You can use to withdraw currency at an atm abroad but you get charged interest from the point you withdraw. Its pence if you just need a few hundred dollars and handy as avoids having to take lots of cash with you.

goingonholiday said:

I always use Halifax Clarity card. Its a credit card so you can sort out paying the bill when you get back, no fees and they give you the mastercard bulk rate. No interest to pay if you pay the bill in full.

You can use to withdraw currency at an atm abroad but you get charged interest from the point you withdraw. Its pence if you just need a few hundred dollars and handy as avoids having to take lots of cash with you.

It was better when you could front load the account, thereby avoiding any interest and not having to remember to pay off the credit before midnight UK time to avoid interest charges.You can use to withdraw currency at an atm abroad but you get charged interest from the point you withdraw. Its pence if you just need a few hundred dollars and handy as avoids having to take lots of cash with you.

Still a useful card, but now slightly less shiny thanks to the Halifax being the Halifax.

Where Chase is slightly better than starling for example at Disney is all the Cash machines on site are Chase so you wont pay any ATM fees.

So all depends if you plan to take cash out.

But other than that its pretty similar. As Mastercard FX rates so same as a clarity card/starling.

With Disney lots of stuff is mobile order via My Disney experience.

So all depends if you plan to take cash out.

But other than that its pretty similar. As Mastercard FX rates so same as a clarity card/starling.

With Disney lots of stuff is mobile order via My Disney experience.

Edited by J210 on Wednesday 23 March 12:17

h0b0 said:

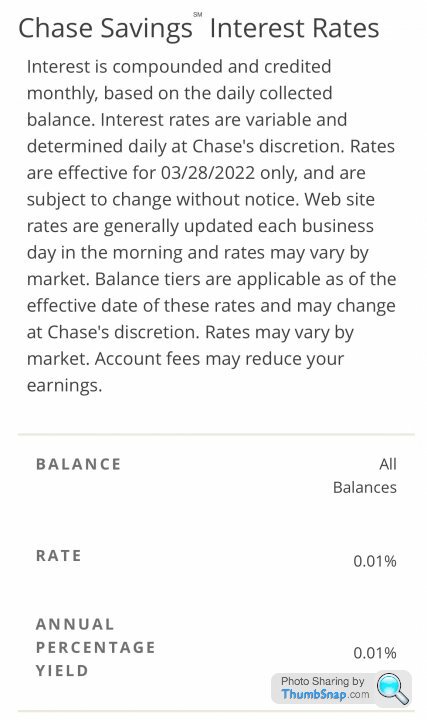

I am using the App and yet I am still a fool. I live in the US where Chase would never buy business through interest rates.1.5% would be insane. I was not doubting the posters, just eager to pounce.

Oh well, I will stick to my 0.02% rate.

I have just opened a chase account, took a while as the checks were quite extensive. I guess maybe the rates are only available to new customers outside of the USA ?Oh well, I will stick to my 0.02% rate.

Gassing Station | Finance | Top of Page | What's New | My Stuff