Pensions management - SJP etc

Discussion

Hi all,

Who does anyone recommend for pension management etc for growth? A few guys at work use SJP and have been impressed with results. Some reviews online read horrific. Fees high but growth of 18% over the last 12 months. My current Fidelity funds (unmanaged) are showing 9.5% growth. Even with fees SJP seems a no brainer but be interested to hear of opinions. I'm 42 yrs old so not drawing anytime soon.

Thanks.

Who does anyone recommend for pension management etc for growth? A few guys at work use SJP and have been impressed with results. Some reviews online read horrific. Fees high but growth of 18% over the last 12 months. My current Fidelity funds (unmanaged) are showing 9.5% growth. Even with fees SJP seems a no brainer but be interested to hear of opinions. I'm 42 yrs old so not drawing anytime soon.

Thanks.

jinkster said:

Hi all,

Fees high but growth of 18% over the last 12 months.

I'd be more interested to see what they've done over the past decade, including maximum drawdown. To give an example I've an investment that is 106.18% up over the past 3 years, but only 85.47% up over the past 5. It's easy to cherry pick a benchmark duration to make a volatile asset look great.Fees high but growth of 18% over the last 12 months.

Keep in mind that the return you get is (underlying investment performance - fees), so starting out by picking a service known for high fees seems like going horse racing and starting by taking one of the horse's legs off.

Looking at SJP's own figures, none of its pension funds appear to have achieved a 0-12 month discrete performance of +18%. However, a couple - SJP Japan and SJP UK Equity Income - have exceeded +16%.

https://www.sjp.co.uk/individuals/fund-prices/pens...

It'd be interesting to see which funds your friends are holding to achieve the returns that they claim.

As with any pension provider, costs are a critical consideration. Not only the ongoing costs while you're building up your pension pot, but any costs associated with drawdown when you retire too.

In the case of SJP, paying an initial 'advice charge' of 4.5% and initial 'product charge' of 1.5% would be instant red flags for me.

https://www.sjp.co.uk/individuals/fund-prices/pens...

It'd be interesting to see which funds your friends are holding to achieve the returns that they claim.

As with any pension provider, costs are a critical consideration. Not only the ongoing costs while you're building up your pension pot, but any costs associated with drawdown when you retire too.

In the case of SJP, paying an initial 'advice charge' of 4.5% and initial 'product charge' of 1.5% would be instant red flags for me.

jinkster said:

A couple of friends are in the Polaris 4 fund and looking at like for like based on my Fidelity self chosen funds.

Polaris 4?Looks like 8.2% growth over the past 12 months, according to them

Where are they claiming 18%?!

Maybe they are including their active contributions to skew things.

As said above: find a real IFA. Or continue to DIY - you already appear to be beating them!

jinkster said:

Hi all,

Who does anyone recommend for pension management etc for growth? A few guys at work use SJP and have been impressed with results. Some reviews online read horrific. Fees high but growth of 18% over the last 12 months. My current Fidelity funds (unmanaged) are showing 9.5% growth. Even with fees SJP seems a no brainer but be interested to hear of opinions. I'm 42 yrs old so not drawing anytime soon.

Thanks.

Look at performance of funds over a much longer term. Use proper data to do this and not anecdotes.Who does anyone recommend for pension management etc for growth? A few guys at work use SJP and have been impressed with results. Some reviews online read horrific. Fees high but growth of 18% over the last 12 months. My current Fidelity funds (unmanaged) are showing 9.5% growth. Even with fees SJP seems a no brainer but be interested to hear of opinions. I'm 42 yrs old so not drawing anytime soon.

Thanks.

Consider the impact of charges over the long term.

Do the basic maths to understand the compounding impact of charges. Eg. 1% annually applied over 20 years leaves for pot reduced by 1- 0.99^20=??

Notsofastfrank said:

The biggest Red Flag for you or anybody else considering SJP is that they are not independent. SJP advisers are just salesmen for SJP funds, you have no choice. Speak to a real IFA.

Spoiler alert...there is no such thing as truly independent.Even a so called IFA will be working off a relatively narrow range of common go to products/investments. So whilst they have the ability to recommend anything, they'll in effect still be using a panel like a restricted adviser.

Nothing wrong with using a panel, so long as it's got good stuff on it. Which SJP's does not.

OP, you are saying that a published review shows 18% growth? Can you post a link

I would be cautious of what other people are claiming

I would be cautious of what other people are claiming

- 18% after fees across a portfolio may not be sustainable (mine are 10% to 15% up over the same period, across 4 my 5 pension providers)

- people don’t like to admit they have backed a loser, and will call out one winning bet among many

- some outfits (probably the agents rather than companies) can offer incentives to existing clients to to bring in more punters

911hope said:

Look at performance of funds over a much longer term. Use proper data to do this and not anecdotes.

Consider the impact of charges over the long term.

Do the basic maths to understand the compounding impact of charges. Eg. 1% annually applied over 20 years leaves for pot reduced by 1- 0.99^20=??

it's actually much worse than that because they will charge you fees and also fund charges which seems to total around 2+ % annually and after 20 years when you realise the amount you will have paid out over those years in charges and fees it will stagger you.Consider the impact of charges over the long term.

Do the basic maths to understand the compounding impact of charges. Eg. 1% annually applied over 20 years leaves for pot reduced by 1- 0.99^20=??

if SJP were as good as your pal says they would just sack all their staff, get a giant bank loan and invest it all into their own funds...

start your own SIPP with one of the large and well know providers such as HL , Interactive Investor, AJ Bell etc and put the money into a global tracker ETF.

If you’re 42, I’d just self-service on whatever pension platform has the lowest fees, and put it into the biggest global index fund you can find, like Vanguard all world (VWRP).

Then in ten years time, you can look at getting advice on how to reduce risk as you get closer to pension age.

I’m of the belief that few financial advisors, especially SJP will beat a global index fee especially when fees are taken into consideration, and you are young enough to take on the risk of all equities.

Then in ten years time, you can look at getting advice on how to reduce risk as you get closer to pension age.

I’m of the belief that few financial advisors, especially SJP will beat a global index fee especially when fees are taken into consideration, and you are young enough to take on the risk of all equities.

GiantEnemyCrab said:

They are f king expensive and good luck trying to move away from them.

king expensive and good luck trying to move away from them.

How much do they charge then? How is that broken down? How does that differ from what other are charging? king expensive and good luck trying to move away from them.

king expensive and good luck trying to move away from them.Anyone can move from SJP at any time. Why would you think someone would need 'good luck' to do so?

OddCat said:

How much do they charge then? How is that broken down? How does that differ from what other are charging?

Anyone can move from SJP at any time. Why would you think someone would need 'good luck' to do so?

1) finding out how much they charge is difficult.Anyone can move from SJP at any time. Why would you think someone would need 'good luck' to do so?

2) if you leave them within the first 5 years there is usually a crippling exit fee

3) the charges just keep on coming... have a look at the spread of their fund charges ... around 5% last time I looked

4) their fund performances are poor https://www.moneymarketing.co.uk/news/80-of-sjp-fu...https://www.yodelar.com/st-jamess-place-fund-revie... though that could be due to all the associated fees

5) whilst I know several who have SJP accounts and who are 'happy' with them, none of those folk can say why they are happy - it's almost as though at one time they were stressed "because I've been told that I should start saving into a pension" and the SJP man came along and relieved that stress so they got on with their busy lives 'knowing that problem was solved'.

6) yet to hear any reasoned argument from a client who can explain why they are 'good value''

jinkster said:

My current Fidelity funds (unmanaged) are showing 9.5% growth.

Don't change a thing! 9.5% p.a. net compounded is a massive return, especially if risk is sensibly under control and it's all in tax free wrappers.xeny said:

It's easy to cherry pick a benchmark duration to make a volatile asset look great.

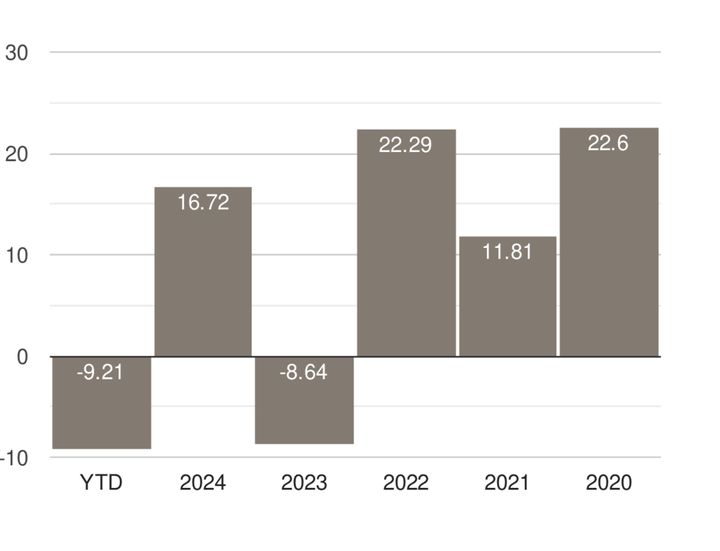

^^^ And be wary of this.Be very careful with the 20% figure, especially when looking at the last year or two. Depending on exactly where you start and end your 12 month period makes an insane difference to the kind of results you could come up with.

This is an extreme example with the performance of a tech fund from the last few years -

But even a global index tracker will be very variable according to how you pick your dates -

Right now it is showing 0.22% over the last 12 months on the tech fund and 1.53% on the tracker. As others have said, you need to look over longer periods and have some understanding of how broadly the investments are spread.

Not trying to rake over old coals but there used to be a forum sponsor who did extremely well for a lot of PHers before before crashing out very loudly and under circumstances that different people have different opinions on.

But the investments remained and now continue with Cobens, the company that took them on. https://forum.cobensdirect.co.uk/

The founder of the original company is also close to launching a new venture with similar intentions to what was run for private clients previously. You would find information on this at https://forum.qandamoney.co.uk/

Not trying to reopen any discussions but the OP asked for recommendations……….

This is an extreme example with the performance of a tech fund from the last few years -

But even a global index tracker will be very variable according to how you pick your dates -

Right now it is showing 0.22% over the last 12 months on the tech fund and 1.53% on the tracker. As others have said, you need to look over longer periods and have some understanding of how broadly the investments are spread.

Not trying to rake over old coals but there used to be a forum sponsor who did extremely well for a lot of PHers before before crashing out very loudly and under circumstances that different people have different opinions on.

But the investments remained and now continue with Cobens, the company that took them on. https://forum.cobensdirect.co.uk/

The founder of the original company is also close to launching a new venture with similar intentions to what was run for private clients previously. You would find information on this at https://forum.qandamoney.co.uk/

Not trying to reopen any discussions but the OP asked for recommendations……….

Gassing Station | Finance | Top of Page | What's New | My Stuff