My house hasn't appreciated in value in 12 years

Discussion

Northern Ireland is always a bit of a weird market.

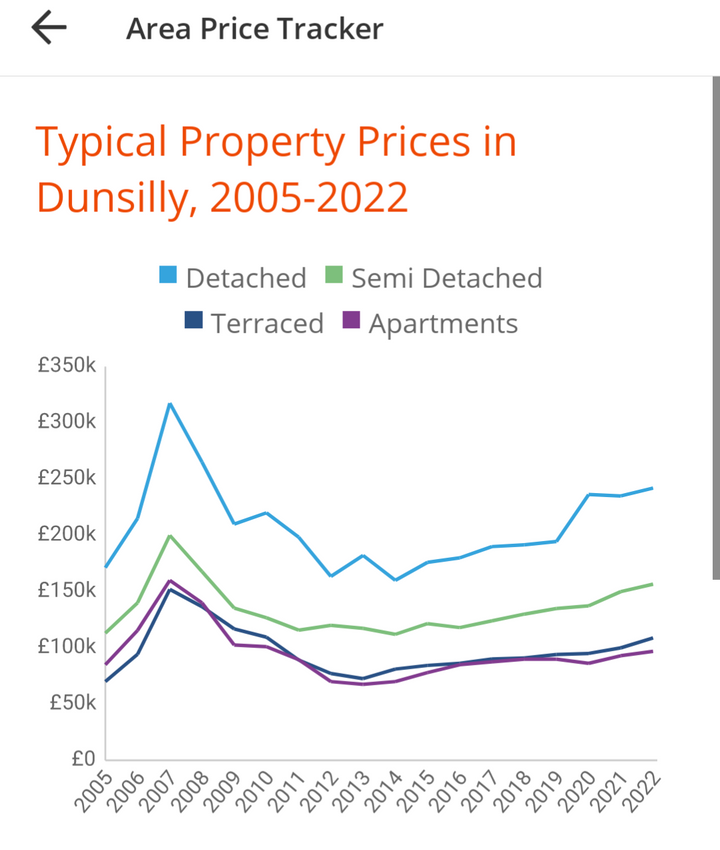

My area seems to have bottomed in 2014 and gone up at least 60% since then. This general average price tracker is only up to 2022 but prices still on the rise.

We sold at the bottom in 2014 at a 20% loss from when we bought it in 2009 but it wasn't real money we lost, just numbers on a solicitors summary really, as we built a new house for cheaper anyway.

But this is the bit I just can't get my head around. The house we built is 2300sqft or 215sqm. To build now, it's £2k minimum per sqm. So that would put my house at £430k to build. Add another £30k for ground works and a detached garage. So it would cost me £460k to build it again, and that's if someone gave me a free plot of land.

But it's valued around £320k. It's a clear disconnect between construction costs and home price valuations.

We're looking at moving and looked at a property up near a local forest. Beautiful area and house is 3000sqft. Huge garage, storey and a half measuring just under 1200sqft. Beast of a garage which wouldn't be cheap to build. Priced at £420k and it sits on half an acre. Struggle to self build this for £600k...

So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

My area seems to have bottomed in 2014 and gone up at least 60% since then. This general average price tracker is only up to 2022 but prices still on the rise.

We sold at the bottom in 2014 at a 20% loss from when we bought it in 2009 but it wasn't real money we lost, just numbers on a solicitors summary really, as we built a new house for cheaper anyway.

But this is the bit I just can't get my head around. The house we built is 2300sqft or 215sqm. To build now, it's £2k minimum per sqm. So that would put my house at £430k to build. Add another £30k for ground works and a detached garage. So it would cost me £460k to build it again, and that's if someone gave me a free plot of land.

But it's valued around £320k. It's a clear disconnect between construction costs and home price valuations.

We're looking at moving and looked at a property up near a local forest. Beautiful area and house is 3000sqft. Huge garage, storey and a half measuring just under 1200sqft. Beast of a garage which wouldn't be cheap to build. Priced at £420k and it sits on half an acre. Struggle to self build this for £600k...

So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

mrmistoffelees said:

Interesting exercise. I bought my current house for £275k in 2016, neighbour has recently sold theirs (same design as mine albeit a little bit smaller) for 500k. In that time I've paid £26k interest, and according to notes, £32400 since the beginning of 2020 on maint and upkeep. That covers about half of the time I've been here, so can effectively double it, so call it 90 grand for a notional £225k uplift seems a reasonable return.

This gets really interesting when you add CGT into the mix, for stuff that isn't the family home.I bought my flat for 225k in London in 2004. Inflation adjusted that's 480k. Its is, on a good day, to the right seller, worth 550k. We didn't sell it when we bought our house as we had no time (it was a fast, competitive buying process), and then a close friend moved into it and it's been his home ever since.

The capital gains tax (even tapered) makes that a worthless sale. Sure, I get cash which I can use for other stuff but the reality is that it will have cost me money, or made no money at all. The cash from a sale could be invested, or used to pay down my own mortgage. The former would be taxed, the latter would be a good idea, but there is already a plan for that and my rate is low.

It makes sod all yield, as income is taxed at my top rate.

A mate lives there right now, paying well below market rate. As soon as he leaves, and the mortgage is done, it's getting wrapped in some sort of tax structure to be left to my kids - not as an investment (as that's pointless), but as a place to live in our capital.

I certainly won't rent it out, as evicting bad tenants will be impossible and the risk is too high. It will sit there, idle, possibly being used as a home office/gym/home cinema (it's close to our home), or an Air BnB (still probably not worth the income vs hassle, but at least eviction of a wrongun won't be an issue). To me, it's really the kids' inheritance as it can both be IHT wrapped (expensively, admittedly) and could be of actual use to them.

Possibly the only reason to sell it would be to fund some sort of overseas retirement home, one day, using the difference between London property and something near a mountain somewhere on the continent. But then we'd probably sell our actual home for that, rather than take the CGT shaftation on the flat.

Yes, there is stuff one can do to minimise CGT liability - a big refurbishment would lower the taxable value, for example: but what's the point? You have to spend the cash for that. The OP's point about spending money and not really seeing it back is a bit mitigated on a second property, as it removes a tax burden, but his point is well made. Obviously, if I need to sell it I will take advice years in advance and plan...but on a basic level, it drives that property, even in the capital, is not some sort of surefire win.

Contrast that with banging money into an S&S ISA for 20 years. Or even a GIA with CGT applicable.

£250k on my flat into the S&P500 in 2004 would be worth £1.7m today (a bit less due to fund fees).

More relevantly, £75k (my deposit) would be worth £492,000 (minus fees), if I had put it into the S&P500 then. I'd have to calculate if investing the money and paying rent would have left me better off than using my deposit and paying mortgage interest. I doubt it, but mainly because most of my tenure was at very low interest rates. Had my mortgage been at 5%+ since 2004, I suspect the maths of mortgage interest vs rent would be very close: and I'd have almost the value of the flat in cash now, having been far closer in cost (rent vs mortgage interest) for the time I lived in it.

Property investing is best left to professionals, not foolish amateurs who don't understand inflation, leveraged yield or tax planning, but do believe property investment charlatans.

I know this thread is about your own home - as others have said, that's not an investment: it's both your home, and a way to not pay rent in retirement.

But it doesn't hurt to do a bit of critical thinking about it all, which is (to his critics on this thread) what the OP was trying to do.

Edited by Harry Flashman on Monday 20th May 21:42

soupdragon1 said:

So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

A friend of mine who is a medium sized house builder just can't build the mid sized, stone homes they're known for as the costs simply don't add up. Not a lot can be done re the build cost, nothing about the sale price so the only way their traditional model could work is if the land price were to fall. This means they're trying to pivot the model to where it can be profitable but this means smaller units that are put up more cheaply and that segment is pretty sown up by the larger firms. They have a genuine problem on their hands finding a market they can work in. tight fart said:

You only pay CGT on profit so if you haven’t made any there’s none to pay, not sure why you think it’s tappered?

You pay CGT on inflation, basically, when talking about assets. You pay the tax on the difference between the purchase price and the price you sold it for (tapered for the years you actually lived in it) .There is no adjustment for inflation. This sort of works if the taxable asset is doing way better than inflation (equities have been one such class, if you bought a suitable index, or even just a global tracker). UK property, as we have established, does not do a freat deal better than inflation, generally. In my case, anything above £250k is taxable - not anything above the inflation adjusted £480k that 250k in 2004 is in today's money.Only way I pay no CGT (excepting putting it into a tax wrapper) is the tapering for the years i lived in it, minus any improvements made to it reduce the taxable gain down to zero.

Edited by Harry Flashman on Monday 20th May 21:51

DonkeyApple said:

soupdragon1 said:

So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

A friend of mine who is a medium sized house builder just can't build the mid sized, stone homes they're known for as the costs simply don't add up. Not a lot can be done re the build cost, nothing about the sale price so the only way their traditional model could work is if the land price were to fall. This means they're trying to pivot the model to where it can be profitable but this means smaller units that are put up more cheaply and that segment is pretty sown up by the larger firms. They have a genuine problem on their hands finding a market they can work in. Wage inflation is pretty firmly baked in for most sectors but thinking back to 2008, trades struggled for work and labour costs came down. Even Joe the master shovel technician was earning today's equivalent of £50k prior the 2008 crash, before suddenly finding himself serving the pints on a Friday night, instead of drinking them.

Material costs remain high, although that huge inflation seems to have settled a bit.

If I was to have a guess, I would think the equilibrium would come from falling land prices but at the same time, I can't reconcile that back to where I live. There is a site for £85k a few miles away, countryside plot, overlooking a huge lough and mountains in the distance. Another 2 sites side by side, 100 yards from the shore, guaranteed view for life, albeit, no mountain backdrop, just the 20 mile stretch of lake thatll the punters will have to make do with... £50k each and they've been for sale for well over a year with no takers.

People just aren't buying sites when you look at the build costs vs buying an existing home, and those homes are going like hot cakes here in NI.

I spoke with an estate agent about selling my own house and she said she'll have buyers beating the door down to buy it. I'm sure she bloody well will when it's being sold for miles less than the bricks and mortar value. If I find the right house at the other side of the trade, sure that's fine. Bizarre set up though.

DonkeyApple said:

soupdragon1 said:

So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

A friend of mine who is a medium sized house builder just can't build the mid sized, stone homes they're known for as the costs simply don't add up. Not a lot can be done re the build cost, nothing about the sale price so the only way their traditional model could work is if the land price were to fall. This means they're trying to pivot the model to where it can be profitable but this means smaller units that are put up more cheaply and that segment is pretty sown up by the larger firms. They have a genuine problem on their hands finding a market they can work in. I bought my 2 bed flat (1980’s build, good area of Essex) back in 2009 for £177k and put it on the market in 2020 and 2023 and really struggled to sell it (EA had estimated it to be £280 to 300k, we didn’t think it was worth near that). In the end we sold it for £250k with £12k of extras. I say this as what we found out was there was the government ISA for first time buyer that if you put £3k in for 3 years they would give an extra £3k cash back at the end but only if the property was sold for below £250k outer London or £450k inner London.

I’m not against the idea of helping to buy for FTB but the system does hinder everyone if the rates don’t go up with the rest of the housing market. I can see the flat staying at the upper limit if this skeam doesn’t change and the new buyer in a world of problems when they sell

I’m not against the idea of helping to buy for FTB but the system does hinder everyone if the rates don’t go up with the rest of the housing market. I can see the flat staying at the upper limit if this skeam doesn’t change and the new buyer in a world of problems when they sell

soupdragon1 said:

The question is I guess, will it correct and find equilibrium again?

Wage inflation is pretty firmly baked in for most sectors but thinking back to 2008, trades struggled for work and labour costs came down. Even Joe the master shovel technician was earning today's equivalent of £50k prior the 2008 crash, before suddenly finding himself serving the pints on a Friday night, instead of drinking them.

Material costs remain high, although that huge inflation seems to have settled a bit.

If I was to have a guess, I would think the equilibrium would come from falling land prices but at the same time, I can't reconcile that back to where I live. There is a site for £85k a few miles away, countryside plot, overlooking a huge lough and mountains in the distance. Another 2 sites side by side, 100 yards from the shore, guaranteed view for life, albeit, no mountain backdrop, just the 20 mile stretch of lake thatll the punters will have to make do with... £50k each and they've been for sale for well over a year with no takers.

People just aren't buying sites when you look at the build costs vs buying an existing home, and those homes are going like hot cakes here in NI.

I spoke with an estate agent about selling my own house and she said she'll have buyers beating the door down to buy it. I'm sure she bloody well will when it's being sold for miles less than the bricks and mortar value. If I find the right house at the other side of the trade, sure that's fine. Bizarre set up though.

Yup. The key at present is that employment has held up. So long as that does then this status quo will remain. Pretty much everything pivots around the monthly salary flows and everything else can be fudged. For there to be a material change I think we'd need a notable drop in pensioner monthly incomes via a stock market crash or a drop in working incomes via a notable reduction in the number of higher paid roles. Wage inflation is pretty firmly baked in for most sectors but thinking back to 2008, trades struggled for work and labour costs came down. Even Joe the master shovel technician was earning today's equivalent of £50k prior the 2008 crash, before suddenly finding himself serving the pints on a Friday night, instead of drinking them.

Material costs remain high, although that huge inflation seems to have settled a bit.

If I was to have a guess, I would think the equilibrium would come from falling land prices but at the same time, I can't reconcile that back to where I live. There is a site for £85k a few miles away, countryside plot, overlooking a huge lough and mountains in the distance. Another 2 sites side by side, 100 yards from the shore, guaranteed view for life, albeit, no mountain backdrop, just the 20 mile stretch of lake thatll the punters will have to make do with... £50k each and they've been for sale for well over a year with no takers.

People just aren't buying sites when you look at the build costs vs buying an existing home, and those homes are going like hot cakes here in NI.

I spoke with an estate agent about selling my own house and she said she'll have buyers beating the door down to buy it. I'm sure she bloody well will when it's being sold for miles less than the bricks and mortar value. If I find the right house at the other side of the trade, sure that's fine. Bizarre set up though.

What's causing what you are seeing and what I think most of us also see which is that buyers are favouring complete deals over anything that requires work whether a basic refresh through complete refurbs to being a scratch build is the finance element followed by the lack of capital upside.

Firstly, the number of people who can back more than one finance deal has slumped as the Boomers who were cash rich are fading from the renovating side of the market and the GenX and Millenials contain far fewer buyers who can first take out a mortgage to buy the property and then take out a second loan to renovate. The under 55s really need everything to be done for the one price and for that to be dealt with via one loan against it. Some will argue that this is because they're all consumer fairies who need a TV crib immediately nor able to operate a paintbrush but the true driver is that they can't borrow big slugs to finance the work. If it can't be acquired via zero or pay later deals then it can't really be done.

Secondly, as you say, everything is so expensive not just the materials but the land, the labour, the bureaucracy. And not helping that is that if building from scratch you used to have become an employer, employing a whole series of professionals and frankly today you aren't. Instead you are paying vast sums for the life experience of being a full time carer for a legion of adults randomly pretending to be disabled.

But, mass box construction by large companies appears to be workable and ultimately what the U.K. needs the most is social housing. There's no shortage of lovely larger homes in the U.K. and starting around now and running for the next 15-20 years is the Great Boomer Asset Dumping where all these things from nice family homes to classic cars are going to be steadily flowing onto the market to help pay their children's gambling losses and shopping addictions.

I think we need to increase the supply of small homes from bedsits up to 2 bedders as its these units that allow FTBs on easily, divorcees to find space, downsizers to find places, landlords to buy in easily and for those in need of support to be homed affordably.

I'd love to see more small unit innovation across the board for the penniless to the wealthy but I guess the reason that most of what you see is basic 3 bed boxes all wedged in on an old field is just a function of what works financially.

soupdragon1 said:

We're looking at moving and looked at a property up near a local forest. Beautiful area and house is 3000sqft. Huge garage, storey and a half measuring just under 1200sqft. Beast of a garage which wouldn't be cheap to build. Priced at £420k and it sits on half an acre. Struggle to self build this for £600k...

So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

It's subjective but that's hideous, it's like an outdoor centre.So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

The fact that self building something is not economic sense does not necessarily mean there is anything wrong with the market.

It's the extra cost of building anything as a one-off bespoke project.

It's like having a yacht built individually or a car restored, it costs more than it ends up being worth.

Because the secondhand value is heavily influenced by mass produced alternatives.

It's the industrial revolution, it happened 200 years ago, get used to it!

It's the extra cost of building anything as a one-off bespoke project.

It's like having a yacht built individually or a car restored, it costs more than it ends up being worth.

Because the secondhand value is heavily influenced by mass produced alternatives.

It's the industrial revolution, it happened 200 years ago, get used to it!

hidetheelephants said:

soupdragon1 said:

We're looking at moving and looked at a property up near a local forest. Beautiful area and house is 3000sqft. Huge garage, storey and a half measuring just under 1200sqft. Beast of a garage which wouldn't be cheap to build. Priced at £420k and it sits on half an acre. Struggle to self build this for £600k...

So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

It's subjective but that's hideous, it's like an outdoor centre.So what is going on here. This disconnect can't be right or be maintained forever. Effectively, when the bricks and mortar value are considered, the land it sits on is worth a large amount of cash less than zero. I don't get it....

I get it though, kerb appeal etc. I don't find it offensive at all. For me, it's all about layout, how it functions as a space for family, for when guests come over and that type of thing. While kerb appeal and outdoor aesthetics are high priority for some, they rank a bit lower for me. Perhaps I'm an outlier in that regard but yeah, it's all subjective.

OutInTheShed said:

It's the extra cost of building anything as a one-off bespoke project.

We had 4 glazing guys on site, in addition to all the builders, for 2 days installing just the ground floor glazing on our build, this is after 2 of them came onsite previously to measure up etc. Compare that to what’s happening on a developer new build site about 1 mile away, every window of every house is templated, essentially it’s one massive production line. No need to remeasure, straight forwards installs that’s done 100s of times before, etc etc.

The cost savings a developer can achieve from mass building is something no one-off project can get close, I actually think there is nothing wrong with the ‘quality’ of houses developers build, except for the total lack of privacy due to how many houses are squeezed into one area in order to maximise project (which is quite understandable).

But if you can afford to do a one-off bespoke build to your exact design/spec, why wouldn’t you want to do it? Our build isn’t done yet, but I’m already looking forwards to the retirement project sometime around 2050

. We are all a long time dead, so why not make what time we have doing something fun/interesting.

. We are all a long time dead, so why not make what time we have doing something fun/interesting.

Edited by gangzoom on Thursday 23 May 19:50

Edited by gangzoom on Friday 24th May 06:32

Gassing Station | Homes, Gardens and DIY | Top of Page | What's New | My Stuff