2021 Budget Predictions

Discussion

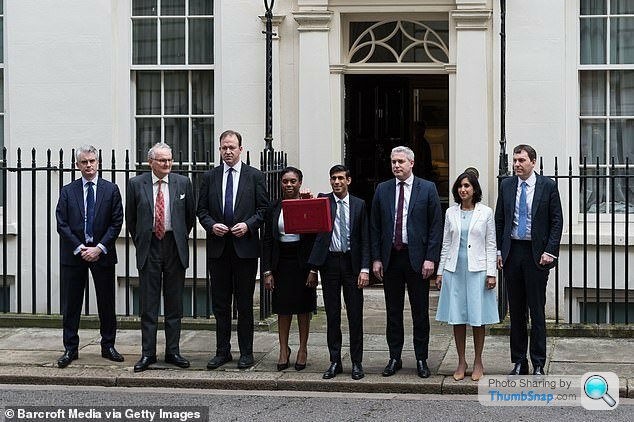

Impressed with Sunak. Treading a delicate line. Increases where huge profits are made, rewarding investment. Not entering panic mode.

Disgusted with Starmer waffling about NHS with their rock solid package already in the face of countless people losing everything. Instagram? Shut up. Clown.

Disgusted with Starmer waffling about NHS with their rock solid package already in the face of countless people losing everything. Instagram? Shut up. Clown.

So corporation tax goes to 25 percent, from 19.

How does that fit in with us PAYE folk paying 40% once we get to 50 grand or so, and 20 percent past the personal allowance ? Plus NI ?

I get the impression that costs will just be passed on but it doesn't seem that unfair based on what salaried folk have to pay unless i am missing something ?

Plus, obviously, the accountants will be working overtime to reduce it for their clients, if you claim that its hit you for five figures then you are still doing alright and were really doing all right before.

With the Furlough payments based on declared income, its almost like the govt are having a proper go at those who are self employed and perhaps playing a bit fast and loose with the old tax stuff.

I think Rishi is doing a decent job, I think the mark of his stewardship would be if he could coerce some of the local takeaways to maybe accept cards as their reluctance seems to be mainly based on tax evasion.

How does that fit in with us PAYE folk paying 40% once we get to 50 grand or so, and 20 percent past the personal allowance ? Plus NI ?

I get the impression that costs will just be passed on but it doesn't seem that unfair based on what salaried folk have to pay unless i am missing something ?

Plus, obviously, the accountants will be working overtime to reduce it for their clients, if you claim that its hit you for five figures then you are still doing alright and were really doing all right before.

With the Furlough payments based on declared income, its almost like the govt are having a proper go at those who are self employed and perhaps playing a bit fast and loose with the old tax stuff.

I think Rishi is doing a decent job, I think the mark of his stewardship would be if he could coerce some of the local takeaways to maybe accept cards as their reluctance seems to be mainly based on tax evasion.

J4CKO said:

With the Furlough payments based on declared income, its almost like the govt are having a proper go at those who are self employed and perhaps playing a bit fast and loose with the old tax stuff.

Perhaps I should have played fast and loose in the past as my sole trader profits put me outside of the support for the self employed.There's not that much difference between PAYE and someone working through a Ltd company. You pay corporation tax, potentially some PAYE related taxes and then tax on dividend. The main saving is Employers NI. No paid holidays / sick leave.

Edited by Chris Type R on Wednesday 3rd March 21:17

NRS said:

Biggy Stardust said:

Are you aware of the new rules & regulations pretty much every week, from special taxation to banning eviction?

Are you aware that if the government didn't raise tax from BTL then it would have to tax 'proper' people a bit more?

Are you aware that this still sounds like jealousy in the veneer of social 'fairness'?

Biggy I'll try and put it another way.....

1) I'm sure you agree with all the advice/adages of paying for you own house/mortgage and not someone else's via renting?

2) I think prices have risen as a result of the buy to let increase

3) So when you have a buy to let you've contributed to making it harder for someone else to make their point 1) come true.

So a buy to letter is in a small individual (but large collective) way a hinderance to others who want to do the same, and shelter is a basic human need, hence why I think it should have been restrained.

Are you aware I'm not saying it's not a business

Are you aware I'm not saying you're wrong for doing it,

Are you aware I'm not actually Jealous,

Are you aware I just believe that overall it's not been a benefit.

ant1973 said:

DeejRC said:

Yes Ant. Cos he wants/needs the money being spent! I thought we all understood this?

How about incentivising people to take on employees? I get that investing in capital drives productivity but I would have thought that a direct employment subsidy may have been useful as well. Scootersp said:

Thanks,

Biggy I'll try and put it another way.....

1) I'm sure you agree with all the advice/adages of paying for you own house/mortgage and not someone else's via renting?

2) I think prices have risen as a result of the buy to let increase

3) So when you have a buy to let you've contributed to making it harder for someone else to make their point 1) come true.

So a buy to letter is in a small individual (but large collective) way a hinderance to others who want to do the same, and shelter is a basic human need, hence why I think it should have been restrained.

Are you aware I'm not saying it's not a business

Are you aware I'm not saying you're wrong for doing it,

Are you aware I'm not actually Jealous,

Are you aware I just believe that overall it's not been a benefit.

Triggered?Biggy I'll try and put it another way.....

1) I'm sure you agree with all the advice/adages of paying for you own house/mortgage and not someone else's via renting?

2) I think prices have risen as a result of the buy to let increase

3) So when you have a buy to let you've contributed to making it harder for someone else to make their point 1) come true.

So a buy to letter is in a small individual (but large collective) way a hinderance to others who want to do the same, and shelter is a basic human need, hence why I think it should have been restrained.

Are you aware I'm not saying it's not a business

Are you aware I'm not saying you're wrong for doing it,

Are you aware I'm not actually Jealous,

Are you aware I just believe that overall it's not been a benefit.

(btw- It's Mr. Stardust to you)

Gecko1978 said:

RichB said:

TTmonkey said:

It just reminds me how juvenile I can be that I smiled when I saw this...

What am I missing?

Didn't realise he was going for small businesses either.

Chris Type R said:

J4CKO said:

With the Furlough payments based on declared income, its almost like the govt are having a proper go at those who are self employed and perhaps playing a bit fast and loose with the old tax stuff.

Perhaps I should have played fast and loose in the past as my sole trader profits put me outside of the support for the self employed.There's not that much difference between PAYE and someone working through a Ltd company. You pay corporation tax, potentially some PAYE related taxes and then tax on dividend. The main saving is Employers NI. No paid holidays / sick leave.

Edited by Chris Type R on Wednesday 3rd March 21:17

RichB said:

Gecko1978 said:

RichB said:

TTmonkey said:

It just reminds me how juvenile I can be that I smiled when I saw this...

What am I missing?

Didn't realise he was going for small businesses either.

poordecisions said:

youngsyr said:

If a company has invested a significant amount in this fiscal year, but has a 31 May year end, do we know if it will benefit from the Superdeduction, will it be pro-rated, or not available at all?

It’s from 2023, so this year doesn’t really effect thingsI heard Sunak say super deduction was "for the next 2 years".

CT hike is from 2023.

He hasn’t gone after small business. You could argue he will be going after reasonably profitable businesses in a cpl of yrs. Crucially though, it will be on businesses that can afford it. Yes, it’s govt putting their hands in your pockets, BUT...well...your country has called, what are you going to do?

I own/run a reasonably profitable engineering consultancy. In 2023 I may/not be on the hook for the 26% CT, depending on life, accountants and f k knows what else. But if I am...what kind of t

k knows what else. But if I am...what kind of t t would I be to complain about my lot in life? I’ve got to pay another £15k in tax, leaving me some 200k to the good. The country just took a kicking, I’m in and hopefully will continue to be in a financial place that I can afford to shoulder more of the burden to pay up, than say a nurse. That’s called being a society in my book.

t would I be to complain about my lot in life? I’ve got to pay another £15k in tax, leaving me some 200k to the good. The country just took a kicking, I’m in and hopefully will continue to be in a financial place that I can afford to shoulder more of the burden to pay up, than say a nurse. That’s called being a society in my book.

I own/run a reasonably profitable engineering consultancy. In 2023 I may/not be on the hook for the 26% CT, depending on life, accountants and f

k knows what else. But if I am...what kind of t

k knows what else. But if I am...what kind of t t would I be to complain about my lot in life? I’ve got to pay another £15k in tax, leaving me some 200k to the good. The country just took a kicking, I’m in and hopefully will continue to be in a financial place that I can afford to shoulder more of the burden to pay up, than say a nurse. That’s called being a society in my book.

t would I be to complain about my lot in life? I’ve got to pay another £15k in tax, leaving me some 200k to the good. The country just took a kicking, I’m in and hopefully will continue to be in a financial place that I can afford to shoulder more of the burden to pay up, than say a nurse. That’s called being a society in my book. ant1973 said:

I was actually thinking about reduced NI contributions. If you have looked at my other posts, I favour tax and NI (of all flavours) being merged to bring simplicity and coherence to what is a needlessly complex area of tax. Taxing employment in the form of employer's NI is a dumb idea. It's even dumber in the face of what looks like a pretty unpleasant economic environment.

I don't disagree with you generally.Simplifying the tax system may give the opportunity to remove loopholes. But govt would be poor at executing it.

Ditto all policies that can be used to encourage employment should be. As it is, Sunak is pussying about at the moment. The CT changes will net not very much. Lots of fluff, no substance, other than let's give more free cash out. (Not entirely sure of the logic of keeping furlough going for a quarter after all restrictions are due to lit for example).

J4CKO said:

Chris Type R said:

J4CKO said:

With the Furlough payments based on declared income, its almost like the govt are having a proper go at those who are self employed and perhaps playing a bit fast and loose with the old tax stuff.

Perhaps I should have played fast and loose in the past as my sole trader profits put me outside of the support for the self employed.There's not that much difference between PAYE and someone working through a Ltd company. You pay corporation tax, potentially some PAYE related taxes and then tax on dividend. The main saving is Employers NI. No paid holidays / sick leave.

Edited by Chris Type R on Wednesday 3rd March 21:17

Murph7355 said:

ant1973 said:

I was actually thinking about reduced NI contributions. If you have looked at my other posts, I favour tax and NI (of all flavours) being merged to bring simplicity and coherence to what is a needlessly complex area of tax. Taxing employment in the form of employer's NI is a dumb idea. It's even dumber in the face of what looks like a pretty unpleasant economic environment.

I don't disagree with you generally.Simplifying the tax system may give the opportunity to remove loopholes. But govt would be poor at executing it.

Ditto all policies that can be used to encourage employment should be. As it is, Sunak is pussying about at the moment. The CT changes will net not very much. Lots of fluff, no substance, other than let's give more free cash out. (Not entirely sure of the logic of keeping furlough going for a quarter after all restrictions are due to lit for example).

The tax code has been vastly complicated over the past 40 years precisely to remove loop holes.

Think of it as a contract between companies and the government. Lawyers on both sides spend a huge amount of time setting out exactly what each party's responsibilities and deliverables are.

If they don't, one side or another will run a coach and horses through it.

Look up "double Dutch sandwich" for just one example!

ant1973 said:

According to the Budget report, the cost of the "super deduction" will be just under £25bn.

That is more than the increase in corporation tax is estimated to raise by 2025 - 2026 (c. 17bn).

So this is in effect a tax transfer from non-capital intensive businesses to capital intensive businesses.

Which is reasonable from a "rebalancing" perspective. That is more than the increase in corporation tax is estimated to raise by 2025 - 2026 (c. 17bn).

So this is in effect a tax transfer from non-capital intensive businesses to capital intensive businesses.

ITP said:

They, and by they I mean Rishi and his henchman Jesse Norman, have some kind of vendetta against ltd company contractors. They just want to ‘win’ against them, because they keep getting beaten in court, apart from the odd case. Everyone is telling them what they are doing is wrong but they just want to prove a point. They say what they are doing with IR35 will bring in more tax. It won’t, it will bring in less, but that’s not really their motivation.

Anyone with any wish to bring the public finances into balance would be moving against "ltd company contractors" for the simple reason you pay significantly less tax and NI (including the employer NI borne by the employer) than when you were on PAYE (often doing the exact same job and hours). Labour brought in IR35 and the Tories gave it some teeth. As contracting via a limited company grew it creates the seeds of its own demise IMO, as once it reaches a certain size it becomes unaffordable.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff