How much of a mess are we really in?

Discussion

b hstewie said:

hstewie said:

hstewie said:

hstewie said: I don't but lots of people do and guess what?

Most of them aren't on quarter of a million quid and they also face challenges about childcare.

Just to stress I'm not suggesting the answer for everyone is "move to the midlands".

But I am suggesting someone who can't fund the lifestyle they want on £250K might need to reflect on their priorities and if needed reset their expectations a little.

You know - like people on far less are expected to do.

£250k is what £3k per week take home ?Most of them aren't on quarter of a million quid and they also face challenges about childcare.

Just to stress I'm not suggesting the answer for everyone is "move to the midlands".

But I am suggesting someone who can't fund the lifestyle they want on £250K might need to reflect on their priorities and if needed reset their expectations a little.

You know - like people on far less are expected to do.

A Nurse would take home £2k per month on average.

Downward said:

b hstewie said:

hstewie said:

hstewie said:

hstewie said: I don't but lots of people do and guess what?

Most of them aren't on quarter of a million quid and they also face challenges about childcare.

Just to stress I'm not suggesting the answer for everyone is "move to the midlands".

But I am suggesting someone who can't fund the lifestyle they want on £250K might need to reflect on their priorities and if needed reset their expectations a little.

You know - like people on far less are expected to do.

£250k is what £3k per week take home ?Most of them aren't on quarter of a million quid and they also face challenges about childcare.

Just to stress I'm not suggesting the answer for everyone is "move to the midlands".

But I am suggesting someone who can't fund the lifestyle they want on £250K might need to reflect on their priorities and if needed reset their expectations a little.

You know - like people on far less are expected to do.

A Nurse would take home £2k per month on average.

greygoose said:

Downward said:

b hstewie said:

hstewie said:

hstewie said:

hstewie said: I don't but lots of people do and guess what?

Most of them aren't on quarter of a million quid and they also face challenges about childcare.

Just to stress I'm not suggesting the answer for everyone is "move to the midlands".

But I am suggesting someone who can't fund the lifestyle they want on £250K might need to reflect on their priorities and if needed reset their expectations a little.

You know - like people on far less are expected to do.

£250k is what £3k per week take home ?Most of them aren't on quarter of a million quid and they also face challenges about childcare.

Just to stress I'm not suggesting the answer for everyone is "move to the midlands".

But I am suggesting someone who can't fund the lifestyle they want on £250K might need to reflect on their priorities and if needed reset their expectations a little.

You know - like people on far less are expected to do.

A Nurse would take home £2k per month on average.

This article is quite good. It mentions a lot -

Softening house prices compared to retail price inflation which is now higher

More sellers dropping prices

More homes for sale

ONS adjusting all historical house prices data back to 1970

Mortgage rates not coming down as much as BoE has cut due to swap rates based on government debt expected to be higher for longer

Stamp duty rising

Real wage growth low or zero once you include extra taxes

Bubble wording around recent house prices - my favourite I'll cut and paste below

https://uk.finance.yahoo.com/news/britain-property...

In 2009, the average property in England cost 6.4 times the average salary; by the end of the 2022-23 financial year, it cost 8.6 times more, according to the ONS’ latest data.

Softening house prices compared to retail price inflation which is now higher

More sellers dropping prices

More homes for sale

ONS adjusting all historical house prices data back to 1970

Mortgage rates not coming down as much as BoE has cut due to swap rates based on government debt expected to be higher for longer

Stamp duty rising

Real wage growth low or zero once you include extra taxes

Bubble wording around recent house prices - my favourite I'll cut and paste below

https://uk.finance.yahoo.com/news/britain-property...

In 2009, the average property in England cost 6.4 times the average salary; by the end of the 2022-23 financial year, it cost 8.6 times more, according to the ONS’ latest data.

Yes, there’s not much in that article I’d argue with. The ONS revision is both baffling and risible - another example of just how useless an organisation it is.

The market’s screwed because it’s highly distorted, by compounding factors over the last 20+ years:

As far as base rate goes right now, clearly the markets have no more trust and optimism in Labour than businesses or consumers.

The market’s screwed because it’s highly distorted, by compounding factors over the last 20+ years:

- huge population increases

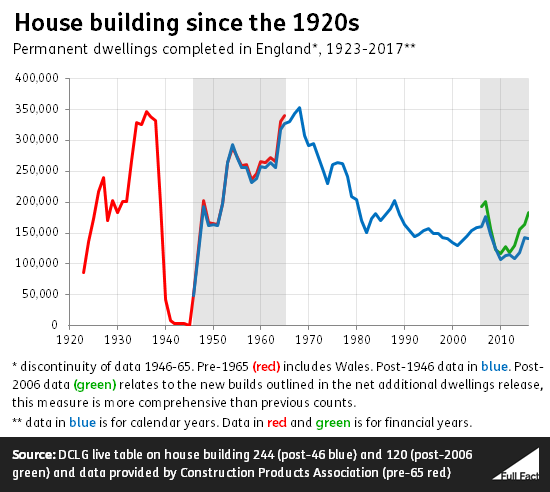

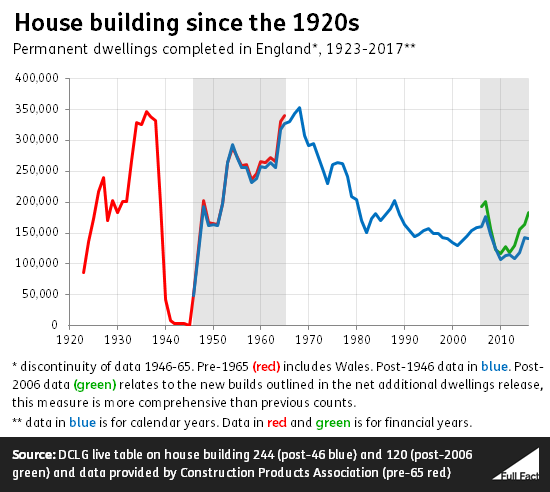

- decreases in building

- increases in planning and environmental bureaucracy

- declines in bank competition and lending since GFC

As far as base rate goes right now, clearly the markets have no more trust and optimism in Labour than businesses or consumers.

Digga said:

Yes, there’s not much in that article I’d argue with. The ONS revision is both baffling and risible - another example of just how useless an organisation it is.

The market’s screwed because it’s highly distorted, by compounding factors over the last 20+ years:

As far as base rate goes right now, clearly the markets have no more trust and optimism in Labour than businesses or consumers.

In my view everything you have mentioned is largely irrelevant. The main problem is the destruction in the value of our money. It has been rapidly destroyed since the GFC bailouts which started small and continued increasing. We were led to believe this didn’t cause prices to rise because prices were falling at the same time due to Amazon destroying high street and Chinese cheap goods etc etc etc. So on net prices remained stable - if you believe the governement's doctored indexes. The market’s screwed because it’s highly distorted, by compounding factors over the last 20+ years:

- huge population increases

- decreases in building

- increases in planning and environmental bureaucracy

- declines in bank competition and lending since GFC

As far as base rate goes right now, clearly the markets have no more trust and optimism in Labour than businesses or consumers.

But house prices have shown the inflation or money being worth less in plain site for all to see if you were looking. Most of my friends seem to think house prices only go up due to shortages and immigration etc etc etc. All nonsense. House prices go up due to the availability of cheap credit making them more 'affordable'. Take away these cheap rates and it comes crashing down. We now seem to have 35 years mortgages and 4 or 5x salary multiples being common place.

So now that nothing else is driving down prices globally guess what is happening, they are going up. And I believe they will continue to go up. All prices are going higher -

Interest Rates - price of borrowing

Taxes - price of government

Wages - price of labour

And everything else

I think both things can be correct; the value of sterling has been debased and we have relied on 'cheap' imports to disguise the fact, but we have also not been building in sufficient quantity for decades.

There are various reasons for the latter:

There are various reasons for the latter:

- the abolition of 'council' houses,

- the squeeze in credit on SME builders (they were 30% of built total in late 80's, but now only 10%)

- UK SME reliance on banks rather than other commercial sources of capital (compared to USA)

- Planning and/or environmentalism

A bit more from the coal face.

My daughter is looking for a job.

She has a 2.1 in Law with business from Exeter and is looking at graduate roles.

On Indeed,Total and all the other websites the majority of roles are in recruitment or sales.

Where are the quality jobs being advertised

ALL are paying minimum wage.

She watched an interview with a recruiter,If an attractive job gets posted,the recruiter can have 400+ applications in a couple of hours. They take the first 100 applicants for interviews,everyone else hears nothing.

Whilst she accepts she can’t earn big money from the outset,she and her peers are thinking what was the point of going to University when they can earn the same money stacking shelves.

I think in we are in for a Tsunami of problems when her age group need housing and a bigger wage to support a family.

We can’t keep burying our heads in the sand and keep wages down and keep creaming in ever bigger profits.

I don’t know what the solution is but we need to find one pretty quick before Gen Z give up entirely.

My daughter is looking for a job.

She has a 2.1 in Law with business from Exeter and is looking at graduate roles.

On Indeed,Total and all the other websites the majority of roles are in recruitment or sales.

Where are the quality jobs being advertised

ALL are paying minimum wage.

She watched an interview with a recruiter,If an attractive job gets posted,the recruiter can have 400+ applications in a couple of hours. They take the first 100 applicants for interviews,everyone else hears nothing.

Whilst she accepts she can’t earn big money from the outset,she and her peers are thinking what was the point of going to University when they can earn the same money stacking shelves.

I think in we are in for a Tsunami of problems when her age group need housing and a bigger wage to support a family.

We can’t keep burying our heads in the sand and keep wages down and keep creaming in ever bigger profits.

I don’t know what the solution is but we need to find one pretty quick before Gen Z give up entirely.

smifffymoto said:

what was the point of going to University when they can earn the same money stacking shelves.

Ask Tony Blair.Seriously, the lack of vocational skills in the UK (i.e. real trades and apprenticeships) vs. useless degrees is risible. It has been disastrous for both industry and pupils.

This is why people within business think grads are often clowns. General degree from general uni and expecting the world out the gate.

Go into a sales role or recruitment and find your way into the role really want. I’m in sales and it really isn’t what most older people in the U.K. think it is these days.

Just so you know, everything you describe happened for my generation too and I’m 37. It isn’t new, either go to a good uni and get a first or expect to grind it out a bit. Pretty easy

Go into a sales role or recruitment and find your way into the role really want. I’m in sales and it really isn’t what most older people in the U.K. think it is these days.

Just so you know, everything you describe happened for my generation too and I’m 37. It isn’t new, either go to a good uni and get a first or expect to grind it out a bit. Pretty easy

Edited by okgo on Wednesday 12th March 11:08

smifffymoto said:

I think in we are in for a Tsunami of problems when her age group need housing

We already see house prices maintained at exorbitant multiples of salary. This indicates that salary is not the sole driver, we also need to factor in individual and family wealth. Your daughter's cohort will see a lot of inheritance money over the next few decades, further entrenching the housing haves/have-nots.smifffymoto said:

I think in we are in for a Tsunami of problems when her age group need housing and a bigger wage to support a family.

We can’t keep burying our heads in the sand and keep wages down and keep creaming in ever bigger profits.

I don’t know what the solution is but we need to find one pretty quick before Gen Z give up entirely.

Again if you look through the lense of currency davaluation then this seems obvious.We can’t keep burying our heads in the sand and keep wages down and keep creaming in ever bigger profits.

I don’t know what the solution is but we need to find one pretty quick before Gen Z give up entirely.

For the last x years from GFC where the government pumped more and more currency into the economy then this allowed businesses and most people to prosper. Businesses were able to operate and profit because credit was cheap and people wiling to spend because they felt flush.

This was in reality only an illusion. Everyone has been getting poorer. But because prices of stuff didnt rise no one seemed to notice. So this allowed governments to keep doing stupid sheet in even bigger and bigger amounts.

If you look at wage growth this has not kept up with house prices. What this means is wages have been lagging behind the real rate of inflation or currency devaluation. Again everyone poorer.

Now people are starting to realise because prices of stuff are going Up and businesses starting to suffer due to tighter credit conditions both for the businesses operating with debt and the consumers struggling to pay their debts and find excesss to spend on sheet they dont really need.

Now the BoE is talking about more cutting to avoid recession but not if wages start to tick up. They want to stop wages going up because they fear this will drive more inflation.

Newsflash

Our currency is already seriously devalued through x years of stupid monetary policy. Maybe we would need the same x years - choose your number - of tighter monetary conditions to allow our currency to regain some value. But you cant do this without economic pain. Businesses going bankrupt, house prices crashing, people becoming unemployed at scale etc.

There is so much debt now in the system that was all based on a goldilocks economy of zero interest rates but prices not rising. Everyone got more and more debt thinking they would continue to earn the same or more for the next 35 years so got bigger and bigger nortgages. Now that governments see prices rising they should raise rates. But that will cause chaos so they try to tinker round the edges but it is failing.

Government debt is way out of control too. We need massive cuts in government spending and we need governments to start paying down debt not borrowing more and more.

This would mean lots of government workers becoming unemployed and all claiming benefits. Again not likely to happen.

The only fixes if you ask me are pain, pain and more pain.

Would a house price crash be good, would it fix the house price affordability problem - probably yes. Will it happen - ask a home owner and they say No because of the shortage of homes yada yada and immigration etc etc etc

smifffymoto said:

A bit more from the coal face.

My daughter is looking for a job.

She has a 2.1 in Law with business from Exeter and is looking at graduate roles.

On Indeed,Total and all the other websites the majority of roles are in recruitment or sales.

Where are the quality jobs being advertised

ALL are paying minimum wage.

She watched an interview with a recruiter,If an attractive job gets posted,the recruiter can have 400+ applications in a couple of hours. They take the first 100 applicants for interviews,everyone else hears nothing.

Whilst she accepts she can’t earn big money from the outset,she and her peers are thinking what was the point of going to University when they can earn the same money stacking shelves.

I think in we are in for a Tsunami of problems when her age group need housing and a bigger wage to support a family.

We can’t keep burying our heads in the sand and keep wages down and keep creaming in ever bigger profits.

I don’t know what the solution is but we need to find one pretty quick before Gen Z give up entirely.

The thing is though that starting graduate salaries were never usually that high for the reason that said graduate had few useful skills for chosen sector. My daughter is looking for a job.

She has a 2.1 in Law with business from Exeter and is looking at graduate roles.

On Indeed,Total and all the other websites the majority of roles are in recruitment or sales.

Where are the quality jobs being advertised

ALL are paying minimum wage.

She watched an interview with a recruiter,If an attractive job gets posted,the recruiter can have 400+ applications in a couple of hours. They take the first 100 applicants for interviews,everyone else hears nothing.

Whilst she accepts she can’t earn big money from the outset,she and her peers are thinking what was the point of going to University when they can earn the same money stacking shelves.

I think in we are in for a Tsunami of problems when her age group need housing and a bigger wage to support a family.

We can’t keep burying our heads in the sand and keep wages down and keep creaming in ever bigger profits.

I don’t know what the solution is but we need to find one pretty quick before Gen Z give up entirely.

The minimum wage, with living wage, has therefore probably reached the level of said graduate starting salary. That doesn't mean that starting salary x 3 isn't possible further down the road.

Also it has often been tough to get a job in law even with relevant degree, but other professions are available. Plenty of accountants who did a law degree for one example.

Edited by JagLover on Wednesday 12th March 11:31

okgo said:

Just so you know, everything you describe happened for my generation too and I’m 37. It isn’t new, either go to a good uni and get a first or expect to grind it out a bit. Pretty easy

We rocked up after the crash which was a little unlucky. Edited by okgo on Wednesday 12th March 11:08

Olivera said:

We already see house prices maintained at exorbitant multiples of salary. This indicates that salary is not the sole driver, we also need to factor in individual and family wealth. Your daughter's cohort will see a lot of inheritance money over the next few decades, further entrenching the housing haves/have-nots.

That is very true, but what happens when that money is gone. And it will be in a couple of generations.smifffymoto said:

The inherited house theory only really works with 1 child families and no IHT to pay.

How will they afford to run the house on minimum wage?

Who will earn enough to purchase the house if they want or need to sell?

It's not a theory, it's a fact that housing wealth won't disappear, but will instead (mostly) pass down to following generations. House ownership might become a hereditary fact - if your parents didn't own then you won't own, if your parents did own then you will likely own. It's disastrous for many reasons - a non merit based society, entrenched inequality and so on. But we've built a system that entirely facilitates this - no CGT on primary residence, generous IHT allowances and exemptions, and a (albeit recently dampened) BTL culture.How will they afford to run the house on minimum wage?

Who will earn enough to purchase the house if they want or need to sell?

I cannot help but think two things -

(1) we really at at a point where we need to do something a little more adventurous… say… use Brexit for an Ireland-style low tax corporate destination.

(2) we could really use some Truss-enomics. Tell the BoE to get prepp’d and ready, and lets go for some business-friendly turbocharged plans.

Seriously though - before anyone asks me to produce my fully-costed manifesto - it does feel as though the entire economy is in zombie-mode. Stagflation. With the morally questionable last chance saloon of hoping that the war in Ukraine will drag on so that some UK defence companies will profit and that will somehow trickle down to the wider economy. That seems to be all we have in the cupboard.

(1) we really at at a point where we need to do something a little more adventurous… say… use Brexit for an Ireland-style low tax corporate destination.

(2) we could really use some Truss-enomics. Tell the BoE to get prepp’d and ready, and lets go for some business-friendly turbocharged plans.

Seriously though - before anyone asks me to produce my fully-costed manifesto - it does feel as though the entire economy is in zombie-mode. Stagflation. With the morally questionable last chance saloon of hoping that the war in Ukraine will drag on so that some UK defence companies will profit and that will somehow trickle down to the wider economy. That seems to be all we have in the cupboard.

okgo said:

This is why people within business think grads are often clowns. General degree from general uni and expecting the world out the gate.

Go into a sales role or recruitment and find your way into the role really want. I’m in sales and it really isn’t what most older people in the U.K. think it is these days.

Just so you know, everything you describe happened for my generation too and I’m 37. It isn’t new, either go to a good uni and get a first or expect to grind it out a bit. Pretty easy

Most degrees are a literal waste of time anyway.Go into a sales role or recruitment and find your way into the role really want. I’m in sales and it really isn’t what most older people in the U.K. think it is these days.

Just so you know, everything you describe happened for my generation too and I’m 37. It isn’t new, either go to a good uni and get a first or expect to grind it out a bit. Pretty easy

I did mech eng, so Wednesday afternoons (ostensibly for 'sports') we had lectures or practical workshops from 9am to 5pm. Wife did Maths and was not quite so packed, but still very few free periods.

Contrast with a lot of the herberts on other spurious courses, many of whom didn't even have to get up in the mornings, and you realise just how little actual learning is involved with a lot of so-called higher education.

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff