Stock market is a "fully-fledged epic bubble" and will burst

Discussion

Mr Whippy said:

A global tracker with a customisable blacklist would be lovely.

Direct indexinghttps://www.morningstar.com/articles/1052221/what-...

I hear occasional chat from the U.S. but haven't really seen it on the radar in the UK yet.

b hstewie said:

hstewie said:

hstewie said:

hstewie said:Mr Whippy said:

I’ll be honest I’ve not looked at constituents etc.

I assume global trackers hold a bit of everything? Or is it just S&P500, FTSE100, Nifty50 and all the big per-country indexes?

If so then that does protect you a bit from rubbish… but then probably not as diversified as one would think (ie, lots of weight in top end of S&P500)

You can download the constituents of most indexes.I assume global trackers hold a bit of everything? Or is it just S&P500, FTSE100, Nifty50 and all the big per-country indexes?

If so then that does protect you a bit from rubbish… but then probably not as diversified as one would think (ie, lots of weight in top end of S&P500)

This is an MSCI World Index tracker for example.

https://www.ssga.com/uk/en_gb/institutional/etfs/f...

Peloton and the other stocks on the screenshot will make you poor if you're invested in them but you'll have next to no exposure via broad global indexes.

Slighly on topic - found this interesting re how index funds may be creating more volatility - buying the winners, therefore pushing up prices (iteratively).

https://www.youtube.com/watch?v=xyzoCJY7BPU&fe...

speedy_thrills said:

ooid said:

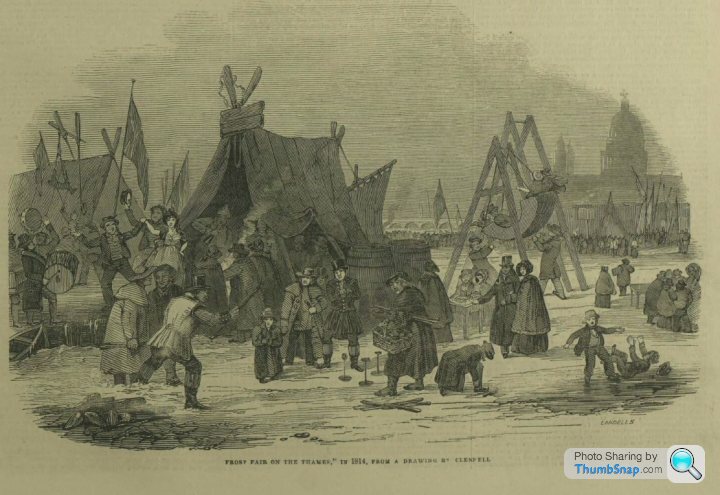

Wasn't that due to a volcano eruption in Indonesia or something like that?https://en.wikipedia.org/wiki/River_Thames_frost_f...

https://en.wikipedia.org/wiki/Little_Ice_Age

"Several causes have been proposed: cyclical lows in solar radiation, heightened volcanic activity, changes in the ocean circulation, variations in Earth's orbit and axial tilt (orbital forcing), inherent variability in global climate, and decreases in the human population (such as from the Black Death... "

Derek Chevalier said:

Slighly on topic - found this interesting re how index funds may be creating more volatility - buying the winners, therefore pushing up prices (iteratively).

https://www.youtube.com/watch?v=xyzoCJY7BPU&fe...

Mike Green is great on this topic. I've not seen this specific video but I suspect it's well worth a watch.https://www.youtube.com/watch?v=xyzoCJY7BPU&fe...

Derek Chevalier said:

Slighly on topic - found this interesting re how index funds may be creating more volatility - buying the winners, therefore pushing up prices (iteratively).

https://www.youtube.com/watch?v=xyzoCJY7BPU&fe...

Are we saying global passives are bad now? (I’ve not watched the vid)https://www.youtube.com/watch?v=xyzoCJY7BPU&fe...

Jon39 said:

rdjohn said:

I was in my 30s when I was speaking with an experienced fund manager in 1986 just after Big-Bang. He went on-and-on about how the 1970s were so very difficult. The only thing they had in the office were basic adding machines, or, if lucky a Sinclair calculator. They simply read the FT and thought “ Oh s t” In 1986, he had a flashy computer (no Windows) and thought he knew everything.

t” In 1986, he had a flashy computer (no Windows) and thought he knew everything.

Of course in October 1987, Black Friday happened and he still thought “Oh” we did not see that coming. ....

t” In 1986, he had a flashy computer (no Windows) and thought he knew everything.

t” In 1986, he had a flashy computer (no Windows) and thought he knew everything.Of course in October 1987, Black Friday happened and he still thought “Oh” we did not see that coming. ....

I was a novice in 1987, so did not see that coming either, but it did not matter because I did not panic.

Looking back though, it was unprofessional for 'an experienced fund manager', to make that comment (leaving aside his main job of increasing fee income).

The market rise during 1987, prior to that crash, was enormous. That was one obvious clue he overlooked.

There was a week of panic, but followed promptly by a strong recovery.

By the end of 1987, for anyone who held throughout that year;

FTSE 100 ... = +2.0% (Total Return = +6.2%)

All-Share .... = +4.5% (Total Return = +8.44%)

Enormous panic, but turned out out to be no big deal, for those who stayed in the market continually.

That (very serious at the time) crash, only shows as a tiny blip on charts now.

40-years later, I actually believe that fund managers do have a good array of tools to better understand the consequences of their decisions.

Inevitably, events like Ukraine create great uncertainty, but within a few days the market has a pretty good understanding of how things lie and so reflect a fair current valuation.

Consequently, it is a much safer place to put your cash. You can be certain that if you put it in a Building Society, after 3-years, it is most unlikely to have offset inflation.

The guy in the 1920s who invested heavily in one company and lost the lot was just plain dumb - with 20/20 hindsight. No one really knew the true value of what he was buying.

Phooey said:

Are we saying global passives are bad now? (I’ve not watched the vid)

Anecdotally I have two investment managers - one for my pension, one for investments.The investment one has done much better in the last year, albeit still losing money, and they are the active rather than passive manager.

Phooey said:

Derek Chevalier said:

Slighly on topic - found this interesting re how index funds may be creating more volatility - buying the winners, therefore pushing up prices (iteratively).

https://www.youtube.com/watch?v=xyzoCJY7BPU&fe...

Are we saying global passives are bad now? (I’ve not watched the vid)https://www.youtube.com/watch?v=xyzoCJY7BPU&fe...

loafer123 said:

Phooey said:

Are we saying global passives are bad now? (I’ve not watched the vid)

Anecdotally I have two investment managers - one for my pension, one for investments.The investment one has done much better in the last year, albeit still losing money, and they are the active rather than passive manager.

For example, MSCI World Large Growth is down 15% more YTD than MSCI World Small Value.

b hstewie said:

hstewie said:

hstewie said:

hstewie said: "The ARK Innovation exchange traded fund, through which retail investors could piggyback on Wood’s picks, peaked at $132.50 on June 30. Wednesday’s closing price was $36.93."

I saw this quote about ARKK a few days ago..

- Value investing is like buying a dollar for 90 cents

- Growth investing is like buying a dollar 5 years from now for 50 cents

- ARKK investing is like setting your dollar bill on fire and then trying to sell it for $100

b hstewie said:

hstewie said:

hstewie said:

hstewie said: Something to consider.

"The ARK Innovation exchange traded fund, through which retail investors could piggyback on Wood’s picks, peaked at $132.50 on June 30. Wednesday’s closing price was $36.93."

In an effort to change course (or punt!), she's taking on extra risk by not replacing the sold holdings so the etf has only 35 holdings (original 46). She may come out smelling of roses, but with such a concentrated holding, she can't afford any mistakes! One positive new, at least she doesn't have a concentrated position on Netflix "The ARK Innovation exchange traded fund, through which retail investors could piggyback on Wood’s picks, peaked at $132.50 on June 30. Wednesday’s closing price was $36.93."

https://seekingalpha.com/article/4508942-arkk-risk...

By reducing the number of holdings in the ETF quite a bit, it puts more pressure on the team to get its selections right. Getting a few names wrong now can be much more painful, especially if their weights are much higher. With less holdings now than in the recent past, ARKK has also increased its weightings for its top holdings, as the chart below shows. Since the end of 2021, the top five holdings have gone from a 30.86% weight to a 36.48% weight as of last Thursday, with the top ten going from 51.25% to 58.87%.

Nice summary I thought:

Another interesting risk here is simple overconfidence. With the Ark complex doing quite well in 2020, it seems the team might have believed that its strategies would always work. During her media appearances over the past year, Cathie Wood has refused to amid she is wrong and says that Ark Invest has the best analysts. Perhaps like a number of others, she was just a benefactor of a low interest rate environment with very easy monetary policy. Now that the Fed is hiking its rates and starting to reduce its balance sheet, these growth names that don't have profits or positive cash flows are not being favored in the market. As interest rates continue to rise, like the 10-Year Treasury yield below, it's hard to see ARKK returning 50% a year moving forward especially if global economies struggle to grow in the short term. Sometimes, one just has to admit that they are wrong and move on to a different strategy, but that's not the plan here.

In the meantime, she is still deducting her fees daily from the ever diminishing AUM!

Edited by chip* on Saturday 14th May 12:37

b hstewie said:

hstewie said:

hstewie said:

hstewie said: Something to consider.

"The ARK Innovation exchange traded fund, through which retail investors could piggyback on Wood’s picks, peaked at $132.50 on June 30. Wednesday’s closing price was $36.93."

Ouch. Timely Pensioncraft vid"The ARK Innovation exchange traded fund, through which retail investors could piggyback on Wood’s picks, peaked at $132.50 on June 30. Wednesday’s closing price was $36.93."

ARK Invest - Time To Buy?

https://www.youtube.com/watch?v=Qp-BX1lpmXc

Derek Chevalier said:

Slighly on topic - found this interesting re how index funds may be creating more volatility - buying the winners, therefore pushing up prices (iteratively).

I haven't watched the video but it seems logical that index funds would have that effect. However I've never seen any evidence of it.In fact, I remember reading somewhere that in spite of the vast amount of assets owned by index funds, they only account for a relatively small fraction of trading activity and therefore have little influence on prices.

LeoSayer said:

Derek Chevalier said:

Slighly on topic - found this interesting re how index funds may be creating more volatility - buying the winners, therefore pushing up prices (iteratively).

I haven't watched the video but it seems logical that index funds would have that effect. However I've never seen any evidence of it.In fact, I remember reading somewhere that in spite of the vast amount of assets owned by index funds, they only account for a relatively small fraction of trading activity and therefore have little influence on prices.

The thing I'd be concerned with in Index funds is to keep an eye on index weighting because a very small number of companies make up such a high proportion of the index weight in indexes like the S&P500 currently. It's a less diverse investment than it might initially look on first inspection.

speedy_thrills said:

The thing I'd be concerned with in Index funds is to keep an eye on index weighting because a very small number of companies make up such a high proportion of the index weight in indexes like the S&P500 currently. It's a less diverse investment than it might initially look on first inspection.

Well exactly.Look at it like this:

https://finviz.com/map.ashx

That’s a lot of area for…

Amazon

Apple

Tesla

Microsoft

Nvidia

The few big ones *were* probably getting on for 15-20% but now nearer 10% of the index value.

And we’re still unwinding all that leverage and speculative craziness from the last 24 months.

Even if it’s a soft landing, the impact on stocks is going to be painful for many who’ve decided to start buying heavily into the hype so have lots of these expensive units.

I’m not sure on exhaustive list of what ARKK was invested in, but a great deal of the last 24 months if the IPO/SPV frenzy have fallen spectacularly too.

I think Cathie is now aiming for the broken clock right twice a day logic… hoping the Fed blink and re-inflate everything.

Also I’m not sure what amazing analysis gets you with future projections for tech companies.

I mean, if it was such a sure thing, the market would price them higher wouldn’t they.

They’re speculative… and the speculation was wrong. The analysis didn’t think to consider that a raft of these companies might fail to make good on their projections due to economic headwinds?

Hmmm. Speculate by all means. But yeah… to not just say “this was speculative, still is, might be worth more, the same, or less in 5 years” and have done is worrying hubris.

Gassing Station | Finance | Top of Page | What's New | My Stuff