Crypto Currency Thread (Vol.2)

Discussion

okgo said:

g4ry13 said:

The average person is too easily distracted by mindlessly scrolling through instagram, watching Love Island and standing in line for the latest iPhone. They're not going to think about how they're getting shafted and revolt against the existing monetary system.

You aren’t some higher power chap.Do you still live with your parents?

Huge crossover between folk on here and conspiracy theory types IMO.

Edited by okgo on Friday 12th April 12:15

And no, I live with my wife thanks.

If you don't wish to get involved then stay that way. But no need to try and be rude about people.

okgo said:

It’s just so obvious though - all this s t about people being blinded is just the same tripe as those that believe in the on landing not happening or Twin Towers being a set up.

t about people being blinded is just the same tripe as those that believe in the on landing not happening or Twin Towers being a set up.

It's pretty obvious that majority of the public is oblivious to what's going on and are easily led. They are incapable of making well informed decisions. If it's not being pushed down their throat by media outlets then they won't know about it. t about people being blinded is just the same tripe as those that believe in the on landing not happening or Twin Towers being a set up.

t about people being blinded is just the same tripe as those that believe in the on landing not happening or Twin Towers being a set up.ERIKM400 said:

I completely agree that money manipulation and inflation are very usefull for governments but that is exactly how we ended up with the financial s t show we are in right now.

t show we are in right now.

As to inflation "not necesserily being a bad thing" look at this chart and explain to me in which way it's not bad for me as an individual

O/T but I thought the decline in the purchasing power of the dollar was due to coming off the gold standard in 1971. Not only does that event not merit a mention on the chart but it is clear that the dollar had been reducing in real value since Bretton Woods. t show we are in right now.

t show we are in right now.As to inflation "not necesserily being a bad thing" look at this chart and explain to me in which way it's not bad for me as an individual

We live and learn...

Scootersp said:

What I interpreted from those links is that the tech is the same, and other scarce digital assets have(?)/could be made and made even more scarce (I don't know specific examples), but they would not be better and so people stay with Bitcoin, it's the preferred one, it has the network, is uniquely popular, but not actually unique? So you might be say it's the only viable scarce digital asset?

"Pre-set scarcity by Satoshi" I have a problem with pre-set/determined scarcity, the scarcity being a decision? When you create things you can play around with scarcity, alter the supply as you wish try and encourage demand due to the rarity, If he'd set 1 million would the bitcoin price today be where it is, it would have been over 20 times as scarce?

It's perhaps scarce now but Satoshi, they say might have mined up to nearly 1/20th of all the Bitcoin at a low low fiat input price, perhaps he deserves it for his genius but I don't think the answer to fiat is something that you don't have work to gain, you just buy and wait? Bitcoin can work as a stable transacting platform, but the fluctuating price and upward trend certainty vibe for all, cannot work forever, it has to have a limit.

I am happy to watch from the sidelines and see others play their cards as they see them, if they keep winning so be it, the courage of their convictions to go for it, is like mine not too, no one horse wins all the races, I sit this out as it just never feels right to move in. Just like I suspect you'd never move into metals regardless of the future price action there, you'll stick to your crypto almost come what may?

For BTC to work the developer(s) had to make a very delicate compromise between cryptografic security, decentralisation, speed and anonimity."Pre-set scarcity by Satoshi" I have a problem with pre-set/determined scarcity, the scarcity being a decision? When you create things you can play around with scarcity, alter the supply as you wish try and encourage demand due to the rarity, If he'd set 1 million would the bitcoin price today be where it is, it would have been over 20 times as scarce?

It's perhaps scarce now but Satoshi, they say might have mined up to nearly 1/20th of all the Bitcoin at a low low fiat input price, perhaps he deserves it for his genius but I don't think the answer to fiat is something that you don't have work to gain, you just buy and wait? Bitcoin can work as a stable transacting platform, but the fluctuating price and upward trend certainty vibe for all, cannot work forever, it has to have a limit.

I am happy to watch from the sidelines and see others play their cards as they see them, if they keep winning so be it, the courage of their convictions to go for it, is like mine not too, no one horse wins all the races, I sit this out as it just never feels right to move in. Just like I suspect you'd never move into metals regardless of the future price action there, you'll stick to your crypto almost come what may?

The reason why nobody has (yet) come up with a better solution is that when you try to improve one of these aspects, you are going to sacrifice the other.

I think you do not really understand the importance of the capped 21 milion BTC supply.

This is THE insurance against manipulation and inflation of BTC.

Satoshi has mined the first million BTC because someone had to bootstrap the system. After that it was paramount that he (they) disappeared completely and forever because otherwise he (they) would have created a centralized point of potential failure (himself) in a system that is designed to be completely decentralized.

This also means that he (they) can never touch these BTC ever again, they had to be sacrificed.

I am not a BTC or crypto maximalist. I do own precious metals, in self custody of course

, I do have money in pension funds and other investments, I own real estate.

, I do have money in pension funds and other investments, I own real estate.But I believe that at the moment BTC and crypto offer a generational opportunity for investment, just like you would like to have bought Apple, Microsoft, Amazon and a couple of other stocks years ago for a couple of € - £. But just as most tech company stocks have gone bust, so will most crypto coins because there's a lot of rubbish out there (hint: don't buy dog coins, especially not if they're wearing a hat)

I will and do take profits from my crypto holdings but will hold on to the majority of BTC I own.

g4ry13 said:

The average person is too easily distracted by mindlessly scrolling through instagram, watching Love Island and standing in line for the latest iPhone. They're not going to think about how they're getting shafted and revolt against the existing monetary system.

Yes, yes, people should revolt and place their wealth into a money system that requires power and internet connection at all times. Not to mention your purchasing power could get eroded 25% between your front door and corner shop. You might think everyone else in society is a lemon, but you seen to have no understanding of the basics of the current system that allows BTC to even exist (you do pay the power companies in USD/GBP etc etc).Any more advice?

Crypto was developed to facilite transfers of funds from Point A to Point B.

A network for people who needed to pass on money from one country to another.

When it was developed no Wise was there, no Airtm, Uphold or netteller.

Bitcoin his too slow to do that job, people use it to store money value.

Litecoin is much faster, Litecoin was developed from the same source,

What here is discussed is the lawless room for people promising you wealth, and as most people promising you wealth mean their wealth. There you go. Exchanges fill the same space the developer crew wished to avoid.

A network for people who needed to pass on money from one country to another.

When it was developed no Wise was there, no Airtm, Uphold or netteller.

Bitcoin his too slow to do that job, people use it to store money value.

Litecoin is much faster, Litecoin was developed from the same source,

What here is discussed is the lawless room for people promising you wealth, and as most people promising you wealth mean their wealth. There you go. Exchanges fill the same space the developer crew wished to avoid.

Exchanges are for exchanging. They don’t occupy the same space at all, unless you don’t understand Bitcoin.

The difference with Bitcoin is that it is a way to hold wealth yourself. You hold it, you can take it anywhere. Your own personal Fort Knox.

Dont hold it on an exchange. Keep it on a cold wallet. Most amazing store of value ever invented. Can’t be inflated or confiscated, no chance of being hacked, no way of blocking or closing your account, no third party organisation to f k things up…it’s all on you.

k things up…it’s all on you.

Some people don’t get it or can’t handle it…but that will change.

The difference with Bitcoin is that it is a way to hold wealth yourself. You hold it, you can take it anywhere. Your own personal Fort Knox.

Dont hold it on an exchange. Keep it on a cold wallet. Most amazing store of value ever invented. Can’t be inflated or confiscated, no chance of being hacked, no way of blocking or closing your account, no third party organisation to f

k things up…it’s all on you.

k things up…it’s all on you.Some people don’t get it or can’t handle it…but that will change.

ERIKM400 said:

BTC is not a good store of value because of volatility?

That just depends on your timeframe.

Take a look at this chart: try to find the 9 red days were people are not in profit

BTC can't be used directly for making payments?

There have been countless examples on this forum of people buying things using BTC.

BTC is ulseless for international money transfers?

Please give me your BTC adress and I will send you 100 sats right away.

No, wait. I'll do this Saturday night at 23h00 to prove you the system works 24/7

I completely agree that money manipulation and inflation are very usefull for governments but that is exactly how we ended up with the financial s t show we are in right now.

t show we are in right now.

As to inflation "not necesserily being a bad thing" look at this chart and explain to me in which way it's not bad for me as an individual

I'm not sure quite what post you read, but your comments don't seem to reflect what I actually typed.... That just depends on your timeframe.

Take a look at this chart: try to find the 9 red days were people are not in profit

BTC can't be used directly for making payments?

There have been countless examples on this forum of people buying things using BTC.

BTC is ulseless for international money transfers?

Please give me your BTC adress and I will send you 100 sats right away.

No, wait. I'll do this Saturday night at 23h00 to prove you the system works 24/7

I completely agree that money manipulation and inflation are very usefull for governments but that is exactly how we ended up with the financial s

t show we are in right now.

t show we are in right now.As to inflation "not necesserily being a bad thing" look at this chart and explain to me in which way it's not bad for me as an individual

You were the one who said it was too volatile to be a store of value, not me. I was simply agreeing.

ERIKM400 said:

The things that are currently standing in the way are price volatility...

That graph is the most laughably pointless thing to ever have been made. It means absolutely nothing, but I guess works well to point at and say "look always profitable", for people who don't have the most basic understanding of finance. If you bought on about 21st Nov 2021, at £44k, then you'd have had to wait over 3 years to be in profit. Similarly, if you've bought back in 2010 then you will have been in profit almost since you bought. Worrying about whether "on average" the holders have made money is pointless. As for saying Btc can't be used for payments, I said no such thing, I said it isn't being used for payments, which it isn't. Tesla famously said they would accept Bitcoin, and now don't. There are virtually no companies which do accept Btc as Bitcoin, and those payment processors which do allow you

"to pay" in Btc are simply selling Btc on your behalf, and paying the merchant in £/$.

I equally never said it couldn't be used for international money transfers, you said that you could use it to send money to someone in Nigeria without a bank account, I said that it was already possible using mobile numbers which require neither the internet nor a bank account, and also asked if they had the internet on their phone to receive bitcoin, why wouldn't they have a bank account?

Maybe rather than asking me to explain why inflation is not a bad thing, you could explain why it is a bad thing. To me it makes very little difference. Generally pay rises keep up with inflation and generally asset prices keep up with inflation, over the medium to long term. It only matters if you keep large amounts of cash, which very few people do. If in 1950 a loaf of bread was 20c, but you got paid $6 a week you're worse off than someone today paying $2 per loaf but paid $800 per week, it's all relative and despite your graph of doom Americans today are richer and lead a better quality of life than at any point in history, so you're going to have to explain why inflation is a bad thing.

As I said in my previous post, just because you don't like it, or can't understand it, doesn't mean it's a bad thing. A low level of inflation is generally seen as a good thing, economically, which is why the BoE have a 2% target and not a 0% target.

Condi said:

Why would anyone in power (be that political, financial, business/economic) who do very nicely out of the current system want to upset the apple cart and "revolt" against something which pays for their comfortable lifestyles? There has to be a reason for things to change, and if the people who run the system are doing very nicely then it will carry on as it is.

Gorbachev did so far I recall. The system brings those up which help the system (grow).

Most people love to put 100 $ into a product do a few clicks and get 150$ out.

That is the impression most people got when jumping the 1st time onto the bandwagon.

Now many people are wiser.

Condi said:

That graph is the most laughably pointless thing to ever have been made. It means absolutely nothing, but I guess works well to point at and say "look always profitable", for people who don't have the most basic understanding of finance. If you bought on about 21st Nov 2021, at £44k, then you'd have had to wait over 3 years to be in profit. Similarly, if you've bought back in 2010 then you will have been in profit almost since you bought. Worrying about whether "on average" the holders have made money is pointless.

As for saying Btc can't be used for payments, I said no such thing, I said it isn't being used for payments, which it isn't. Tesla famously said they would accept Bitcoin, and now don't. There are virtually no companies which do accept Btc as Bitcoin, and those payment processors which do allow you

"to pay" in Btc are simply selling Btc on your behalf, and paying the merchant in £/$.

I equally never said it couldn't be used for international money transfers, you said that you could use it to send money to someone in Nigeria without a bank account, I said that it was already possible using mobile numbers which require neither the internet nor a bank account, and also asked if they had the internet on their phone to receive bitcoin, why wouldn't they have a bank account?

Maybe rather than asking me to explain why inflation is not a bad thing, you could explain why it is a bad thing. To me it makes very little difference. Generally pay rises keep up with inflation and generally asset prices keep up with inflation, over the medium to long term. It only matters if you keep large amounts of cash, which very few people do. If in 1950 a loaf of bread was 20c, but you got paid $6 a week you're worse off than someone today paying $2 per loaf but paid $800 per week, it's all relative and despite your graph of doom Americans today are richer and lead a better quality of life than at any point in history, so you're going to have to explain why inflation is a bad thing.

As I said in my previous post, just because you don't like it, or can't understand it, doesn't mean it's a bad thing. A low level of inflation is generally seen as a good thing, economically, which is why the BoE have a 2% target and not a 0% target.

So a graph showing that if you have a time frame of four years or more and an IQ that exceeds your shoe size it's impossible to lose money by investing in BTC (the percentage returns are triple digits!) is pointless just because you say so and that proves BTC is a bad store of value?As for saying Btc can't be used for payments, I said no such thing, I said it isn't being used for payments, which it isn't. Tesla famously said they would accept Bitcoin, and now don't. There are virtually no companies which do accept Btc as Bitcoin, and those payment processors which do allow you

"to pay" in Btc are simply selling Btc on your behalf, and paying the merchant in £/$.

I equally never said it couldn't be used for international money transfers, you said that you could use it to send money to someone in Nigeria without a bank account, I said that it was already possible using mobile numbers which require neither the internet nor a bank account, and also asked if they had the internet on their phone to receive bitcoin, why wouldn't they have a bank account?

Maybe rather than asking me to explain why inflation is not a bad thing, you could explain why it is a bad thing. To me it makes very little difference. Generally pay rises keep up with inflation and generally asset prices keep up with inflation, over the medium to long term. It only matters if you keep large amounts of cash, which very few people do. If in 1950 a loaf of bread was 20c, but you got paid $6 a week you're worse off than someone today paying $2 per loaf but paid $800 per week, it's all relative and despite your graph of doom Americans today are richer and lead a better quality of life than at any point in history, so you're going to have to explain why inflation is a bad thing.

As I said in my previous post, just because you don't like it, or can't understand it, doesn't mean it's a bad thing. A low level of inflation is generally seen as a good thing, economically, which is why the BoE have a 2% target and not a 0% target.

Euhmm...

Well yeah, now you've convinced me that I'm wrong.

Please stop quoting me out of context, that's just proving the weakness of your arguments.

I did NOT say that volatility is a problem for BTC as a store of value. It is CURRENTLY a problem for it's use as a payment method but that will be resolved in the future.

As for inflation not being a bad thing: the graph I provided shows that inflation has eroded the value and purchasing power of the US dollar (and all other currencies) away to almost zero over the course of the last 100 years.

Because, contrary to what you say wages are not rising as fast as inflation is.

Here's inflation adjusted income in the US over the past decades:

Of course the Bank of England (and all other central banks) want inflation because that is the only thing preventing (or more accurate: slowing down) the inevitable collaps of their failing financial systeem.

ERIKM400 said:

So a graph showing that if you have a time frame of four years or more and an IQ that exceeds your shoe size it's impossible to lose money by investing in BTC (the percentage returns are triple digits!) is pointless just because you say so and that proves BTC is a bad store of value?

Euhmm...

Well yeah, now you've convinced me that I'm wrong.

Clearly you're either ignoring the obvious, thick or being deliberately obtuse... Euhmm...

Well yeah, now you've convinced me that I'm wrong.

Bitcoin's worth as a store of value has nothing to do with what happens over a 4 year timeframe, but is to do with the day to day volatility which is very high in comparison to almost any other asset class. If you buy at £44k and then it goes down to £22k, I would say that is a pretty disastrous result even if then it goes back up 3 years later. FWIW anyone who has bought Btc at all over the last 3 weeks is currently sitting on a loss of between 1.5% and 10% depending when they bought. A 10% loss in 6 days does not a good store of value make.

And he returns are very obviously not triple digit if you've bought at anything above half of what today's price is.

I'm not trying to convince you that you're wrong, but simply showing you how you are wrong.

ERIKM400 said:

Please stop quoting me out of context, that's just proving the weakness of your arguments.

I did NOT say that volatility is a problem for BTC as a store of value. It is CURRENTLY a problem for it's use as a payment method but that will be resolved in the future.

How will it be resolved? What methods are there which will resolve it? It's a single tradable product without any fundamental or extrinsic value, and with no other use than an investment/gambling product. It is always going to be susceptible to times when the buyers and sellers are unequal and so I don't see how you can say so confidently it is going to be resolved in future. I did NOT say that volatility is a problem for BTC as a store of value. It is CURRENTLY a problem for it's use as a payment method but that will be resolved in the future.

ERIKM400 said:

As for inflation not being a bad thing: the graph I provided shows that inflation has eroded the value and purchasing power of the US dollar (and all other currencies) away to almost zero over the course of the last 100 years.

Because, contrary to what you say wages are not rising as fast as inflation is.

Here's inflation adjusted income in the US over the past decades:

Of course the Bank of England (and all other central banks) want inflation because that is the only thing preventing (or more accurate: slowing down) the inevitable collaps of their failing financial systeem.

Where is that graph from? And what, exactly, does it show? Inflation simply isn't measured by the M2 money supply, inflation is defined as the increase in the cost of goods and services, so maybe you can explain, simply, what relevance that has? Especially as it includes bank deposits, which therefore includes fractional reserves and so as the loans get paid back the money supply decreases, as well as increasing when more loans are made. Measuring money supply does not equal inflation. Because, contrary to what you say wages are not rising as fast as inflation is.

Here's inflation adjusted income in the US over the past decades:

Of course the Bank of England (and all other central banks) want inflation because that is the only thing preventing (or more accurate: slowing down) the inevitable collaps of their failing financial systeem.

The Federal Reserve Bank of St Louis (part of the US Central Bank and a centre for economic research) disagrees with you. The median personal income (adjusted for inflation), has risen from $26,000 in 1974 to $40,500 2022. (https://fred.stlouisfed.org/series/MEPAINUSA672N) while household income has gone from $56k to $75k in just under 40 years. (https://fred.stlouisfed.org/series/MEHOINUSA672N/)

This blog post explains and shows that US earnings are between 3% and 7% higher in real terms than in 2009, depending on what data set you use. Manufacturing wages at the lower end, overall wages at the higher end. (https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/)

If people are quantitively richer, why does it matter how much $1 buys today vs 100 years ago? A Model T Ford was $700 when it was new. Today a new car is, say, $25,000. This isn't an issue as nobody is buying a car today with dollars from 1910! What matters far more is the value of one currency relative to another, and in this respect the US$ has done very well.

Maybe you could explain why you see it as a problem? You are likely richer than your parents, and almost certainly have a better quality of life and standard of living than your Grandparents. This is itself should show inflation and the decrease in purchasing power of the £ doesn't really matter, if your logic was correct then you'd be worse of than your parents and significantly worse off than your Grandparents.

Edited by Condi on Sunday 14th April 21:06

Condi said:

Maybe you could explain why you see it as a problem? You are likely richer than your parents, and almost certainly have a better quality of life and standard of living than your Grandparents. This is itself should show inflation and the decrease in purchasing power of the £ doesn't really matter, if your logic was correct then you'd be worse of than your parents and significantly worse off than your Grandparents.

“Better quality” and “better standard of living” are very ambiguous terms.I think quality of life has dropped off loads over my lifetime.

But so many people measure quality by ability to afford to buy consumerist trash.

Or their ability to eat trash and walk around like Jabba the Hut.

Standard of living? “Love Life” letters on their mantle piece and huge tellys above that? Big mobile phones?

Condi said:

Where is that graph from? And what, exactly, does it show? Inflation simply isn't measured by the M2 money supply, inflation is defined as the increase in the cost of goods and services, so maybe you can explain, simply, what relevance that has? Especially as it includes bank deposits, which therefore includes fractional reserves and so as the loans get paid back the money supply decreases, as well as increasing when more loans are made. Measuring money supply does not equal inflation.

The Federal Reserve Bank of St Louis (part of the US Central Bank and a centre for economic research) disagrees with you. The median personal income (adjusted for inflation), has risen from $26,000 in 1974 to $40,500 2022. (https://fred.stlouisfed.org/series/MEPAINUSA672N) while household income has gone from $56k to $75k in just under 40 years. (https://fred.stlouisfed.org/series/MEHOINUSA672N/)

This blog post explains and shows that US earnings are between 3% and 7% higher in real terms than in 2009, depending on what data set you use. Manufacturing wages at the lower end, overall wages at the higher end. (https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/)

If people are quantitively richer, why does it matter how much $1 buys today vs 100 years ago? A Model T Ford was $700 when it was new. Today a new car is, say, $25,000. This isn't an issue as nobody is buying a car today with dollars from 1910! What matters far more is the value of one currency relative to another, and in this respect the US$ has done very well.

Maybe you could explain why you see it as a problem? You are likely richer than your parents, and almost certainly have a better quality of life and standard of living than your Grandparents. This is itself should show inflation and the decrease in purchasing power of the £ doesn't really matter, if your logic was correct then you'd be worse of than your parents and significantly worse off than your Grandparents.

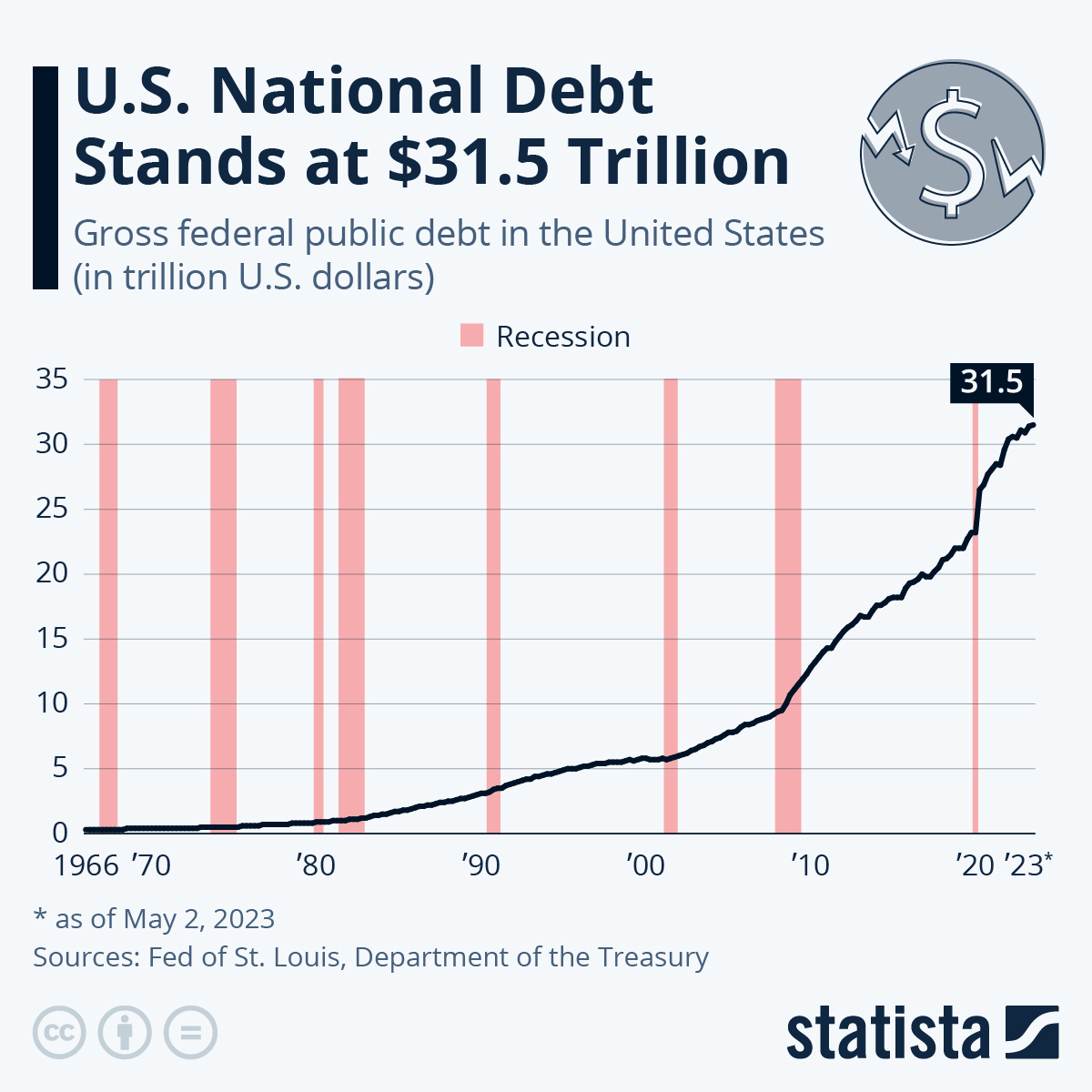

Can you please account for this in your calculations, thanks The Federal Reserve Bank of St Louis (part of the US Central Bank and a centre for economic research) disagrees with you. The median personal income (adjusted for inflation), has risen from $26,000 in 1974 to $40,500 2022. (https://fred.stlouisfed.org/series/MEPAINUSA672N) while household income has gone from $56k to $75k in just under 40 years. (https://fred.stlouisfed.org/series/MEHOINUSA672N/)

This blog post explains and shows that US earnings are between 3% and 7% higher in real terms than in 2009, depending on what data set you use. Manufacturing wages at the lower end, overall wages at the higher end. (https://fredblog.stlouisfed.org/2018/02/are-wages-increasing-or-decreasing/)

If people are quantitively richer, why does it matter how much $1 buys today vs 100 years ago? A Model T Ford was $700 when it was new. Today a new car is, say, $25,000. This isn't an issue as nobody is buying a car today with dollars from 1910! What matters far more is the value of one currency relative to another, and in this respect the US$ has done very well.

Maybe you could explain why you see it as a problem? You are likely richer than your parents, and almost certainly have a better quality of life and standard of living than your Grandparents. This is itself should show inflation and the decrease in purchasing power of the £ doesn't really matter, if your logic was correct then you'd be worse of than your parents and significantly worse off than your Grandparents.

Edited by Condi on Sunday 14th April 21:06

dimots said:

Can you please account for this in your calculations, thanks

Account for it how? What point are you trying to make?

Or is it just another meaningless point about how Bitcoin is limited to 21m whereas $ can be minted at will? If so it's up to you or anyone to show why that is a problem. That it can become a problem (eg Germany 1920's), doesn't mean it has to be a problem. Correlation doesn't equal causation.

Gassing Station | Finance | Top of Page | What's New | My Stuff