Crypto Currency Thread (Vol.2)

Discussion

jammy-git said:

Blocking crypto in what way? As in payments to exchanges? They and many other banks have been doing this for ages.

May I point out it's in their interest for crypto to fail.

The bigger problem for the exchanges is they're having their own facilities withdrawn eg. Binance. May I point out it's in their interest for crypto to fail.

Banks mostly don't care much about stuff if there's money in it, they don't care if crypto fails or not. Their real concerns come from making sure they follow regulations - unlike the exchanges.

For all the discussion abut how great crypto is vs 'fiat' there's going to be a hell of a mess if one is cut off from the other.

pquinn said:

Right now? Greater fools and 'stable' coin scams mostly. AKA thin air.

Just because you can make money trading something doesn't mean it's really worth anything. Look at all the people who piled into Hertz. And (I'd hope) no one really thinks AMC or GME or the other memes have a fraction of their assigned value, they're just something to ride for gains (if you're lucky!).

Trade it all you want as the profits certainly can be real enough but don't waste time thinking there's really something behind it. Treat all the chatter as a guide to sentiment (or the next pump) just like you would with any other junk asset but don't start to believe it.

And genuine LOL at anyone thinking any existing stable coins have a real future - so far every single one is a scam printing stuff from nothing pretending it's properly asset backed; that's where all that rapid growth came from. They're not going to replace anything and they certainly aren't a better technical solution.

And ultimately if something's so-called utility is being pegged to the dollar (for example) why not just use dollars? Especially if you're (supposedly) having to sit on a pile of dollar assets to back it all?

The question is going to be whether the problems start when Tether unwinds or just because everyone finally gets locked out by the banks and we get to see just how 'stable' things are. I think the 3 cents on the dollar estimates might be generous and will almost all end up in a very small number of pockets.

Tether, is not a proper stable coin. Just because you can make money trading something doesn't mean it's really worth anything. Look at all the people who piled into Hertz. And (I'd hope) no one really thinks AMC or GME or the other memes have a fraction of their assigned value, they're just something to ride for gains (if you're lucky!).

Trade it all you want as the profits certainly can be real enough but don't waste time thinking there's really something behind it. Treat all the chatter as a guide to sentiment (or the next pump) just like you would with any other junk asset but don't start to believe it.

And genuine LOL at anyone thinking any existing stable coins have a real future - so far every single one is a scam printing stuff from nothing pretending it's properly asset backed; that's where all that rapid growth came from. They're not going to replace anything and they certainly aren't a better technical solution.

And ultimately if something's so-called utility is being pegged to the dollar (for example) why not just use dollars? Especially if you're (supposedly) having to sit on a pile of dollar assets to back it all?

The question is going to be whether the problems start when Tether unwinds or just because everyone finally gets locked out by the banks and we get to see just how 'stable' things are. I think the 3 cents on the dollar estimates might be generous and will almost all end up in a very small number of pockets.

Stable coins are coming, like it or not. They are an old idea. Basically money market funds, ETFs (non leveraged) etc.

Just because it exists on a black chain doesn't make it a scam. Its utility, has nothing to do with $ peg, but removing operational and intraday credit risks from finance. The regulatory framework for genuine stable coins doesn't exist yet, but it's coning.

Really, you sound as hysterical as the BTC fantasists.

stongle said:

It really isn't. It will be stable coins. The central banks and banks themselves are going to be invested in that for all sorts of reasons. And has Bitcoin solved finality? That's always going to be a regulatory hurdle difficult to jump.

Coinbase is piling into this, and stable coins have grown over 20 times in <1yr, from $5bn to over 105bn. They are sniffing out taking on the daily $6trillion FX market.

They (SCs) are ultra convenient to do monetary policy transmission (read helicopter money), and helpful in managing effective lower bound rate (ELB).

The action of people taking deposits from banks and whacking them into stable coins (possibly BOE coin or any other issuer), will have minimal effect on provision of credit BUT a very positive effective on the banks funding position requiring them taking 1yr plus money in financial markets.

Not to mention, is cheaper than FIAT to process reducing pressure on Net Interest Margin. I'm sure funky coins like BTC will continue to exist, but mainstream adoption will be about stable coins and ledgers themselves. The volatility in BTC alone makes them Capital intensive for institutional to hold, so difficult to see how the BOR can build an acceptable (or manageable regulatory framework).

Unfortunately the days of crypto anarchists are probably numbered, they are taking what they can regulate and tax mainstream.

To be honest I think that the goverment will try and introduce stablecoins too...and will probably pay universal living income using it. It would make it much more controllable and make it less likely that the money will flow out of the country when the world's scammers, illegal casinos, and black market sellers turn their eyes to the UK's newly minted residents!Coinbase is piling into this, and stable coins have grown over 20 times in <1yr, from $5bn to over 105bn. They are sniffing out taking on the daily $6trillion FX market.

They (SCs) are ultra convenient to do monetary policy transmission (read helicopter money), and helpful in managing effective lower bound rate (ELB).

The action of people taking deposits from banks and whacking them into stable coins (possibly BOE coin or any other issuer), will have minimal effect on provision of credit BUT a very positive effective on the banks funding position requiring them taking 1yr plus money in financial markets.

Not to mention, is cheaper than FIAT to process reducing pressure on Net Interest Margin. I'm sure funky coins like BTC will continue to exist, but mainstream adoption will be about stable coins and ledgers themselves. The volatility in BTC alone makes them Capital intensive for institutional to hold, so difficult to see how the BOR can build an acceptable (or manageable regulatory framework).

Unfortunately the days of crypto anarchists are probably numbered, they are taking what they can regulate and tax mainstream.

I think it will ultimately fail though, because the underlying issue inherent in a system of constant inflation of money supply reliant on constant growth and consumption is still there.

Bitcoin FTW.

pquinn said:

Ari said:

Then could you tell us where the value does come from please?

Right now? Greater fools and 'stable' coin scams mostly. AKA thin air. Just because you can make money trading something doesn't mean it's really worth anything. Look at all the people who piled into Hertz. And (I'd hope) no one really thinks AMC or GME or the other memes have a fraction of their assigned value, they're just something to ride for gains (if you're lucky!).

Trade it all you want as the profits certainly can be real enough but don't waste time thinking there's really something behind it. Treat all the chatter as a guide to sentiment (or the next pump) just like you would with any other junk asset but don't start to believe it.

And genuine LOL at anyone thinking any existing stable coins have a real future - so far every single one is a scam printing stuff from nothing pretending it's properly asset backed; that's where all that rapid growth came from. They're not going to replace anything and they certainly aren't a better technical solution.

And ultimately if something's so-called utility is being pegged to the dollar (for example) why not just use dollars? Especially if you're (supposedly) having to sit on a pile of dollar assets to back it all?

The question is going to be whether the problems start when Tether unwinds or just because everyone finally gets locked out by the banks and we get to see just how 'stable' things are. I think the 3 cents on the dollar estimates might be generous and will almost all end up in a very small number of pockets.

What's remarkable though, is just how many people believe they've stumbled on a get rich quick guaranteed way of making a fortune. Happening to a mate of mine, he just wants to believe he'll be a millionaire next year with no effort, knowledge or risk by 'investing' in it. Worth a try, maybe, but with borrowed money...

Ari said:

That was pretty much the conclusion I came to from the other thread. Emperor's New Clothes, nothing there, but if enough people believe it then they exist (at least until it's self evident).

What's remarkable though, is just how many people believe they've stumbled on a get rich quick guaranteed way of making a fortune. Happening to a mate of mine, he just wants to believe he'll be a millionaire next year with no effort, knowledge or risk by 'investing' in it. Worth a try, maybe, but with borrowed money...

Wonderful, did you make sure and put him right by starting multiple conversations about it?What's remarkable though, is just how many people believe they've stumbled on a get rich quick guaranteed way of making a fortune. Happening to a mate of mine, he just wants to believe he'll be a millionaire next year with no effort, knowledge or risk by 'investing' in it. Worth a try, maybe, but with borrowed money...

dimots said:

To be honest I think that the goverment will try and introduce stablecoins too...and will probably pay universal living income using it. It would make it much more controllable and make it less likely that the money will flow out of the country when the world's scammers, illegal casinos, and black market sellers turn their eyes to the UK's newly minted residents!

I think it will ultimately fail though, because the underlying issue inherent in a system of constant inflation of money supply reliant on constant growth and consumption is still there.

Bitcoin FTW.

You are sounding ever more delusional Dimots. I did used to think you were pretty rational, but recently not so much.I think it will ultimately fail though, because the underlying issue inherent in a system of constant inflation of money supply reliant on constant growth and consumption is still there.

Bitcoin FTW.

Condi said:

dimots said:

To be honest I think that the goverment will try and introduce stablecoins too...and will probably pay universal living income using it. It would make it much more controllable and make it less likely that the money will flow out of the country when the world's scammers, illegal casinos, and black market sellers turn their eyes to the UK's newly minted residents!

I think it will ultimately fail though, because the underlying issue inherent in a system of constant inflation of money supply reliant on constant growth and consumption is still there.

Bitcoin FTW.

You are sounding ever more delusional Dimots. I did used to think you were pretty rational, but recently not so much.I think it will ultimately fail though, because the underlying issue inherent in a system of constant inflation of money supply reliant on constant growth and consumption is still there.

Bitcoin FTW.

Central bank issued stable coins, solve a lot of problems around monetary transmission. If you look at the absolute car crash that is furlough and bounce back loans; the need is evident. The risk is, monetary financing; but that requires a pretty significant change in government smarts / ethics (it is an ethical issue).

Most people's retirement savings are going to be managed on a DL soon. Outside trade finance, the largest application for blockchain is custody and settlement. It's already here, just most people don't know it.

stongle said:

Allowing for forum brevity, the first part of Dimots post is going to prove true. The 2nd bit, is what it is. No central bank is pushing for a reset. Its not happening. Ever.

Central bank issued stable coins, solve a lot of problems around monetary transmission. If you look at the absolute car crash that is furlough and bounce back loans; the need is evident. The risk is, monetary financing; but that requires a pretty significant change in government smarts / ethics (it is an ethical issue).

Most people's retirement savings are going to be managed on a DL soon. Outside trade finance, the largest application for blockchain is custody and settlement. It's already here, just most people don't know it.

What is advantageous, from a central bank's POV, about a distributed ledger, rather than a ledger they control/own themselves? They are going to have to pay people - somehow - to run a network which is going to be extremely interesting to hackers and criminal groups, and so will require some significant security protocols. Central bank issued stable coins, solve a lot of problems around monetary transmission. If you look at the absolute car crash that is furlough and bounce back loans; the need is evident. The risk is, monetary financing; but that requires a pretty significant change in government smarts / ethics (it is an ethical issue).

Most people's retirement savings are going to be managed on a DL soon. Outside trade finance, the largest application for blockchain is custody and settlement. It's already here, just most people don't know it.

I do think they will introduce something, but I suspect it will be far more "in house" than a distributed ledger on a vast network. As for your assumption that retirement savings will be managed on one, why? There was a lot of interest in smart contracts in international commodity transactions, and several were tried about 4 or 5 years ago, but since then it's all gone very quiet - they didn't offer the advantages which were promised and a lot of the paperwork still had to be checked by hand. From a customers POV the savings accounts I have now are more than adequate and I don't see what advantages a blockchain record will have?

Condi said:

I do think they will introduce something, but I suspect it will be far more "in house" than a distributed ledger on a vast network.

Pretty certain they won't be introducing it in the UK. Bank of England use none of this stuff now and it won't be in the next generation payment and settlement systems either. Condi said:

They are going to have to pay people - somehow - to run a network which is going to be extremely interesting to hackers and criminal groups, and so will require some significant security protocols.

Which is what they currently do. It's a whole specialised world of its own. Joey Deacon said:

I am sure this must be a complete coincidence, but the massive rises in the value of BTC seemed to coincide with billions of Tether being printed.

on the rise you would expect it, but to continue printing off as the prices falls, well that makes no sense and highlights how they are trying to manipulate the price.62 Billion, 42 billion in a year, still in the eco system, where? 100 billion USD stablecoins, where are they. There are no rules on stable coins they say one thing but the fact is they are just worthless tokens with no monetary value, yet used by people as expected value medium. '

Yet i'm an idiot, they are basically printing money on South American scale, yet have found a loop hole in this process, and no one really cares they are backed by f

k all. If they is a point in time when idiocracy is personified in real life, well this is out emperors new clothes momment, in action.

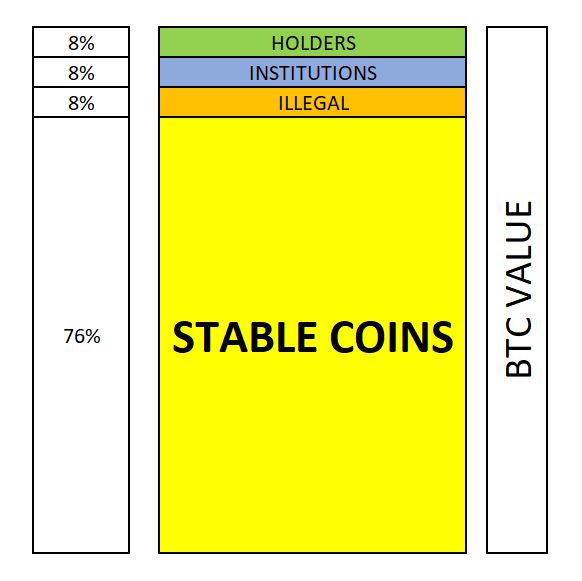

k all. If they is a point in time when idiocracy is personified in real life, well this is out emperors new clothes momment, in action.Here's a diagram to display BTC current value. So BTC true value is about half or less what it is now.

jammy-git said:

Did you just make that with Excel?

yes i will do some more, all based on my analysis. Will help people determine the value. In this case stable coins make 76% of BTC value, but as they themselves are over leveraged by about 75%, then the truer value, as you see is about 30-40% of current value, which i see between 10-15k GDP as I predicted earlier this year it is heading to.Tether is still trying to maintain a higher price, 500 million USD printed n a few weeks, would make sense if it was not for the Tether circulation has never actually decreased.

Gassing Station | Finance | Top of Page | What's New | My Stuff