S&P500 at record highs - time to stay in or pull out?

Discussion

StoutBench said:

As a relatively new investor since the COVID dip I'm amazed at how many people there are on this thread wobbling. Although a lot seems to be people not actually invested or only in a bit. I'm planning to hold for 25 more years so for me this is just part of the process.

Rather depends on what you are invested in for what purpose and what profit or loss ££ you are sitting on.I trimmed back quite a few USA based funds including UBS S and P 500 early last week and dumped all my Baillie Giff American because its had such a stellar run.

I sold approx 30 % of a tech fund on Feb 20th, as it happens was pretty good timing. I did it because i'd been planning to derisk the money in that fund as it was concentrated literally 60% in 5 firms (msft, appl, etc), not as any knee jerk reaction. I was going to go further, but due to the ongoing crazies, have stopped selling for now because the fund value has since dropped so much its actually balanced itself down.

Surely no-one is investing for the short term, that would be gambling.

Sense would seem to just keep on as normal and don't look until next year. I'll just keep buying as part of a diversified portfolio happy in the knowledge that this month's investments are buying considerably more than last month.

You're never going to win by buying high and selling low, as they say.

Sense would seem to just keep on as normal and don't look until next year. I'll just keep buying as part of a diversified portfolio happy in the knowledge that this month's investments are buying considerably more than last month.

You're never going to win by buying high and selling low, as they say.

supersport said:

Surely no-one is investing for the short term, that would be gambling.

Sense would seem to just keep on as normal and don't look until next year. I'll just keep buying as part of a diversified portfolio happy in the knowledge that this month's investments are buying considerably more than last month.

You're never going to win by buying high and selling low, as they say.

This!Sense would seem to just keep on as normal and don't look until next year. I'll just keep buying as part of a diversified portfolio happy in the knowledge that this month's investments are buying considerably more than last month.

You're never going to win by buying high and selling low, as they say.

The last few weeks has been a bloodbath but the increases recently were not natural for whatever reason and a correction was coming. Hopefully things can level off and I am into this for the next decade at least with my SIPP so holding tight looking at historical data for the last 10 years. So far this is just a minor blip. Could it get worse? Yes of course. But I'm prepared to take a brave pill and keep going. I'll let you know in 2035 if I'm eating a pot noodle or enjoying steak!

Sheepshanks said:

supersport said:

Surely no-one is investing for the short term, that would be gambling.

Even for the long term, it's still gambling. You just have to hope it's going to work out OK, but it might not.

If you’d done that at 45yr old you’d have been an old man before you were back where you were.

asfault said:

Armitage.Shanks said:

macron said:

Interesting time for the Chancellor to be suggesting people shouldn't have cash ISA's, and pump dough into stocks....

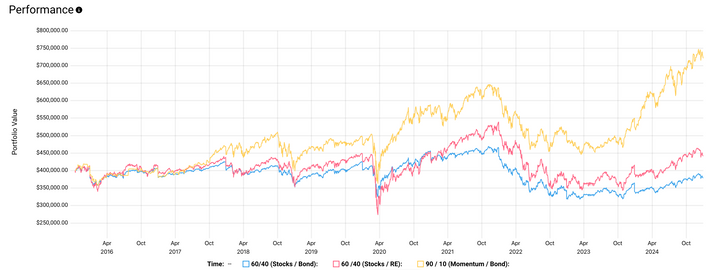

Interesting. A pal has just decided to pull 50% out of his S&S ISA and put it into a Cash ISA 3yr fix at 4.3%. If the 'ideal' draw down is 4% he'd rather bank on a sure thing than uncertainty. Although in his case pension draw down is a misnomer given he has a FS index linked pension.Well, assuming there were three dudes with completely different risk apetite, decided to get voluntary redundancy and retirement at 65, managed to accumulate 400k in their pension pots back in 2015.

Here are their three completely different portfolios once they start decumulation, while the withdrawal rate is similar, around 6% (24k annually).

-The yellow is me, before Derek come and say how irresponsible and reckless I have been!!

Here are their three completely different portfolios once they start decumulation, while the withdrawal rate is similar, around 6% (24k annually).

-The yellow is me, before Derek come and say how irresponsible and reckless I have been!!

supersport said:

Surely no-one is investing for the short term, that would be gambling.

Sense would seem to just keep on as normal and don't look until next year. I'll just keep buying as part of a diversified portfolio happy in the knowledge that this month's investments are buying considerably more than last month.

You're never going to win by buying high and selling low, as they say.

Is it gambling? Sense would be to look at the market and understand what is going on - is this a correction or might it become a full bear scenario and what MIGHT happen to stop that. OR is it already oversold. There really isn't a clear picture either way right now - so I would struggle to be "happy" at all. Sense would seem to just keep on as normal and don't look until next year. I'll just keep buying as part of a diversified portfolio happy in the knowledge that this month's investments are buying considerably more than last month.

You're never going to win by buying high and selling low, as they say.

Personally, I wouldn't be sticking my head in the sand with the Tangerine Supremo in the White House. History / theory would suggest that there would be a monetary policy intervention coming at some point (probably soon at the current rate), to prevent full bear scenario - but Trump is looking hard to read / irrational. Its not clear if he's playing the madman or really is one. If you can get happy with that - you must be very long brave pills.

I have a shorter investment horizon, and have started to de-risk elsewhere a bit due to age (although yet to touch SPX) - but I do worry Trump really does want to rip up the rulebook - and then it really does become gambling or "all bets are off"....

Just looked at my online portal for my main" pots " to see the actual difference between end of December and today.

All in funds with the modest Pension being more heavily USA centric than the others although overall USA still around 35%.

ISA down 1% , IIB down 2% , Modest Pension down 0.50% and the Decent Pension down also 0.50%.

Given all the noise I genuinely didn't think that was too bad.

All in funds with the modest Pension being more heavily USA centric than the others although overall USA still around 35%.

ISA down 1% , IIB down 2% , Modest Pension down 0.50% and the Decent Pension down also 0.50%.

Given all the noise I genuinely didn't think that was too bad.

alscar said:

Just looked at my online portal for my main" pots " to see the actual difference between end of December and today.

All in funds with the modest Pension being more heavily USA centric than the others although overall USA still around 35%.

ISA down 1% , IIB down 2% , Modest Pension down 0.50% and the Decent Pension down also 0.50%.

Given all the noise I genuinely didn't think that was too bad.

I've just checked my valuations from 1st January as I thought your figures were very good. I too am down 0.5%, but I unfortunately check my balances too often so assumed it would be more. However, with a balanced portfolio I am down 5% from the all time high mid February.All in funds with the modest Pension being more heavily USA centric than the others although overall USA still around 35%.

ISA down 1% , IIB down 2% , Modest Pension down 0.50% and the Decent Pension down also 0.50%.

Given all the noise I genuinely didn't think that was too bad.

One has to be careful of selective dates with any valuations, in particular fund managers!

Claret m said:

alscar said:

Just looked at my online portal for my main" pots " to see the actual difference between end of December and today.

All in funds with the modest Pension being more heavily USA centric than the others although overall USA still around 35%.

ISA down 1% , IIB down 2% , Modest Pension down 0.50% and the Decent Pension down also 0.50%.

Given all the noise I genuinely didn't think that was too bad.

I've just checked my valuations from 1st January as I thought your figures were very good. I too am down 0.5%, but I unfortunately check my balances too often so assumed it would be more. However, with a balanced portfolio I am down 5% from the all time high mid February.All in funds with the modest Pension being more heavily USA centric than the others although overall USA still around 35%.

ISA down 1% , IIB down 2% , Modest Pension down 0.50% and the Decent Pension down also 0.50%.

Given all the noise I genuinely didn't think that was too bad.

One has to be careful of selective dates with any valuations, in particular fund managers!

For the last couple of years I look every 3 months.

Might be worth considering for context that yesterday S&P500 close (5521) is where it was in September, so back 7 months in price growth but with 7 months of dividend distributions.

Assuming none of us have a crystal ball, for a simple long-only ISA/pension fund it seems sensible to continue to accumulate stock at prices 10% below what last month and approximately the same as 7 months ago.

Different approach for trading it but that's a different subject.

Assuming none of us have a crystal ball, for a simple long-only ISA/pension fund it seems sensible to continue to accumulate stock at prices 10% below what last month and approximately the same as 7 months ago.

Different approach for trading it but that's a different subject.

For those of you crazy gamblers sizing up your odds, after the 10% draw down we saw yesterday on S&P from the all time high reached on 02/19.

Going back to the 1929 crash, the S&P has been higher a week later 76% of the time after a similar

10% draw down..... Of course, as we saw in 2018/20/22 the market can go to decline further after that before recovering.

Going back to the 1929 crash, the S&P has been higher a week later 76% of the time after a similar

10% draw down..... Of course, as we saw in 2018/20/22 the market can go to decline further after that before recovering.

clubsport said:

For those of you crazy gamblers sizing up your odds, after the 10% draw down we saw yesterday on S&P from the all time high reached on 02/19.

Going back to the 1929 crash, the S&P has been higher a week later 76% of the time after a similar

10% draw down..... Of course, as we saw in 2018/20/22 the market can go to decline further after that before recovering.

Not saying you’re wrong and I’m fully invested so I hope you’re right but I don’t think we’ve ever had a crazy irrational wannabe dictator effectively running 70% of the worlds market before.Going back to the 1929 crash, the S&P has been higher a week later 76% of the time after a similar

10% draw down..... Of course, as we saw in 2018/20/22 the market can go to decline further after that before recovering.

Aiminghigh123 said:

Near term analysts are saying a drop to 5300.

It’s had quite a fast drop over the last 22 days.

Not been that long.

A great investor once said

“Buy when others are fearful”

I heard he has done alright on the markets………

On the way down you tend to look at previous support/resistance levels for guidance, because that is what others will also be doing, you learn as you trade. Its very unusual to see a round number such as 5300.It’s had quite a fast drop over the last 22 days.

Not been that long.

A great investor once said

“Buy when others are fearful”

I heard he has done alright on the markets………

Looking at the charts we have a 5324 support level going back to last August, if it were to close below that, as in 5300, technically the next level of support is 5119, where I would expect quite a lot of buying!

Good luck!

Gassing Station | Finance | Top of Page | What's New | My Stuff