S&P500 at record highs - time to stay in or pull out?

Discussion

Sheepshanks said:

TownIdiot said:

To my unskilled eye the top 7 shares seem to have had absolutely extraordinary performance, and I was just wondering if that was likely to reoccur in a future cycle.

You could look at equal weight S&P500 to avoid too much mag 7 distortion.1. Use equal weight rather than a more efficient factor based strategy

2. Constrain yourself to just one part of the global markets.

I use both FTSE Global All-Cap and VWRL/P etf. All-Cap in the SIPP (long-term) and VWRL in the ISA. I think All-Cap is one of the best all-round global funds, but I also like an etf for it's immediate transaction - for example on the 7th April I bought VWRP for £92.28 at just after 8am on Vanguard's Quote and Deal service. Bonds, I am in VGVA. Was also in VAGS (AGG) and the Vanguard Global Bond Index but ditched them for more VGVA. The yield on gilts is better so I don't see the need for global.

okgo said:

As said before, to see such huge gains that would require the UK to innovate in some way, which it doesn’t, oil, fags and booze is what we’ve got. Slow and steady.

Agreed. The sectors that dominate indexes tend to change over time. Sometimes it's been energy, sometimes it's been banks and most recently it's been tech'/pharma.

We all like to believe we're getting things right and the concept of "confirmation bias" is well known. In that context I really don't buy the message that other markets have more or less kept up with the US. North America is where the big tech' companies live and they rule the world. I would cheerfully make the case that anyone who isn't significantly invested one way or another in those big tech' companies will have a portfolio that's lagging behind.

Take a look at MSCI World index. https://www.msci.com/documents/10199/178e6643-6ae6...

APPLE 4.91% Info Tech

NVIDIA 3.90% Info Tech

MICROSOFT 3.89% Info Tech

AMAZON 2.64% Cons Disc

ALPHABET 2.47% Comm Srvcs

META PLATFORMS 1.85% Comm Srvcs

That's 20% of the total index in just 6 companies, all US based.

CLK-GTR said:

That's a really useful visualisation. Would be interesting to see it done by equity sector too.

Not quite that but some useful detail.https://awealthofcommonsense.com/2025/01/updating-...

ooid said:

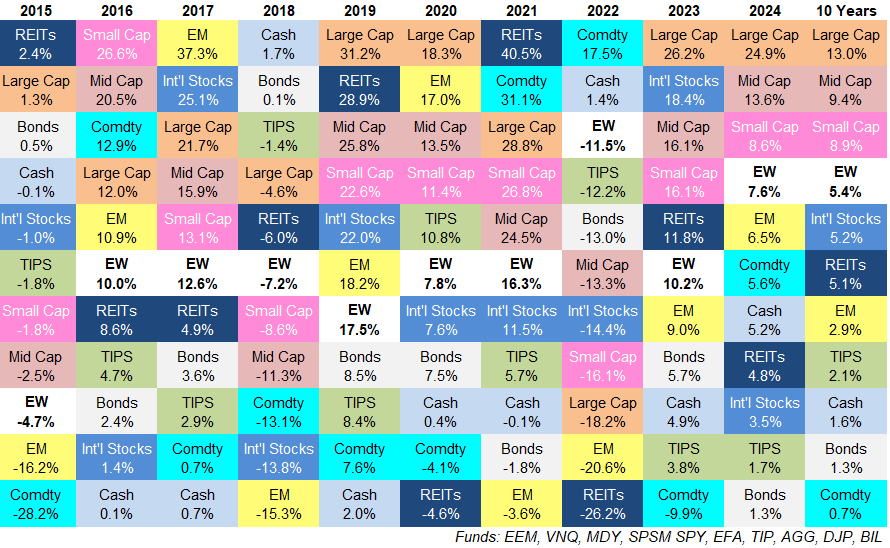

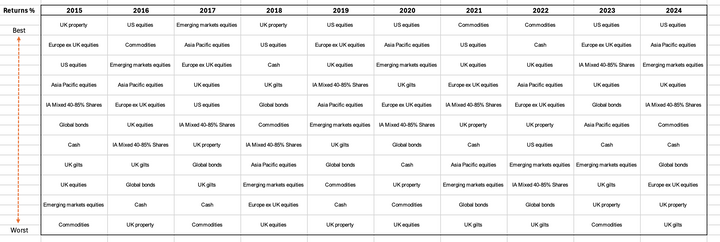

My quick sketchy summary of last 10 years returns for some major asset classes. One thing is certain, is to diversify

Things like this are why I’m always baffled by people going all in on the S&P 500.

Once upon a time people would be using their “buy what’s done best recently” methodology to go all in on Japan and look how that panned out!

Panamax said:

S&P500

1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

Rebased for inflation FTSE 100 must be under water!1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

vindaloo79 said:

Panamax said:

S&P500

1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

Rebased for inflation FTSE 100 must be under water!1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

Derek Chevalier said:

I don't think you have yet specified what timescales you are measuring over.

I'm aware that if you choose your starting point carefully you can make a graph show almost whatever you like. It is IMO undeniable that North America has had a very good run in recent memory. I believe S&P has been averaging 12.8% p.a. over the past 20 years.

Compare FTSE100 which has averaged 6.3% over the past 20 years.

Yes, if you go back 40 years these figures will converge somewhat but few of us have the advantage of starting to invest 40 years ago...

My own focus has been into larger companies, principally US and Europe, with a leaning towards pharma and invested in funds rather than individual shares. I'm pleased to report the strategy has come out similar to MSCI World index over the past decade or so even after covering for my Great Bond Disaster (80/20) which was a self-inflicted injury. Nonetheless I'm well behind the S&P 500. Hopefully risk is sensibly contained as compensation for the missing percentages.

I'm jumpy about the next 2 to 5 year returns in view of current conditions but as long as returns stay positive to inflation it doesn't matter too much (tax free wrappers).

Edited by Panamax on Saturday 26th April 16:18

Derek Chevalier said:

vindaloo79 said:

Panamax said:

S&P500

1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

Rebased for inflation FTSE 100 must be under water!1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

I’ll admit I don’t know what I am proving here. But the above figure shows me what I suspected.

Edited by vindaloo79 on Saturday 26th April 16:22

Derek Chevalier said:

Sheepshanks said:

TownIdiot said:

To my unskilled eye the top 7 shares seem to have had absolutely extraordinary performance, and I was just wondering if that was likely to reoccur in a future cycle.

You could look at equal weight S&P500 to avoid too much mag 7 distortion.1. Use equal weight rather than a more efficient factor based strategy

2. Constrain yourself to just one part of the global markets.

Sheepshanks said:

It's a discussion about the S&P500. Again, depends when you start and finish graphs, but the I think overall the equal weight performance is pretty much the same without the mag 7 distortion.

Distortion is the word I was looking for!Musing on whether the performance of the 7 shares are a function of the way things work in the US and will be a feature going forward or whether we've just seen an unusual/unique turn of events.

vindaloo79 said:

Derek Chevalier said:

vindaloo79 said:

Panamax said:

S&P500

1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

Rebased for inflation FTSE 100 must be under water!1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

I’ll admit I don’t know what I am proving here. But the above figure shows me what I suspected.

Edited by vindaloo79 on Saturday 26th April 16:22

vindaloo79 said:

Derek Chevalier said:

vindaloo79 said:

Panamax said:

S&P500

1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

Rebased for inflation FTSE 100 must be under water!1 Jan 2000 = 1,450

24 April 2025 = 5,500 up by 280%

FTSE 100

1 Jan 2000 = 6,200

24 April 2025 = 8,400 up by 35%

These headlines may not be "income reinvested" but it's a huge mountain to climb.

https://www.ig.com/uk/news-and-trade-ideas/why-has...

I’ll admit I don’t know what I am proving here. But the above figure shows me what I suspected.

Edited by vindaloo79 on Saturday 26th April 16:22

Panamax said:

I believe S&P has been averaging 12.8% p.a. over the past 20 years.

Compare FTSE100 which has averaged 6.3% over the past 20 years.

Much like I don't understand the obsession with the S&P, as suggested, I don't understand why the FTSE 100 would be used as a comparator, given it's a tiny fraction of global market cap and poor recent performance vs most other benchmarks. Compare FTSE100 which has averaged 6.3% over the past 20 years.

TownIdiot said:

Musing on whether the performance of the 7 shares are a function of the way things work in the US and will be a feature going forward or whether we've just seen an unusual/unique turn of events.

It does not matter, the concentration is something else. If you are extremely exposed to single asset (company or property?) and its risks and that sector going kaput, yes it is dangerous. Mag7 or many other modern US companies are simply made out of hundreds of different sub sectors and companies that serve international customers or businesses. Gassing Station | Finance | Top of Page | What's New | My Stuff