Boomer life according to the economist

Discussion

otolith said:

I'm not sure why the writer considers UK rental so problematic - our home ownership rate is higher than many European countries, including Austria (he mentions Vienna), Germany, and Switzerland and similar to Sweden and France.

Sure is Germany, Austria, Netherlands even Denmark I believe have a rental based system. Zj2002 said:

Incorrect assertion. I’m not a landlord but am a Chartered Surveyor so do understand how the property market works.

Bit crack on with your rhetoric.

Bit coincidental that Portia was rather on his own in this debate and then you - a brand new account - miraculously come along to give him some support though, eh?Bit crack on with your rhetoric.

Hustle_ said:

I remain to be convinced that being a landlord is purely altruistic  . I remember the reaction from many on here to the changes to tenancy regulations.

. I remember the reaction from many on here to the changes to tenancy regulations.

‘How dare they? Well, guess what I will do then. I’ll chuck out my tenants out and/or hike rent to the maximum extent possible while I can. You never know, my costs might continue to increase at this rate, and if they do, my decision will be vindicated’

Hopefully enough has been done to incentivise pension saving as a retirement strategy for current generations rather than falling into being an ‘accidental’ landlord.

Somehow I suspect that there will still be enough people to buy that housing stock either way.

It’s very amusing to see the landlords on here so upset for the poor tenants. It’s nothing to do with them being taxed more and making less money, it’s all about the poor tenants!  . I remember the reaction from many on here to the changes to tenancy regulations.

. I remember the reaction from many on here to the changes to tenancy regulations. ‘How dare they? Well, guess what I will do then. I’ll chuck out my tenants out and/or hike rent to the maximum extent possible while I can. You never know, my costs might continue to increase at this rate, and if they do, my decision will be vindicated’

Hopefully enough has been done to incentivise pension saving as a retirement strategy for current generations rather than falling into being an ‘accidental’ landlord.

Somehow I suspect that there will still be enough people to buy that housing stock either way.

Portia5 said:

Zj2002 said:

The amount of investment/ homes that are now mothballed due to BTR no longer stacking up in Scotland is staggering. Financial illiteracy from the government.

Actually the Housing Associations in Glasgow have parked build projects for the same reasons as well.https://www.constructionnews.co.uk/financial/get-l...

....that the dafties would start backtracking on their stupid legislation, but nooooooo...

Kind of illustrates how silly it is to imagine that anyone's going to build anything with such anti-landlord rubbish in play.

That one was 1500 properties evaporated because of rent controls.

Then there's this.....

https://www.insidehousing.co.uk/news/scottish-hous...

So it seems there might be a bit of difficulty in answering the scarcity by "build build build" too....

NRS said:

It’s very amusing to see the landlords on here so upset for the poor tenants. It’s nothing to do with them being taxed more and making less money, it’s all about the poor tenants!

Are the BTR developers part of your anti-landlord rhetoric or are they exceptions to your "landlord bad" drivel?

Sheepshanks said:

Certainly when one of our daughters bought an entry level house, BTLers were snapping up everything and had put a floor under the pricing which meant she was paying more than if they hadn't been in the market. She was lucky that the older couple selling to her said they wouldn't sell to a BTLer, and she paid less than they'd paid for the house 5yrs earlier.

This is the reality and for quite some time? "Homes under the hammer" reruns for years and years ago, how many were first time buyers, and when they were you could see them stretching to beat the professional BTL'ers at auction. You can see this competition increase prices which increases rents, Portia thinks the rent trapped are the ones in tenancies with rents rising around them when in essence many have always been in a rent trap from day one.Portia5 said:

I think what you call "winning" is what businesspeople call 'making a profit'.

BTL is just a n other business. And, like every other industry, some participants' business plans are more robust than others. So inevitably some landlords' business plans have no contingency plans for certain events occurring- especially those over which they've no control. So off they go, although you must understand that the slack their departure creates is taken up by others whose profits inevitably rise.

When they quit the market one of 2 things happen. The quit property goes to another landlord (99% of those sold with tenant in situ) or it goes to someone previously renting who becomes an owner-occupier. The second category always were going to become owners. But there really isn't that many of them.

My argument would be it shouldn't have been/be like any other business because it's homes that every needs and it shouldn't be a 'cornerable' market for those with excess funds to exploit? Not sure it can be unwound now but the fact is as I stated earlier if Portia etc hadn't been allowed to buy all (so many of) these properties then prices would have been lower, those you see as "they could buy if they wanted to" really could have, or certainly been more likely/felt able to?BTL is just a n other business. And, like every other industry, some participants' business plans are more robust than others. So inevitably some landlords' business plans have no contingency plans for certain events occurring- especially those over which they've no control. So off they go, although you must understand that the slack their departure creates is taken up by others whose profits inevitably rise.

When they quit the market one of 2 things happen. The quit property goes to another landlord (99% of those sold with tenant in situ) or it goes to someone previously renting who becomes an owner-occupier. The second category always were going to become owners. But there really isn't that many of them.

You never stopped at say 100 you kept going and that must have been because it was profitable to do so, you must see that this will have impacted the market, you have more purchasing/borrowing power as time goes on and then if you have to beat off the competition by paying more then you set rents at the rate it'll repay any finance and give some profit (a business has to make a profit right). If you lose one to a higher bidder they will do the same and if they've had to borrow more than you to do it, then there is a chance they might push rents even more. You admitted the ratio upon selling is far more of your peers than private buyers, you say they just aren't out there without appreciating that you and your peers are contributing factors to this low number?

In a "business like any other" if prices get a bit tasty, people stop buying that and businesses are forced to be competitive, in housing people can't avoid it, they literally have no choice, no way to even temporarily "vote with their feet" as they might with anything else in life that felt like poor value for money?

Sheepshanks said:

Zj2002 said:

How is BTL parasitic?

Properties purchased on the open market. Renters could buy them if they wanted?

You talk (angrily) about leveraged landlords - perhaps renters could take on leverage and buy for themselves?

If you want BTL to die and prices to drop it will happen across the market - and will effect non landlords as well.

So you would be happy for value drops and negative equity for hard working families just to stick one to landlords? Seems a bit stupid and misguided.

This is a supply issue - pushing landlords out only increases rents.

Certainly when one of our daughters bought an entry level house, BTLers were snapping up everything and had put a floor under the pricing which meant she was paying more than if they hadn't been in the market. She was lucky that the older couple selling to her said they wouldn't sell to a BTLer, and she paid less than they'd paid for the house 5yrs earlier.Properties purchased on the open market. Renters could buy them if they wanted?

You talk (angrily) about leveraged landlords - perhaps renters could take on leverage and buy for themselves?

If you want BTL to die and prices to drop it will happen across the market - and will effect non landlords as well.

So you would be happy for value drops and negative equity for hard working families just to stick one to landlords? Seems a bit stupid and misguided.

This is a supply issue - pushing landlords out only increases rents.

BTL buyers will rarely over pay. They have no emotional attachment to a particular property and are not interested in bidding wars. Add to that getting a BTL mortgage is based on what it will rent for, so higher prices limit what you can buy.

Quite simply this is why BTL properties are popular despite the "low returns" landlords keep talking about.

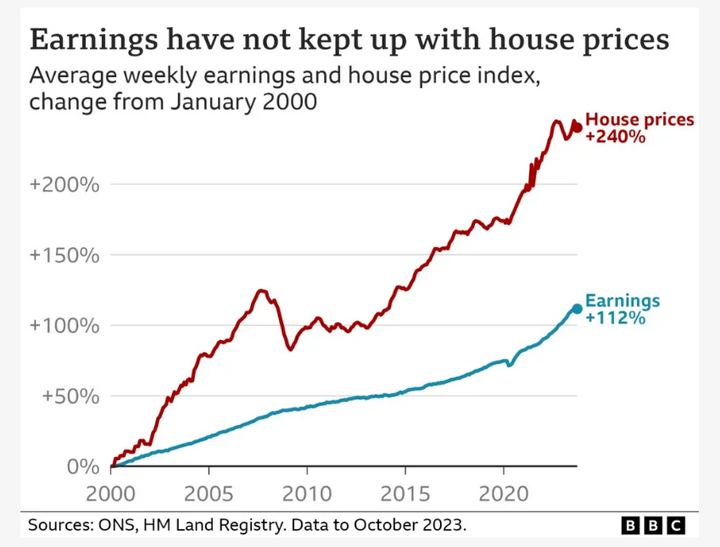

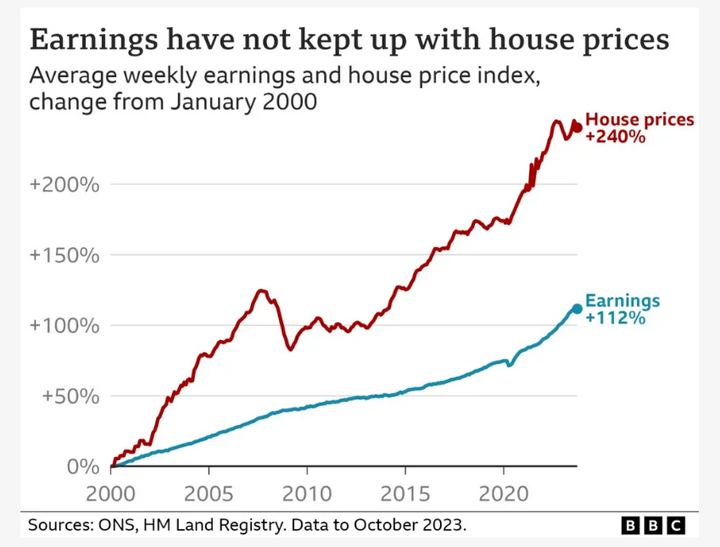

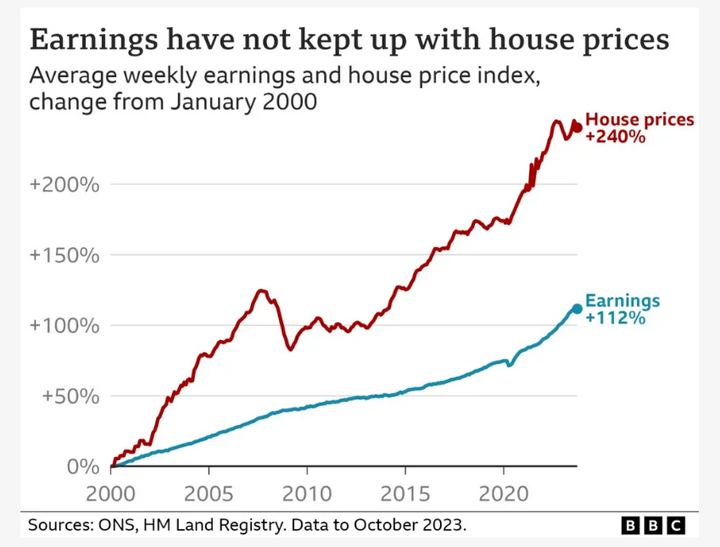

Socially it's a terrible thing, it concentrates wealth into fewer hands and increases inequality, while also increasing the generational divide between those people who have assets and those who don't. It means that younger people are spending more of their income on essential living costs, and so while wages are rising, if rents are rising faster then people are getting worse off. Something does need to be done about house price inflation, houses are becoming much more of an investment class than a place for people to live, which is wrong.

Every single statistic shows that it is much harder for a young person to buy a house today than at almost any point since the Second World War, and it is doing enormous social damage.

First-time buyers face toughest test for 70 years

https://www.bbc.co.uk/news/articles/c87zgx42m5go

Socially it's a terrible thing, it concentrates wealth into fewer hands and increases inequality, while also increasing the generational divide between those people who have assets and those who don't. It means that younger people are spending more of their income on essential living costs, and so while wages are rising, if rents are rising faster then people are getting worse off. Something does need to be done about house price inflation, houses are becoming much more of an investment class than a place for people to live, which is wrong.

Every single statistic shows that it is much harder for a young person to buy a house today than at almost any point since the Second World War, and it is doing enormous social damage.

First-time buyers face toughest test for 70 years

https://www.bbc.co.uk/news/articles/c87zgx42m5go

Condi said:

Quite simply this is why BTL properties are popular despite the "low returns" landlords keep talking about.

Socially it's a terrible thing, it concentrates wealth into fewer hands and increases inequality, while also increasing the generational divide between those people who have assets and those who don't. It means that younger people are spending more of their income on essential living costs, and so while wages are rising, if rents are rising faster then people are getting worse off. Something does need to be done about house price inflation, houses are becoming much more of an investment class than a place for people to live, which is wrong.

Every single statistic shows that it is much harder for a young person to buy a house today than at almost any point since the Second World War, and it is doing enormous social damage.

First-time buyers face toughest test for 70 years

https://www.bbc.co.uk/news/articles/c87zgx42m5go

But, but, but...won't someone think of the landlords!!! Socially it's a terrible thing, it concentrates wealth into fewer hands and increases inequality, while also increasing the generational divide between those people who have assets and those who don't. It means that younger people are spending more of their income on essential living costs, and so while wages are rising, if rents are rising faster then people are getting worse off. Something does need to be done about house price inflation, houses are becoming much more of an investment class than a place for people to live, which is wrong.

Every single statistic shows that it is much harder for a young person to buy a house today than at almost any point since the Second World War, and it is doing enormous social damage.

First-time buyers face toughest test for 70 years

https://www.bbc.co.uk/news/articles/c87zgx42m5go

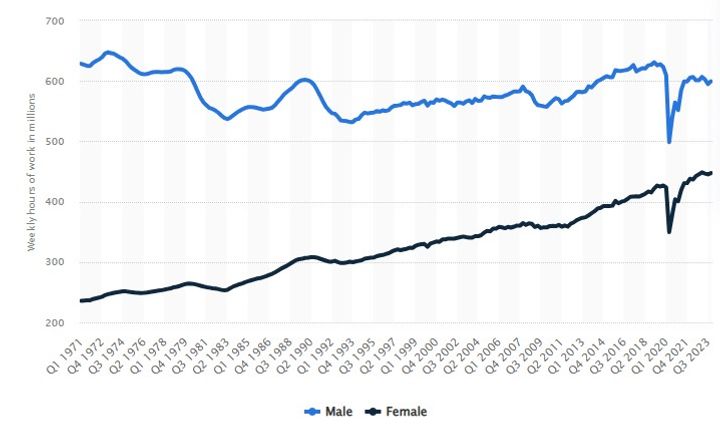

RE the disconnect in growth between median wages and house prices - I wonder to what extent the increase in hours worked by women has enabled the bidding up of house prices. There's a chicken and egg thing going on there, but clearly the affordability is driven by combined household income rather than median wage. For a given wage, if you are both working you will be able to make a better offer for a property than a couple with a stay at home mum.

98elise said:

BTL buyers are outnumbered by owner occupier buyers so they will have a bigger influence on prices.

um, so if all the BTL'ers weren't buyers at all are you implying the prices would be even higher? The BTL'ers could be looked at as false demand for 'homes', they just want an income stream from it. Without them, the owner occupiers would have total influence on prices and I think that if that had of happened in the past prices today would be lower. 98elise said:

BTL buyers will rarely over pay. They have no emotional attachment to a particular property and are not interested in bidding wars. Add to that getting a BTL mortgage is based on what it will rent for, so higher prices limit what you can buy.

This a chicken and egg situation isn't it, I mean who decides the rent estimate, there has been a massive incentive to lend, that it's been so lucrative and landlords have accumulated so many, implies the rent levels haven't been a barrier to making it work? Do the rent just have to go up to ensure the viability? The interest rates rises, has it caused a landlord pinch or rent increases, probably a bit on both sides, but there are no hard and fast rent level limitations in the UK are there.Condi said:

Quite simply this is why BTL properties are popular despite the "low returns" landlords keep talking about.

Socially it's a terrible thing, it concentrates wealth into fewer hands and increases inequality, while also increasing the generational divide between those people who have assets and those who don't. It means that younger people are spending more of their income on essential living costs, and so while wages are rising, if rents are rising faster then people are getting worse off. Something does need to be done about house price inflation, houses are becoming much more of an investment class than a place for people to live, which is wrong.

Every single statistic shows that it is much harder for a young person to buy a house today than at almost any point since the Second World War, and it is doing enormous social damage.

First-time buyers face toughest test for 70 years

https://www.bbc.co.uk/news/articles/c87zgx42m5go

Would you like a little wager on this one (I know you're a bit of a sportsman from the crypto thread):Socially it's a terrible thing, it concentrates wealth into fewer hands and increases inequality, while also increasing the generational divide between those people who have assets and those who don't. It means that younger people are spending more of their income on essential living costs, and so while wages are rising, if rents are rising faster then people are getting worse off. Something does need to be done about house price inflation, houses are becoming much more of an investment class than a place for people to live, which is wrong.

Every single statistic shows that it is much harder for a young person to buy a house today than at almost any point since the Second World War, and it is doing enormous social damage.

First-time buyers face toughest test for 70 years

https://www.bbc.co.uk/news/articles/c87zgx42m5go

https://www.rightmove.co.uk/properties/146913725#/...

Now 50-60 years ago first time buyers would have been all over this one like tramps on chips. Indeed the area was full of young first time buyers and was until the 90's.

So here's the wager. It'll soon end up going to a closing date of sealed bids. They've already had a shedload of interest. One of my mates will be one of the bidders. But....how do you fancy a wager on HOW MANY NON-INVESTOR BIDS THEY GET.?

I wager ZERO. You win if there's any more than zero. Even ONE.

Are we on? £50 to winner's charity of choosing?

I'll (or you can) phone the agent when the deal's done. Countrywide are indeed

s, but tell them you're a Phd student researching the Glasgow property market and you'd like to know the number of non-investor bids the property got for your thesis on the Glasgow property market.

s, but tell them you're a Phd student researching the Glasgow property market and you'd like to know the number of non-investor bids the property got for your thesis on the Glasgow property market. ETA: I'm not bidding on it (because my mate is) but if I was I'd bid £41150 to win.

If it's of interest, 10 grand later and another investor would pay 55-60 for it, and expect +/- £750pcm or £695 from a DSS tenancy.

Edited by Portia5 on Monday 22 April 11:50

Portia5 said:

I'll (or you can) phone the agent when the deal's done. Countrywide are indeed  s, but tell them you're a Phd student researching the Glasgow property market and you'd like to know the number of non-investor bids the property got for your thesis on the Glasgow property market.

s, but tell them you're a Phd student researching the Glasgow property market and you'd like to know the number of non-investor bids the property got for your thesis on the Glasgow property market.

Does a film company looking for a set for a horror film or gritty drug den scene count as an investor? s, but tell them you're a Phd student researching the Glasgow property market and you'd like to know the number of non-investor bids the property got for your thesis on the Glasgow property market.

s, but tell them you're a Phd student researching the Glasgow property market and you'd like to know the number of non-investor bids the property got for your thesis on the Glasgow property market. otolith said:

Does a film company looking for a set for a horror film or gritty drug den scene count as an investor?

I think they usually rent their sets, don't they? But: you're being a bit cruel. It's possibly an old-skool landlord's dungeon disposal, but much more likely something inherited from an old person who's died and left it to someone who doesn't fancy spending the 10 to flip or rent it.. Quite a lot of old folk live in unreconstructed property and that's a typical one.

Like I said, if this was the 1960's, 70's or 80's it would be a 'perfect' rung one purchase for an ambitious young couple.

ETA: Stop Press!!! Closing date set for 12 noon this Friday!!! (that means they've had plenty of interest at numbers that'll satisfy the owner)

Edited by Portia5 on Monday 22 April 12:07

Scootersp said:

98elise said:

BTL buyers are outnumbered by owner occupier buyers so they will have a bigger influence on prices.

um, so if all the BTL'ers weren't buyers at all are you implying the prices would be even higher? The BTL'ers could be looked at as false demand for 'homes', they just want an income stream from it. Without them, the owner occupiers would have total influence on prices and I think that if that had of happened in the past prices today would be lower. 98elise said:

BTL buyers will rarely over pay. They have no emotional attachment to a particular property and are not interested in bidding wars. Add to that getting a BTL mortgage is based on what it will rent for, so higher prices limit what you can buy.

This a chicken and egg situation isn't it, I mean who decides the rent estimate, there has been a massive incentive to lend, that it's been so lucrative and landlords have accumulated so many, implies the rent levels haven't been a barrier to making it work? Do the rent just have to go up to ensure the viability? The interest rates rises, has it caused a landlord pinch or rent increases, probably a bit on both sides, but there are no hard and fast rent level limitations in the UK are there.Surveyors look at the current rent not what it could achieve in the future. Rent levels are not a barrier because a landlord has no incentive to get into a bidding war. Why would you pay more than current market prices. It makes no business sense.

When I bought my first BTL there were 3 similar houses for sale in the same street (two next door to each other), let alone the general area. If someone offered more on a property I was interested in I would just buy one of the others.

All of my properties have actually been bought at just under market, not over market. I have never needed to pay more then my initial offer.

Edited by 98elise on Monday 22 April 12:09

98elise said:

I'm not implying that at all. Your suggesting it's BTL buyers responsible not owner occupiers. It's simply buyers. Neither actually alters the demand or supply equation. As I said earlier, in the case of shared ownership options do you believe house prices are affected by the % of rent vs ownership?

Surveyors look at the current rent not what it could achieve in the future. Rent levels are not a barrier because a landlord has no incentive to get into a bidding war. Why would you pay more than current market prices. It makes no business sense.

When I bought my first BTL there were 3 similar houses for sale in the same street (two next door to each other), let alone the general area. If someone offered more on a property I was interested in I would just buy one of the others.

All of my properties have actually been bought at just under market, not over market.

It is simply buyers but the BTL people means there are more overall buyers, so in your 3 similar houses example you will at least bolster the base price of street with the lowest of the 3, without BLT interest there is a chance all would have had to have reassessed their prices downwards (or more like less upwards?)Surveyors look at the current rent not what it could achieve in the future. Rent levels are not a barrier because a landlord has no incentive to get into a bidding war. Why would you pay more than current market prices. It makes no business sense.

When I bought my first BTL there were 3 similar houses for sale in the same street (two next door to each other), let alone the general area. If someone offered more on a property I was interested in I would just buy one of the others.

All of my properties have actually been bought at just under market, not over market.

Edited by 98elise on Monday 22 April 12:05

Say those 3 homes were being chased by you and x2 families that had to live in/move in to the area, you can likely move quicker, no chain, you snap up the not over priced one that fits your rental plan, all fine, but they are left with the other 2, you've underpinned the others by your purchase, giving the sellers and agent cause to be more rigid, these people need somewhere to live, will incur large costs to be in temporary accommodation, or commuting costs or risk losing their chain etc and so have buy at your price or a bit higher. The street then goes up for the next cycle of the above to repeat at some point?

I am not trying to vilify anyone for making a living here I just don't think you can argue that BLT'ers haven't contributed to increasing prices, when you are arguing there is almost a price suppression element to it?

Gassing Station | Finance | Top of Page | What's New | My Stuff