Boomer life according to the economist

Discussion

The FT article is very good.

The emerging fact is that (increasingly) the balance of lifetime outcomes for younger people are tipping away from work/career (something you can control) and more towards inheritance (the luck of your birthright). That dangerous for us all - in part because too much inequality isn’t great, but more because we want there to be a big incentive to work.

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

The emerging fact is that (increasingly) the balance of lifetime outcomes for younger people are tipping away from work/career (something you can control) and more towards inheritance (the luck of your birthright). That dangerous for us all - in part because too much inequality isn’t great, but more because we want there to be a big incentive to work.

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

Too obvious trolling. That or you’re an idiot. Either way it’s clear evidence to ignore you.

brickwall said:

The FT article is very good.

The emerging fact is that (increasingly) the balance of lifetime outcomes for younger people are tipping away from work/career (something you can control) and more towards inheritance (the luck of your birthright). That dangerous for us all - in part because too much inequality isn’t great, but more because we want there to be a big incentive to work.

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

Yes, and that first time buyer money enables you to save loads - money is paying down the house immediately so you get a lot back, no lost money on rent, and you can save into shares much earlier so get the impact of compound interest earlier. The emerging fact is that (increasingly) the balance of lifetime outcomes for younger people are tipping away from work/career (something you can control) and more towards inheritance (the luck of your birthright). That dangerous for us all - in part because too much inequality isn’t great, but more because we want there to be a big incentive to work.

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

havoc said:

They've been born to rich parents. As the FT clearly demonstrates.

Now stop being a t t and either engage in reasonable discourse or go find another thread to f-up.

t and either engage in reasonable discourse or go find another thread to f-up.

Well if I shut up this thread would not exist. Now stop being a t

t and either engage in reasonable discourse or go find another thread to f-up.

t and either engage in reasonable discourse or go find another thread to f-up.You cannot fathom a different opinion, then I suggest you see a Dr.

businessnewsdaily.com said:

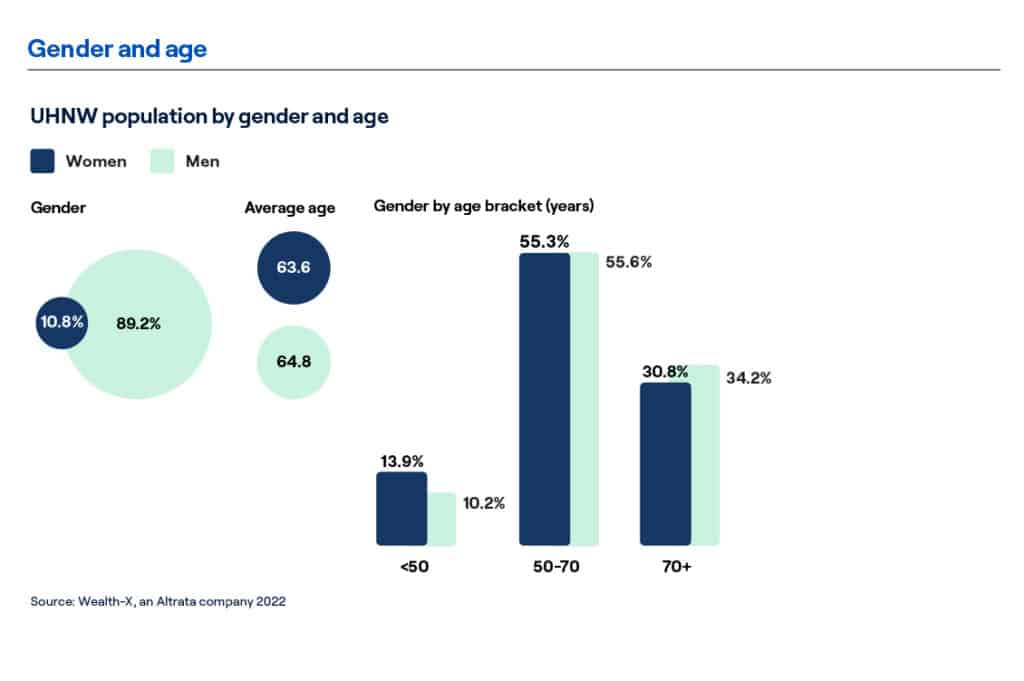

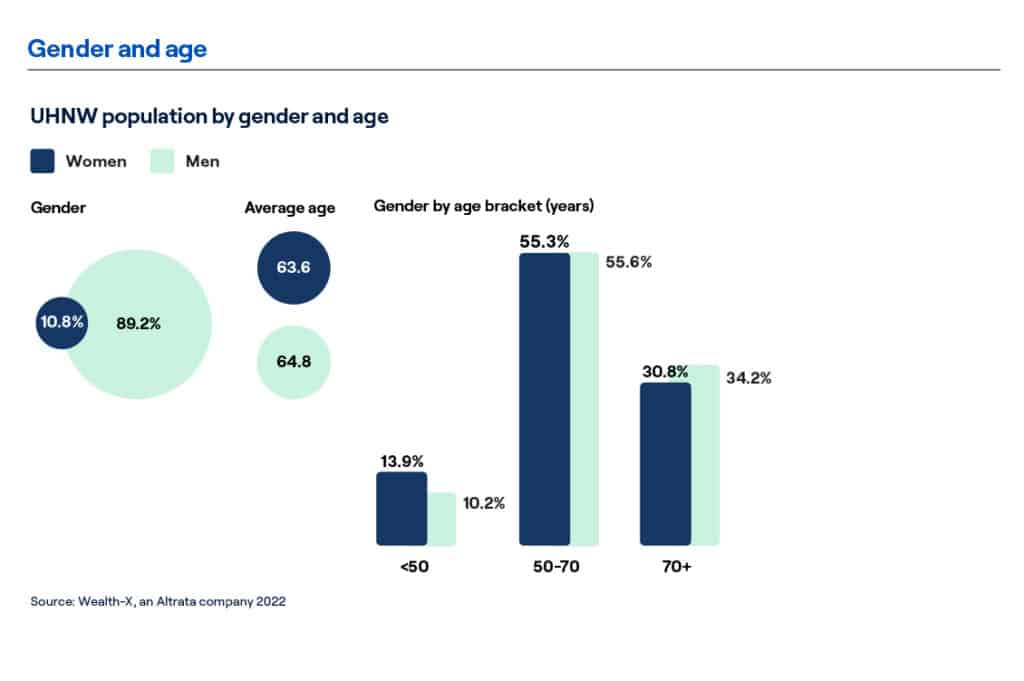

Most of today’s millionaires weren’t born into their wealth, research shows. A study published by Wealth-X found that around 68 percent of those with a net worth of $30 million or more made it themselves. Further, a second study by Fidelity Investments found that 88 percent of all millionaires are self-made, meaning they did not inherit their wealth.

Source: https://www.businessnewsdaily.com/2871-how-most-mi...Learn how to argue, and not just with slurs.

Again you pick:-

- an edge case (UHNWs are not really pertinent to the discussion here which is about the remaining 99.99% of the population, and just because they MADE their money doesn't mean they didn't have ordinarily rich / affluent families to give them seed capital - there's ZERO chance someone from the wrong side of the tracks in Manchester or Birmingham is getting seed capital),

- one that's global not from the UK

- and best of all, one where the age demographic really doesn't help your argument!

...they are near-enough all pre-war and boomers.

How about you pick a data set or an argument that IS relevant, maybe one that proves your point rather than just helping ours?

- an edge case (UHNWs are not really pertinent to the discussion here which is about the remaining 99.99% of the population, and just because they MADE their money doesn't mean they didn't have ordinarily rich / affluent families to give them seed capital - there's ZERO chance someone from the wrong side of the tracks in Manchester or Birmingham is getting seed capital),

- one that's global not from the UK

- and best of all, one where the age demographic really doesn't help your argument!

...they are near-enough all pre-war and boomers.

How about you pick a data set or an argument that IS relevant, maybe one that proves your point rather than just helping ours?

OoopsVoss said:

There isn't enough money, there will be very significant changes. There will be more debt, there will be more tax, hopefully over a long term you get more growth.

I think this is the key really isn't it. And with an increasing aging population exiting the workplace I suppose it becomes inevitable that they (and I include myself in that) will have to contribute more.NickZ24 said:

Source: https://www.businessnewsdaily.com/2871-how-most-mi...

Learn how to argue, and not just with slurs.

ok here is my argument.Learn how to argue, and not just with slurs.

Ok so the guy who set up the clothing business, perhaps he has a few mates he's since sorted out with a job in the warehousing/distribution side of things or sales etc. But hold on for these guys to make enough for a house they should set up their own business right? So they can enjoy the same success?

But then who do they employ for their distribution or sales, and then surely those guys should also just start their own businesses, do you see the flaw?

Not everyone can make it, that's just a plain fact, and those that do rely in part on the others that don't, it's a symbiotic relationship, a business owner needs workers and consumers to be rich, you can have a great idea or product but your profitability/free time is limited if it's just you working on it, so you likely won't be rich, you become rich with the assistance of others.

The others that aren't as rich as you, need to be able to forge an existence of some type else in the long run, everyone suffers.

The work harder ethos is a great one for an individual to have and frugality doesn't have to be a tortuous existence (but this isn't encouraged, we are all bombarded by marketing from day one to extract every pound possible from us), and yes by cutting out things, moving area etc, you can get there still now, but the argument is that it's already impossible/much much harder now for a small subsection of people (say a 18 year old leaving education, living in the south east and kicked out of home so has to rent from day one) and on the current trajectory it can only get worse for all levels?

You can be the hardest working, BIn man, supermarket worker, paramedic etc and feel good about your work ethic, but that won't currently translate into an affordable family life like it used to, and these people are essential to all of us. Your vision is that all these people just aren't educated/ambitious enough, which is perfectly fine for the parent to son/daughter pep talk to maximise their potential but it forgets that someone has to fill that void if you march on upwards? not all nurses can be doctors etc etc etc

Another example would be school teachers, I'm 50 and back then a state secondary school regular teacher could own a home and raise a family in Surrey, now two married teachers would struggle and this is not really progress and what got us here hasn't gone away and so the projection is even worse.

Under your ethos you'd advise no intelligent youngster to be a teacher would you, again those wanting to do a vocation not a high end profession despite their ability can be very beneficial/valuable to society in the long run, but we risk forcing all these people into areas they can sustain themselves, a vocational career is a harder and harder decision to make if you haven't already got some form of financial security? Again in the long run it's not good.

There’s good evidence that inequalities between the rich and poor are expanding, also no question that boomers and gen x did have some advantages.

But there is a fair degree of cherry picking going on here. What it meant for a boomer to have a good standard of living in the 1970s or 80s would be considered very poor by modern standards, housing is more expensive but we don’t all live in Surrey and food is significantly cheaper. Add in the fact that nobody is going down the mines any more, minimum wages exist, unemployment is negligible and technology makes almost every aspect of life easier than it was for previous generations and there is a lot to be grateful for today.

I am not saying it all balances perfectly but let’s not paint it as all bad when it isn’t.

But this seems like the silliest argument to me -

(I do not believe this to be true but it seems others do and it’s ridiculous)

But there is a fair degree of cherry picking going on here. What it meant for a boomer to have a good standard of living in the 1970s or 80s would be considered very poor by modern standards, housing is more expensive but we don’t all live in Surrey and food is significantly cheaper. Add in the fact that nobody is going down the mines any more, minimum wages exist, unemployment is negligible and technology makes almost every aspect of life easier than it was for previous generations and there is a lot to be grateful for today.

I am not saying it all balances perfectly but let’s not paint it as all bad when it isn’t.

But this seems like the silliest argument to me -

brickwall said:

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

You live in the period that you do. Some people will be more motivated than others in every age group but if the terrible hardships that millennials are suffering are enough to put all them off trying altogether then the snowflake generation has truly arrived.(I do not believe this to be true but it seems others do and it’s ridiculous)

Scootersp said:

ok here is my argument.

Ok so the guy who set up the clothing business, perhaps he has a few mates he's since sorted out with a job in the warehousing/distribution side of things or sales etc. But hold on for these guys to make enough for a house they should set up their own business right? So they can enjoy the same success?

And I appreciate that;) Ok so the guy who set up the clothing business, perhaps he has a few mates he's since sorted out with a job in the warehousing/distribution side of things or sales etc. But hold on for these guys to make enough for a house they should set up their own business right? So they can enjoy the same success?

Hoodrich had help no doubt. In the story he had a few attempts, shopify, was later discovered, had a break when the company was bought up by a clothing giant.

The difference is he was not driven to own a house, as many here seem to be.

He was driven to make his product and that he did. He started with 14-15 when most kids watch either TV or Tiktok and dream.

We condition ourselves with getting used to stuff, we also decide what kind of stuff you wish to get used to.

The biggest hindernis is our surroundings, our mates who are also used to complaining, partying or something else.

You need 20 years to grow a company, or get stuck and get used to what you have. Life moves and if we don't move life catches up.

Edited by NickZ24 on Friday 3rd May 14:08

Steve H said:

But this seems like the silliest argument to me -

(I do not believe this to be true but it seems others do and it’s ridiculous)

I’m not saying people won’t go out to work - clearly they will. But they might do less. brickwall said:

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

You live in the period that you do. Some people will be more motivated than others in every age group but if the terrible hardships that millennials are suffering are enough to put all them off trying altogether then the snowflake generation has truly arrived.(I do not believe this to be true but it seems others do and it’s ridiculous)

If Boomers are asking why millennials striving for a house don’t work some overtime and save every penny - the answer may well be “because it won’t make a difference anyway”.

It’s becoming increasingly clear that for many - you can work and save as hard as you like, but the only way to buy a decent home is with family help. If that’s off the table, then you can’t blame them for going “f

k it I’ll enjoy life now then”.

k it I’ll enjoy life now then”.My classical economics training taught me that if we reduce the rewards from X then we may expect people do less of it. If X is “work”, that’s a problem.

brickwall said:

Steve H said:

But this seems like the silliest argument to me -

(I do not believe this to be true but it seems others do and it’s ridiculous)

I’m not saying people won’t go out to work - clearly they will. But they might do less. brickwall said:

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

You live in the period that you do. Some people will be more motivated than others in every age group but if the terrible hardships that millennials are suffering are enough to put all them off trying altogether then the snowflake generation has truly arrived.(I do not believe this to be true but it seems others do and it’s ridiculous)

If Boomers are asking why millennials striving for a house don’t work some overtime and save every penny - the answer may well be “because it won’t make a difference anyway”.

It’s becoming increasingly clear that for many - you can work and save as hard as you like, but the only way to buy a decent home is with family help. If that’s off the table, then you can’t blame them for going “f

k it I’ll enjoy life now then”.

k it I’ll enjoy life now then”.My classical economics training taught me that if we reduce the rewards from X then we may expect people do less of it. If X is “work”, that’s a problem.

I rather suspect that it will depend on the individual but the idea of a generation just not trying as much because life is so hard seems highly unlikely (and in the case of the current generation somewhat unjustified).

brickwall said:

The FT article is very good.

The emerging fact is that (increasingly) the balance of lifetime outcomes for younger people are tipping away from work/career (something you can control) and more towards inheritance (the luck of your birthright). That dangerous for us all - in part because too much inequality isn’t great, but more because we want there to be a big incentive to work.

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

To care about society you have to have a stake in society..The emerging fact is that (increasingly) the balance of lifetime outcomes for younger people are tipping away from work/career (something you can control) and more towards inheritance (the luck of your birthright). That dangerous for us all - in part because too much inequality isn’t great, but more because we want there to be a big incentive to work.

The economy depends on people going out to work, striving for more earnings. But the incentive to work is seriously weakened when huge amounts of those earnings disappear in tax, and whatever’s left is never going to buy you a house for your family.

Steve H said:

brickwall said:

It’s becoming increasingly clear that for many - you can work and save as hard as you like, but the only way to buy a decent home is with family help. If that’s off the table, then you can’t blame them for going “f k it I’ll enjoy life now then”.

k it I’ll enjoy life now then”.

My classical economics training taught me that if we reduce the rewards from X then we may expect people do less of it. If X is “work”, that’s a problem.

Or, knowing that it takes more work than it used to, they might actually do more.  k it I’ll enjoy life now then”.

k it I’ll enjoy life now then”.My classical economics training taught me that if we reduce the rewards from X then we may expect people do less of it. If X is “work”, that’s a problem.

I rather suspect that it will depend on the individual but the idea of a generation just not trying as much because life is so hard seems highly unlikely (and in the case of the current generation somewhat unjustified).

"If you're f

ked if you do and f

ked if you do and f ked if you don't, then why waste the effort?" That WILL be the decision some people come to.

ked if you don't, then why waste the effort?" That WILL be the decision some people come to.Worse...if they can see a route to getting a house on benefits, and NO route to a house through working (at least in the visible term - a lot of people are bad at thinking very-long-term), then they'll play the benefits game and try to get a place on the state and get away with cash-in-hand on the side to pay for bits of nice stuff.

...which is triply harmful. For the economy, there's less labour = less production = less GDP. For the state, there's another mouth-to-feed (or another million?!?). For the individual, there's no self-actualisation and consciously or subconsciously a loss of self, loss of confidence and a loss of esteem.

We can argue back and forth about what they SHOULD do, but I think we all know that people in dark places are very bad at making the right decision on what they SHOULD do. We (as the grown-ups, metaphorically speaking) need to deal with reality, and reality is a substantial chunk of the last two generations WILL make decisions based on emotion and fear, not hopes and desires. So the real questions are how to we deal with that, how do we minimise that, and most importantly, how do we stop it happening again with the generation after?!?

havoc said:

Steve H said:

brickwall said:

It’s becoming increasingly clear that for many - you can work and save as hard as you like, but the only way to buy a decent home is with family help. If that’s off the table, then you can’t blame them for going “f k it I’ll enjoy life now then”.

k it I’ll enjoy life now then”.

My classical economics training taught me that if we reduce the rewards from X then we may expect people do less of it. If X is “work”, that’s a problem.

Or, knowing that it takes more work than it used to, they might actually do more.  k it I’ll enjoy life now then”.

k it I’ll enjoy life now then”.My classical economics training taught me that if we reduce the rewards from X then we may expect people do less of it. If X is “work”, that’s a problem.

I rather suspect that it will depend on the individual but the idea of a generation just not trying as much because life is so hard seems highly unlikely (and in the case of the current generation somewhat unjustified).

"If you're f

ked if you do and f

ked if you do and f ked if you don't, then why waste the effort?" That WILL be the decision some people come to.

ked if you don't, then why waste the effort?" That WILL be the decision some people come to.Worse...if they can see a route to getting a house on benefits, and NO route to a house through working (at least in the visible term - a lot of people are bad at thinking very-long-term), then they'll play the benefits game and try to get a place on the state and get away with cash-in-hand on the side to pay for bits of nice stuff.

...which is triply harmful. For the economy, there's less labour = less production = less GDP. For the state, there's another mouth-to-feed (or another million?!?). For the individual, there's no self-actualisation and consciously or subconsciously a loss of self, loss of confidence and a loss of esteem.

We can argue back and forth about what they SHOULD do, but I think we all know that people in dark places are very bad at making the right decision on what they SHOULD do. We (as the grown-ups, metaphorically speaking) need to deal with reality, and reality is a substantial chunk of the last two generations WILL make decisions based on emotion and fear, not hopes and desires. So the real questions are how to we deal with that, how do we minimise that, and most importantly, how do we stop it happening again with the generation after?!?

So:

- Increasing returns from leisure time

- Reducing returns from working

It’s hardly rocket science (actually, it’s about 1st year undergraduate economics) to see the above means an equilibrium of people more leisure time and less work.

The question is, how do you reverse that trend? You have to make it comparatively more attractive to go out to work, and to seek routes to earn more

- Increase the returns from working: lower income taxes, cheaper living costs (largest of which is housing)

- Reduce the lifestyle available from not working: fewer/less generous universal benefits, less comprehensive welfare state

Steve H said:

You live in the period that you do. Some people will be more motivated than others in every age group but if the terrible hardships that millennials are suffering are enough to put all them off trying altogether then the snowflake generation has truly arrived.

(I do not believe this to be true but it seems others do and it’s ridiculous)

Yes you are living in the period you do but there is a limit. Perhaps the current crop that are moaning are snowflakes but it's definitely harder now than it was no?(I do not believe this to be true but it seems others do and it’s ridiculous)

Higher Deposits to save

Higher multiples to borrow

So higher repayments/longer terms

Student loans an additional tax

So yes they have smart phones and cheap air travel/holidays but the main life purchase is definitely harder.

If we aren't doing anything to arrest the causes of how we got this far, won't it just get worse?

If you extrapolate the above,

student loans interest rate have gone up from the original promises, and the term is now increased before write off = Harder

House prices seem protected as much as possible, so set to still go up, larger deposits/repayments etc = Harder

If it was once possible to have a home and a family on a single income (SE when I was a lad) and now it's a potential struggle for two earners to do the same, then fundamentally more of the fruits of your labour are going somewhere else than they used to?

"The average age of a first-time buyer in the UK is 34 years old. This is 6 years older than the average age of a first-time buyer in 2007, which was 28 years old."

2007 Article titled "Mortgage income multiples at all-time record" a quote from within "Income multiples are rising, with the average mover’s income multiple at 3.03 times salary in May, up from 3.01 in April. For first-time buyers, average income multiples were 3.37 compared with 3.33 in April."

Today "Different lenders use different multipliers, but a rough rule of thumb for single applicants is around 4 to 4.5x your income. If you are going to apply for a joint mortgage with someone else, lenders may use a different multiple, such as 3.5 to 4."

"In the past, a 25-year mortgage was generally the normal term length" today "Average mortgage term for first-time buyers rises to 32 years" so some will be on 40 years.

Are all these people over the years progressively just bigger snowflakes because they should be able to cut out some stuff to save enough to just have a x3 multiple, 25 year mortgage? no they are the current doers dealing with the situation as best they can. Aren't the increase in strikes indicative of a sort of threat of giving up, things feel unfair, "we aren't doing all this work for nothing", are they snowflakes too or do they have a point? When can moaning about things be legitimate and not just you being a snowflake, surely at some point it's justified?

Gassing Station | Finance | Top of Page | What's New | My Stuff