What's happening at this company?

Discussion

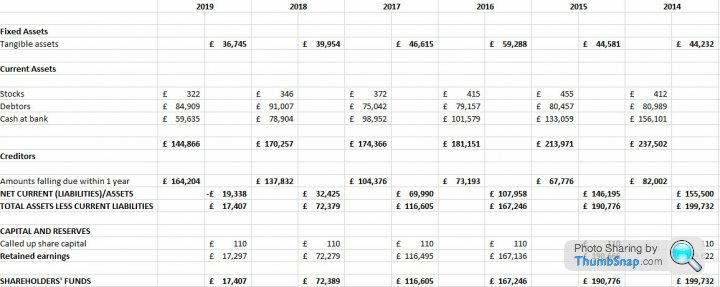

Firstly I have to state I do have a personal interest in the company for which i have attached a summary of their balance sheet for the past 5 years (as recorded at Companies House).

A little background. It is a small precision engineering company. It has 3 directors - a majority shareholder plus his (ex-)wife who were originally 51%/49% but added a 3rd active director diluting their mutual share holding by 10% around 2012.

The principal shareholder is 55 with no immediate plans but the other minority shareholder is 64 and planning retirement shortly. The company has 2 other active employees.

My untrained eye is concerned about the impact on the Shareholder funds over the past 5 years and with the issue of CV-19 this year the balance sheet could head negative for the current year. But as i say I am no accountant so I'd appreciate any comments from those better qualified to make an assessment. Happy to provide any more detail if I can.

A little background. It is a small precision engineering company. It has 3 directors - a majority shareholder plus his (ex-)wife who were originally 51%/49% but added a 3rd active director diluting their mutual share holding by 10% around 2012.

The principal shareholder is 55 with no immediate plans but the other minority shareholder is 64 and planning retirement shortly. The company has 2 other active employees.

My untrained eye is concerned about the impact on the Shareholder funds over the past 5 years and with the issue of CV-19 this year the balance sheet could head negative for the current year. But as i say I am no accountant so I'd appreciate any comments from those better qualified to make an assessment. Happy to provide any more detail if I can.

JPJPJP said:

You’d need the management accounts to make proper sense of it. The balance sheet alone tells you very little other than that it isn’t doing very well for a shareholder perspective

Does your interest give you access to turnover, a breakdown of creditors etc?

No. I don't even know the current turnover! It's personal because one of the employees is my daughter's partner and I'm concerned that things aren't rosy particularly since he was put on furlough(although back full time now). Unfortunately he has little insight to the state of the business as well so I was just trying to get insight from public info.Does your interest give you access to turnover, a breakdown of creditors etc?

Agree it would be helpful to have the full set of accounts, but I don't think you'll get them.

The fall in net worth isn't always a warning sign, but a lender, for example, would what an explanation.

Given the falling net worth of the business over the last few years, they are either running at a loss or overdrawing the profits. Possibly the directors have a lifestyle that needs a certain income to pay for it, so they pay themselves £x regardless of profit.

Cash at bank has also fallen, but so have creditors, so possibly they are taking less trade credit or paying bills early.

Can't imagine Covid has done them any favours.

N.B. I'm not an accountant, but do look at accounts for my job.

Does he know if the directors spend a lot of money? E.g. nice holidays, cars.

The fall in net worth isn't always a warning sign, but a lender, for example, would what an explanation.

Given the falling net worth of the business over the last few years, they are either running at a loss or overdrawing the profits. Possibly the directors have a lifestyle that needs a certain income to pay for it, so they pay themselves £x regardless of profit.

Cash at bank has also fallen, but so have creditors, so possibly they are taking less trade credit or paying bills early.

Can't imagine Covid has done them any favours.

N.B. I'm not an accountant, but do look at accounts for my job.

Does he know if the directors spend a lot of money? E.g. nice holidays, cars.

hepy said:

Agree it would be helpful to have the full set of accounts, but I don't think you'll get them.

I most definitely won't!hepy said:

The fall in net worth isn't always a warning sign, but a lender, for example, would what an explanation.

Given the falling net worth of the business over the last few years, they are either running at a loss or overdrawing the profits. Possibly the directors have a lifestyle that needs a certain income to pay for it, so they pay themselves £x regardless of profit.

This is my fear.Given the falling net worth of the business over the last few years, they are either running at a loss or overdrawing the profits. Possibly the directors have a lifestyle that needs a certain income to pay for it, so they pay themselves £x regardless of profit.

hepy said:

Cash at bank has also fallen, but so have creditors, so possibly they are taking less trade credit or paying bills early.

Can't imagine Covid has done them any favours.

N.B. I'm not an accountant, but do look at accounts for my job.

Does he know if the directors spend a lot of money? E.g. nice holidays, cars.

I don't believe they are particularly profligate but I don't know what the situation is between the principal shareholder and his ex-wife is.Can't imagine Covid has done them any favours.

N.B. I'm not an accountant, but do look at accounts for my job.

Does he know if the directors spend a lot of money? E.g. nice holidays, cars.

JPJPJP said:

He can gauge how much and what type of work he has on his visible horizon compared to at other times. He may even also know if he is working for the same customers / new ones / more / fewer etc.

This is one of the reasons I decided to check up on the company. He was put on furlough and then asked to rock up to work if any orders came in for which he would have his salary topped up to 100%. He refused and spent 6 weeks on regular furlough. The other regular employee wasn't put on furlough but according to my daughter's partner he's a lazy b*****d and just let's his work load drag out so he was kept on full-time.Since he's been back all his work is from 'regular' customers and, to be fair, he's not short of work.

caiss4 said:

He was put on furlough and then asked to rock up to work if any orders came in for which he would have his salary topped up to 100%. He refused and spent 6 weeks on regular furlough. The other regular employee wasn't put on furlough but according to my daughter's partner he's a lazy b*****d and just let's his work load drag out so he was kept on full-time.

That seems the wrong way round to me. I'd keep the good worker and furlough/hopefully get rid of the bad one.Simpo Two said:

That seems the wrong way round to me. I'd keep the good worker and furlough/hopefully get rid of the bad one.

I'm really not sure the owner is bothered; he only turns up twice a week. My potential SiL and the other guy have discrete functions. My 'SiL' just gets on and works through the backlog. He wasn't prepared to commit furlough fraud.Eric Mc said:

There does seem to have been a general run down of Cash at Bank over the past couple of years, most likely in the form of additional dividend payments.

Eric, my own conclusion and perhaps the only one that can be drawn without operating accounts. Thanks for everyone's input and comments; I just didn't feel confident that I was interpreting the limited information correctly. I think I'll have to encourage the 'SiL' to get more intimate with the company's accounts (I did ask him what he thought the t/o was and he quoted £30k per month which I find hard to believe!)If some of the directors/shareholders are contemplating their retirement, perhaps they have been withdrawing what they consider to be their share of the profits in a staged way in advance of that retirement.

Another area they may have been allocating money to from the company is personal pension funds.

All legitimate, I hasten to add. It's their company and their money.

Another area they may have been allocating money to from the company is personal pension funds.

All legitimate, I hasten to add. It's their company and their money.

Eric Mc said:

If some of the directors/shareholders are contemplating their retirement, perhaps they have been withdrawing what they consider to be their share of the profits in a staged way in advance of that retirement.

I'm no expert at reading accounts but my thought was that the directors have lost interest and are hoovering out as much as possible for themselves. It's not a place I'd consider has much future.Simpo Two said:

Eric Mc said:

If some of the directors/shareholders are contemplating their retirement, perhaps they have been withdrawing what they consider to be their share of the profits in a staged way in advance of that retirement.

I'm no expert at reading accounts but my thought was that the directors have lost interest and are hoovering out as much as possible for themselves. It's not a place I'd consider has much future. You can't possibly guess that from those numbers. The numbers are tiny, so it's hardly hoovering.

You can't possibly guess that from those numbers. The numbers are tiny, so it's hardly hoovering. Simpo Two said:

Eric Mc said:

If some of the directors/shareholders are contemplating their retirement, perhaps they have been withdrawing what they consider to be their share of the profits in a staged way in advance of that retirement.

I'm no expert at reading accounts but my thought was that the directors have lost interest and are hoovering out as much as possible for themselves. It's not a place I'd consider has much future.Obviously, if those individuals depart, THAT could lead to future lower profits, especially if their customers and other business relationships were very much tied to those individuals - but that's nothing to do with historic profit extraction.

Eric Mc said:

Just because directors/shareholders extract profits for themselves (their right, it's a private company, not a PLC), does not mean that the company has suddenly become unprofitable.

Obviously, if those individuals depart, THAT could lead to future lower profits, especially if their customers and other business relationships were very much tied to those individuals - but that's nothing to do with historic profit extraction.

I agree with you Eric. At the moment I think the business is still profitable but without sight of the operating accounts we'll never know. Your second para is my fear. i know the minority shareholder was taken on because he came with significant goodwill. The problem is with his imminent retirement he's not actively selling the services and if the majority shareholder has lost/loses interest then I can see the business going down very quickly.Obviously, if those individuals depart, THAT could lead to future lower profits, especially if their customers and other business relationships were very much tied to those individuals - but that's nothing to do with historic profit extraction.

It happens all the time. Customers sometimes follow the departing individual (which can be ameliorated by putting restrictive clauses in the retirement agreement - although such agreements are not foolproof) or the customers decide it's time for a change anyway and seek alternative suppliers anyway.

Gassing Station | Business | Top of Page | What's New | My Stuff